Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

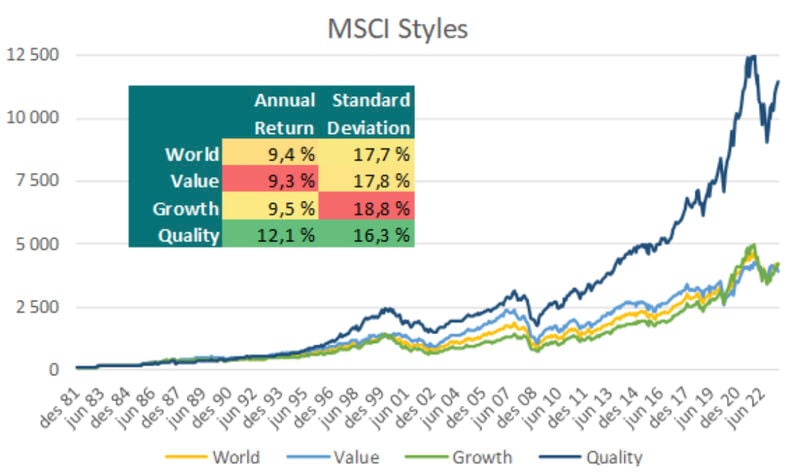

MSCI World long-term performance by style

Quality outperforms by far with a lower standard deviation (NB: past returns are not a guarantee for future returns). Source: Invest In Assets | Stock Market Investing

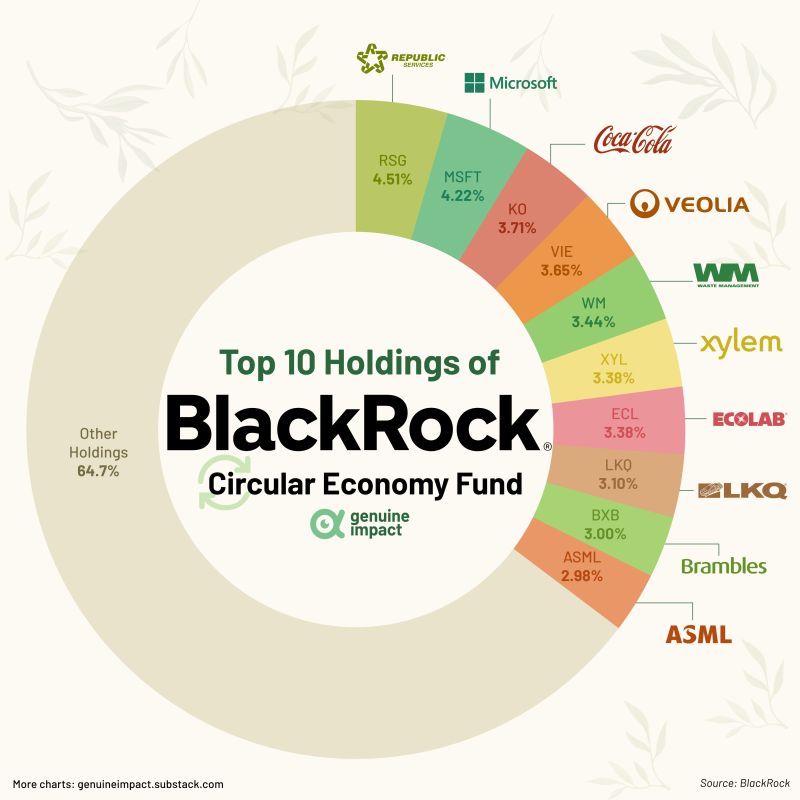

BlackRock's Circular Economy Fund invests in companies that focused on ♻️sustainability and reducing waste.

The fund's diverse portfolio includes waste management companies such as Waste Management and Republic Services, beverage company Coca-Cola, and manufacturer ASML, among others. Chart by Genuine Impact

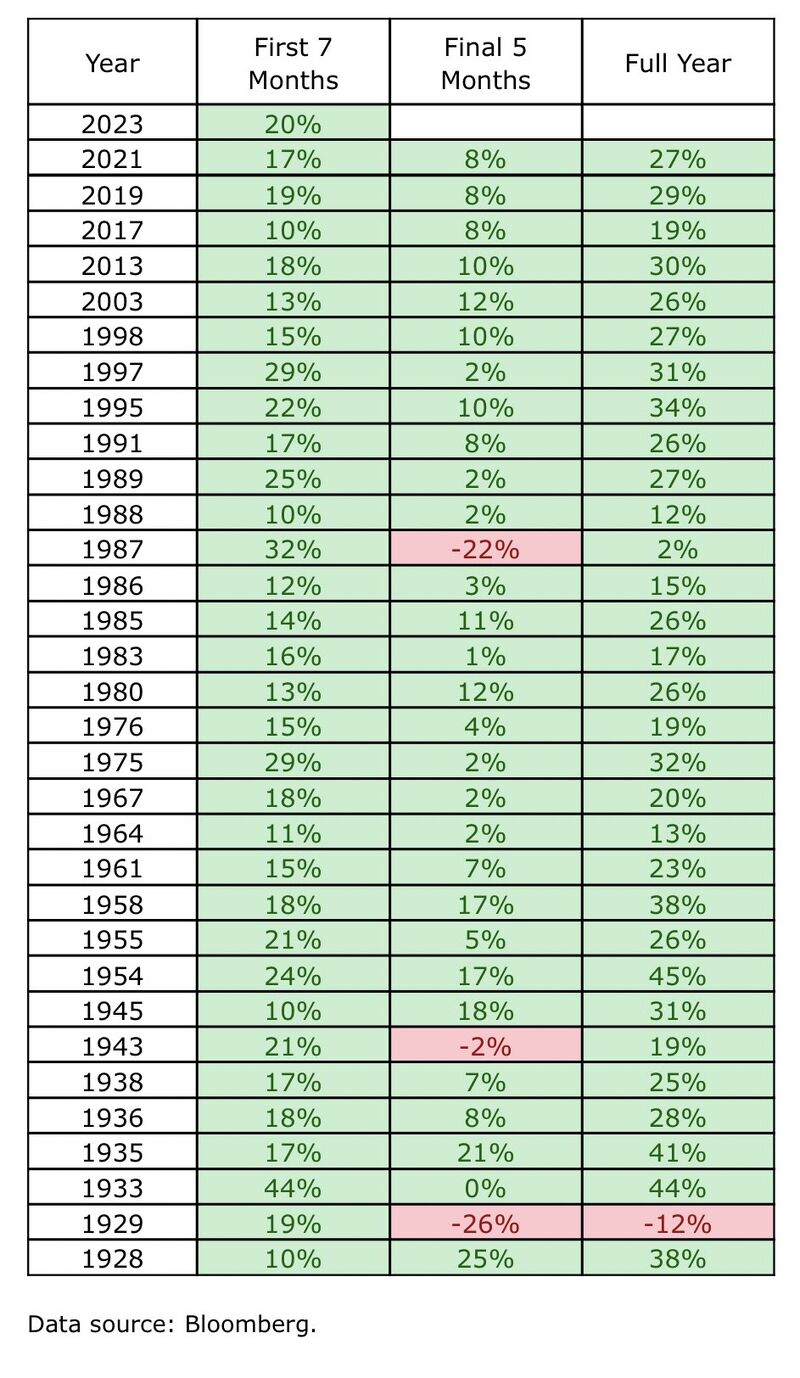

“.. when the S&P 500 is +10% or better YTD at the July-end mark.”

Source: Carl Quintanilla, Bloomberg

China's currency regulators are asking some commercial banks to reduce or postpone their purchases of U.S. dollars

That is in order to slow the yuan's depreciation, two people with direct knowledge of the matter said. The informal instruction, or the so-called window guidance, is the latest in a series of steps taken by authorities this year to bolster a currency that has been hit by China's faltering post-pandemic economic recovery and rising yields for the U.S. dollar and other major currencies. Source: Reuters

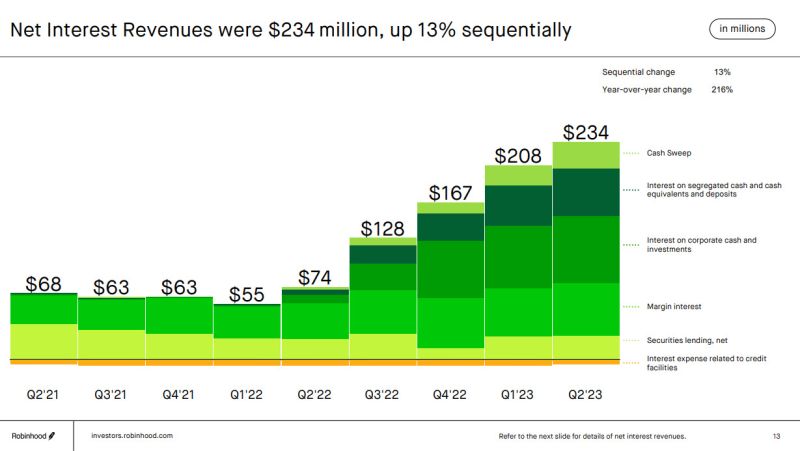

Robinhood now makes much more collecting interest on client cash than from its core business.

This is $234 million that RH's customers should be collecting but they are currently handling to the Trading App. Source: www.zerohedge.com, Robinhood

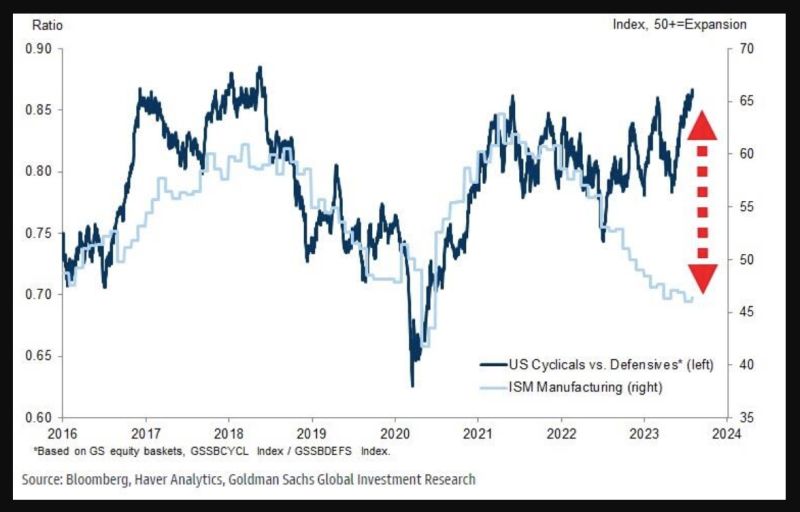

Do US cyclical equities look vulnerable given the extent of growth optimism currently priced in vs. the weakness of ISM manufacturing?

Source chart: Goldman

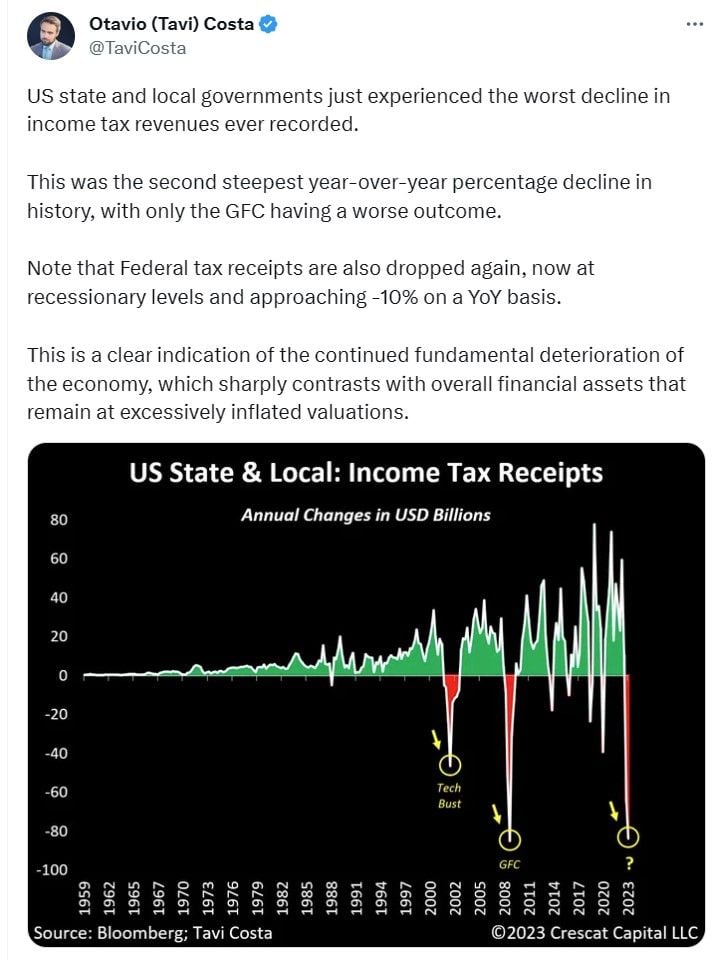

Despite the strong upward move of the Citigroup US economic Surprises index and the strong YTD performance of financial assets, there are signs that things are that rosy for the SU economy

Source: TaviCosta

Investing with intelligence

Our latest research, commentary and market outlooks