Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The History of the stock market is the history of forgetting!

Source: Investment Books (Dhaval)

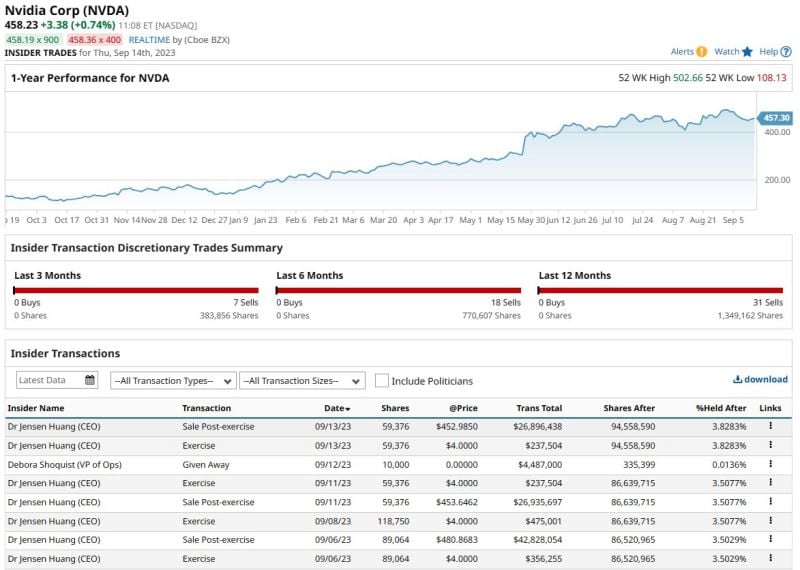

Nvidia Insider Trading Alert 🚨

Nvidia CEO Jensen Huang dumped another $27 million worth of $NVDA shares. He has now sold almost $100 million worth of shares over the last week. Source: Barchart

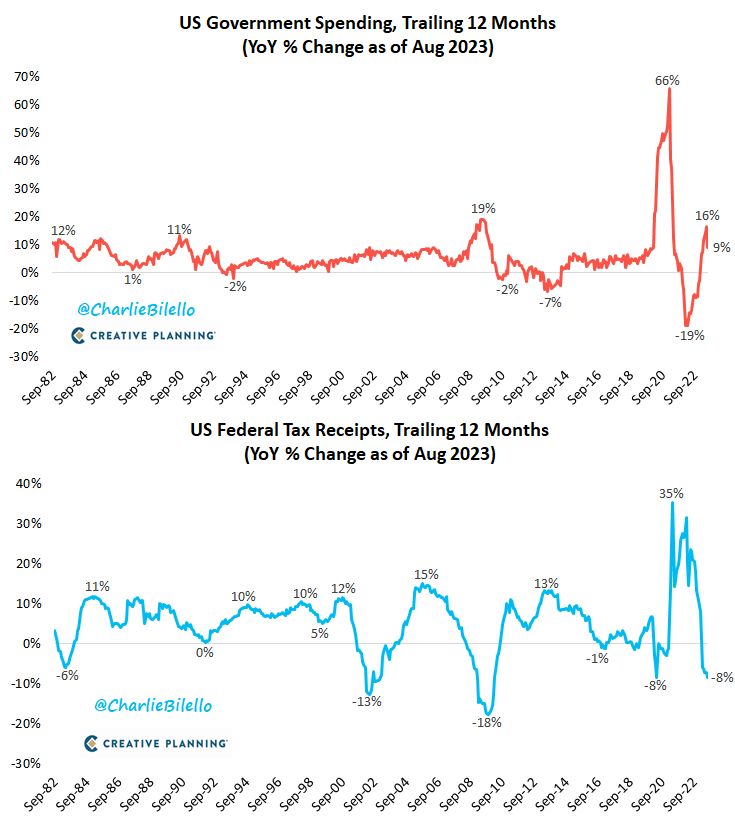

US government spending increased 9% over the last year while tax receipts declined 8%. What a luxury...

Source: Charlie Bilello

The top 10 companies in the S&P 500 with outstanding credit ratings

Among them, Microsoft and Johnson & Johnson stand out as the only two companies boasting the highest AAA rating. Source: Genuine Impact

European Central Bank hikes rates to a record 4% as inflation risks outweigh economic gloom.

- The ECB just raised its key rates again today, by 25bp (main Refi rate at 4.50%, deposit rate at 4.00%) - Concerns around the underlying inflation dynamic appear to have overwhelmed the ongoing negative (and concerning) dynamic in Europe’s economic growth: "inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points." Source: Bloomberg

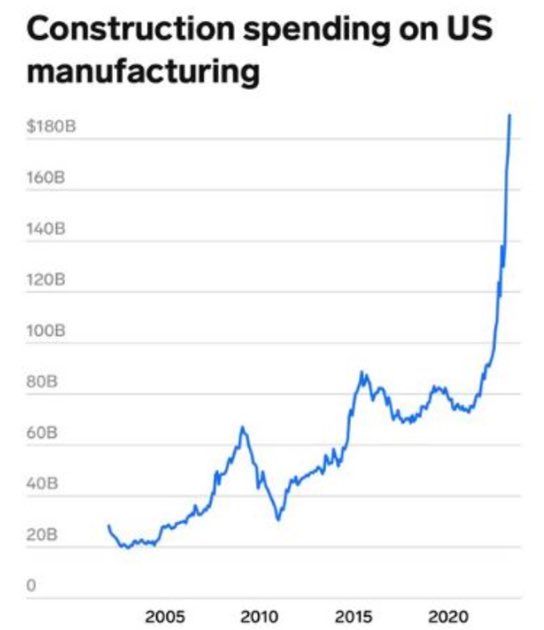

While Germany is deindustrializing US construction spending on manufacturing is going thru the roof. Viel glück Deutschland...

Source: Michael A. Arouet

While China has been offloading US Treasuries for 10+ years, the rate has accelerated

Both Canada and Mexico also now account for a higher % of US imports than China. These stories belong to the "new normal": the East-West divide, reshoring / nearshoring / friendshoring, etc. Source: Tavi Costa, Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks