Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FAT over AI: the match...

while headlines are all about artificial intelligence darling Nvidia, the weight-loss drugs champions Eli Lilly and Novo Nordisk stocks performance has been spectacular as well. Two year chart shows that $LLY is well ahead of "hot" $NVDA...and $NVO is practically "there"... Source: The Market Ear, Refinitiv

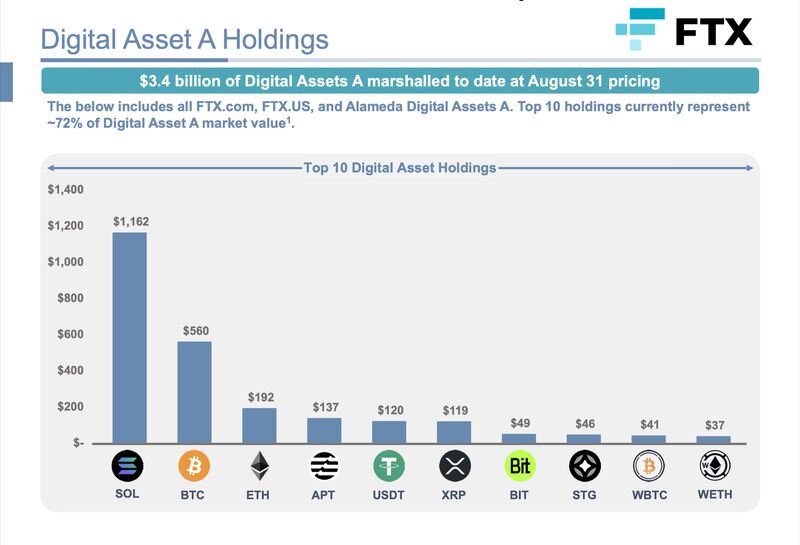

The updated FTX asset report that scares the altcoins / crypto community... A $3.4bn selling tsunami?

Source: Crypto Rower

After hitting a 16-year low against the U.S. Dollar, China's currency had its biggest gain in almost 3 weeks after the country issued a warning not to bet against its currency

Source: Barchart, FT

Cryptocurrencies were again under pressure today with bitcoin testing $25k

There are fears that altcoins face significant downside as FTX potentially seeks to dump its $3.4BN digital asset holdings. This is happening as BTC is close to a 'death cross' - 50DMA dropping below 200DMA... Source: Bloomberg, www.zerohege.com

Median US home prices are now contracting at a level only seen 2 times in the last 60 years:

- 1970 - 2008 Both ended in severe recessions Source: FRED, Game of Trades

Priceless Life Advice from Charlie Munger

Source: Investment Books (Dhaval)

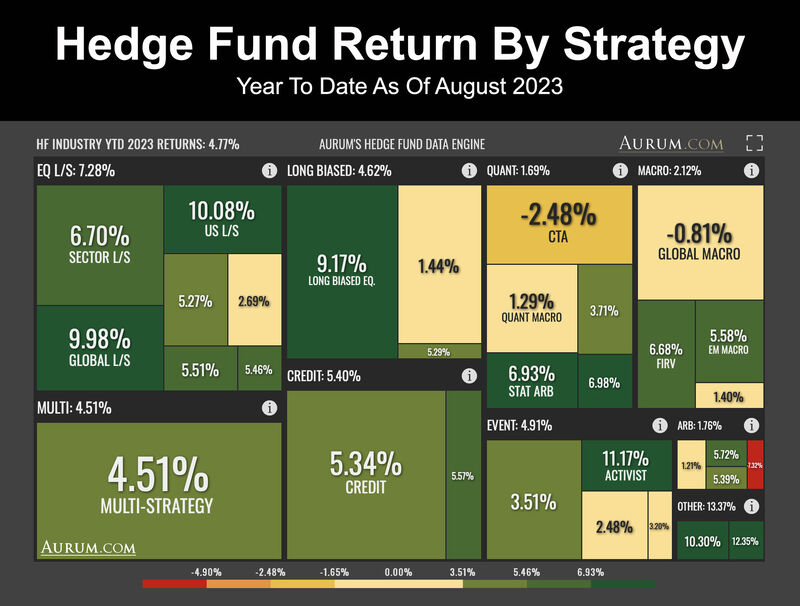

Hedge Fund YTD returns by strategy as of August 2023

Source: www.aurum.com

Investing with intelligence

Our latest research, commentary and market outlooks