Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US CORE CPI LITTLE HOTTER THAN EXPECTED => A FED PAUSE IS LIKELY BUT NO RATE CUT ANYTIME SOON

Consensus expected a reacceleration of Headline inflation (+0.6% MoM after +0.2% in July) and a stabilisation of “core” inflation (+0.2% MoM after +0.16% in July). Key actual numbers are the following: ON A SEQUENTIAL BASIS (MoM) Headline inflation numbers are in-line with expectations (+0.6%). That is the biggest MoM since June 2022 and the second straight monthly increase in CPI...The energy index rose 5.6% in August after increasing 0.1% in July. There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But the gasoline index dominated with an increase of 10.6 percent in August, following a 0.2% increase in the previous month.

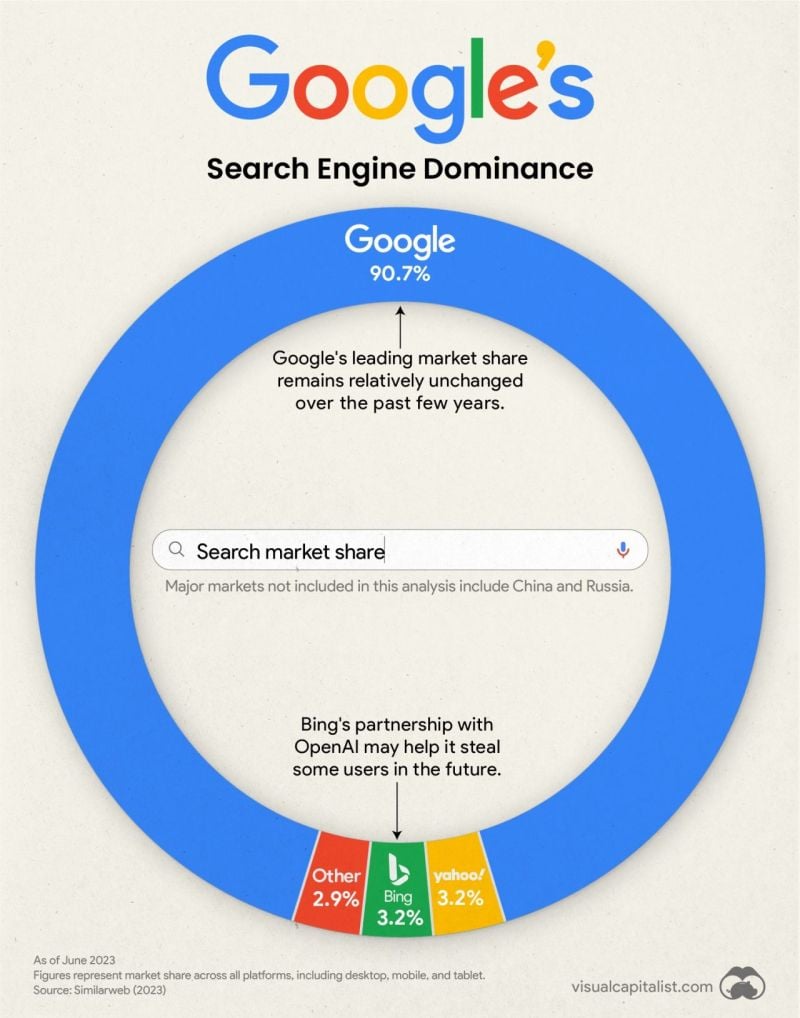

Visualizing Google’s Search Engine Market Share 🔍

https://lnkd.in/dAbVgCFJ

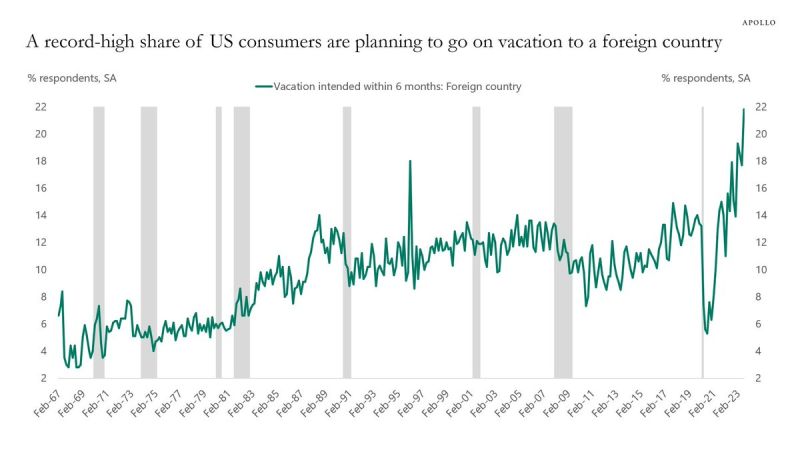

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

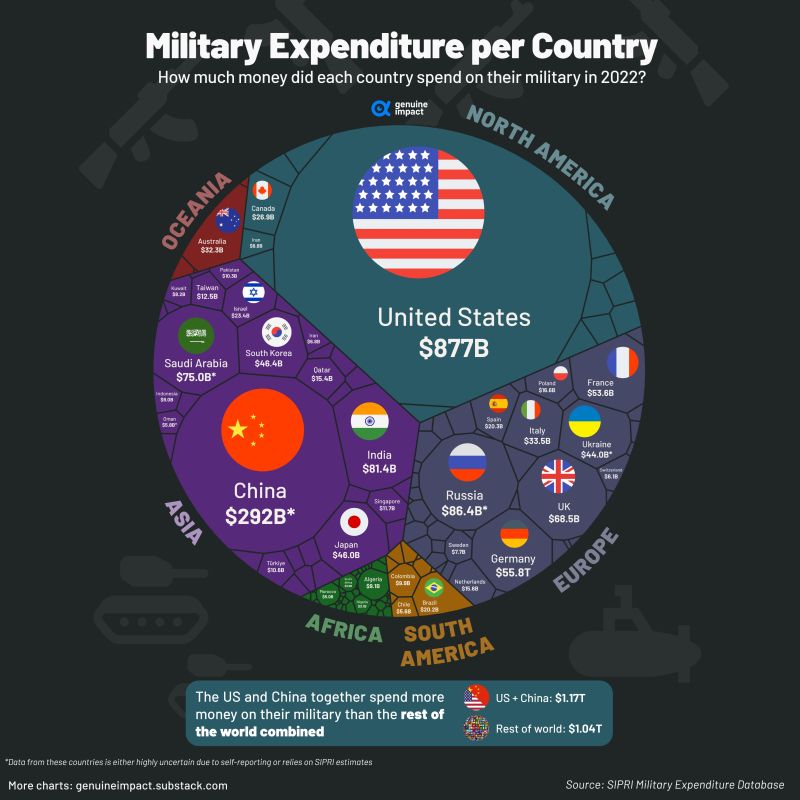

2022 global military budgets hit an all-time high of $2.2 trillion

When you combine the military budgets of the US and China, it surpasses the combined budgets of all other countries in the world! By Genuine Impact / Chris Quinn

Disinflationary forces are fading right now in Germany

Wholesale prices rose 0.2% MoM in August, after 4 consecutive months of declines. Prices of mineral oil products rose markedly (+6.9%) compared w/July 2023. More headaches for the ECB? Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks