Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

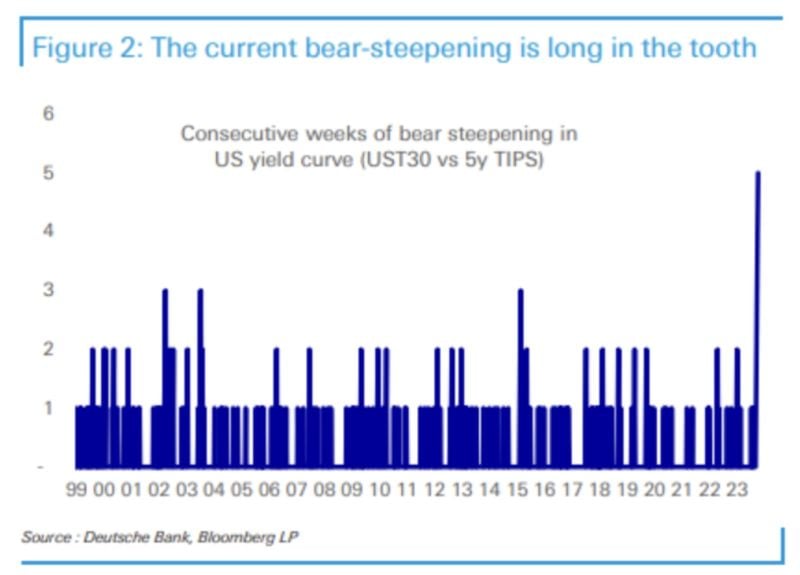

The Treasury Yield Curve has been steepening (i.e. uninverting) for 5 straight weeks, the longest streak in more than 25 years

Source: DB, Barchart

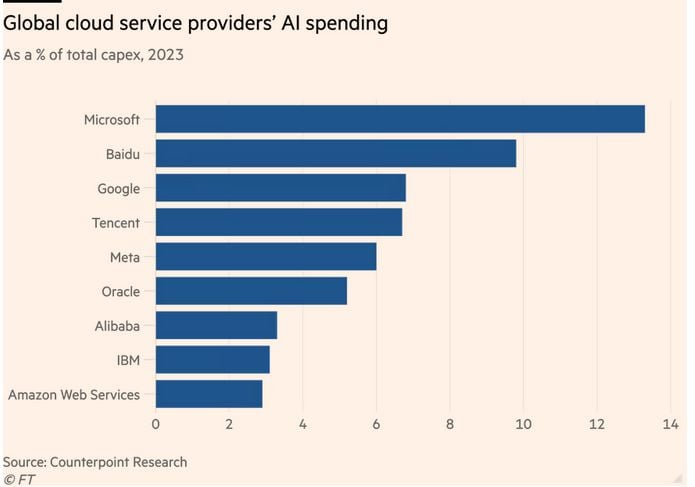

Microsoft $MSFT is devoting more than 13% of CAPEX to artificial intelligence, the highest amount out of the world’s top cloud service providers

Baidu $BIDU follows with nearly 10%, while Google $GOOG and Meta $META are putting between 6-7% of CAPEX to AI. Source: FT

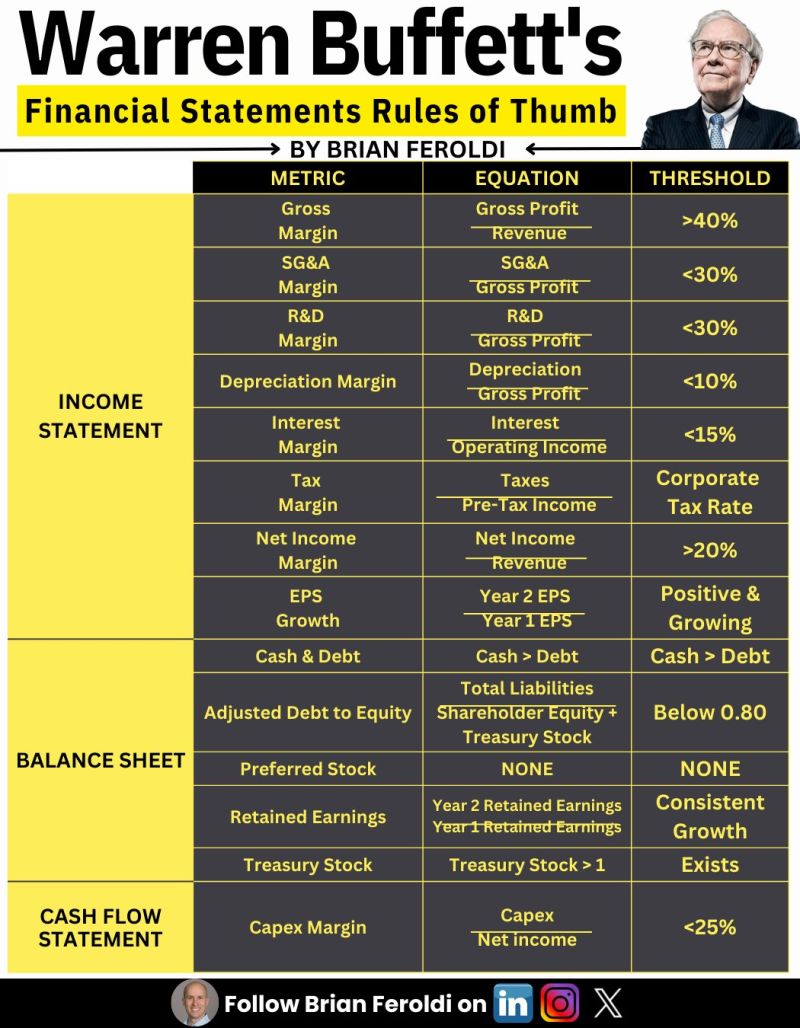

Warren Buffett’s Financial Statement Rules of Thumb

Source: Brian Feroldi

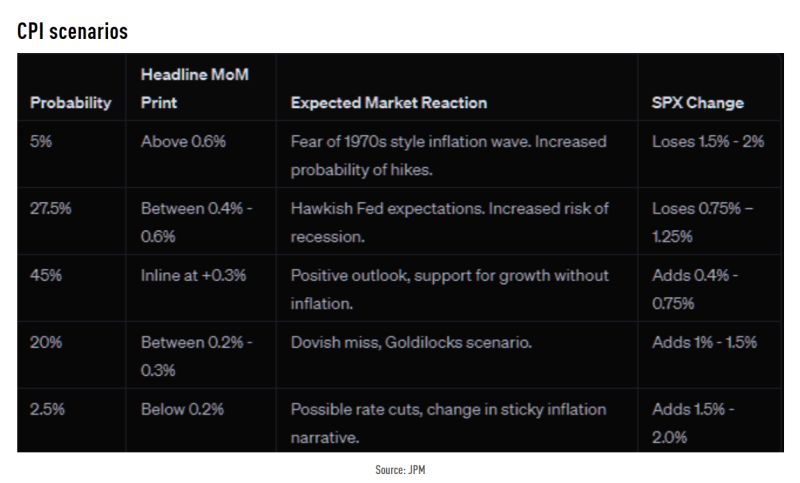

What to expect from today's US CPI data? Main take via JPM's market intelligence team

Source: JPM, TME

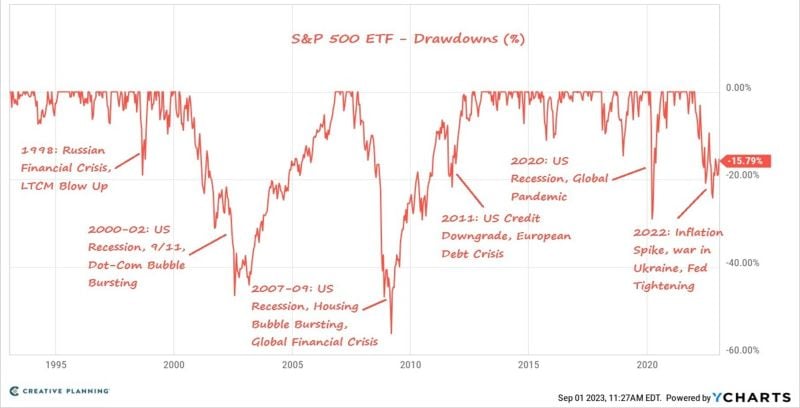

Maximum 3-month total return 60/40 nominal drawdown

Source: TME, Haver

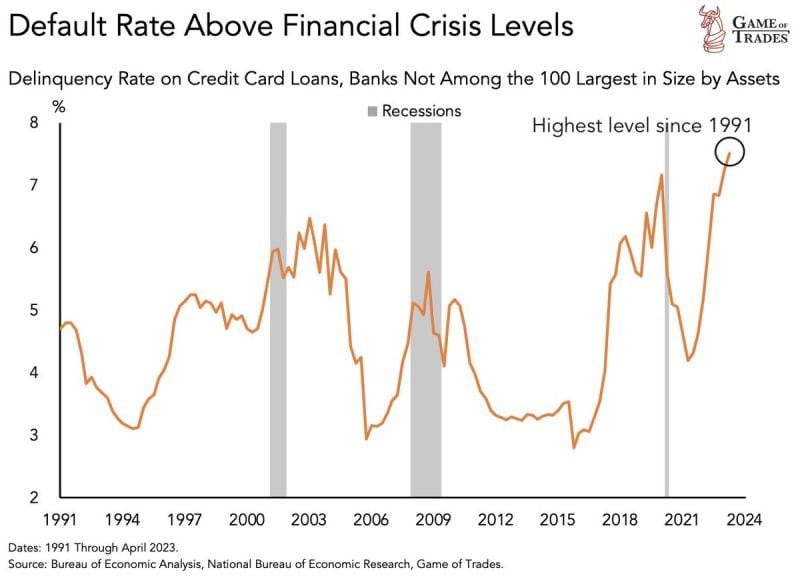

The consumer is borrowing more than they can afford to pay

The consumer default rate on credit card loans from small lenders has seen a sharp spike to 7.51% This level is higher than the: - Dot Com bubble - Financial Crisis - C-19 With credit card interest rates still above 20%. Consumers are going to continue feeling the pressure. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks