Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

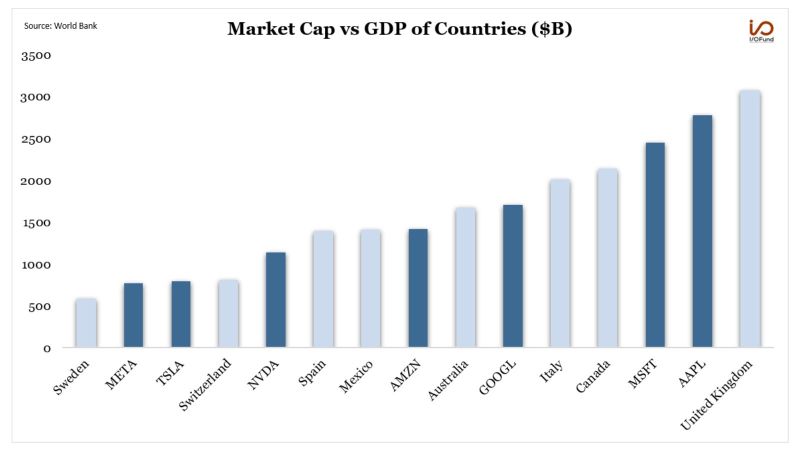

Comparing the market capitalization of Big Tech stocks to the GDP of nations, Apple and Microsoft emerge as giants. They would rank 8th and 9th respectively if they were countries

$AAPL $MSFT $GOOGL $AMZN $NVDA $TSLA $META Source: Beth Kindig

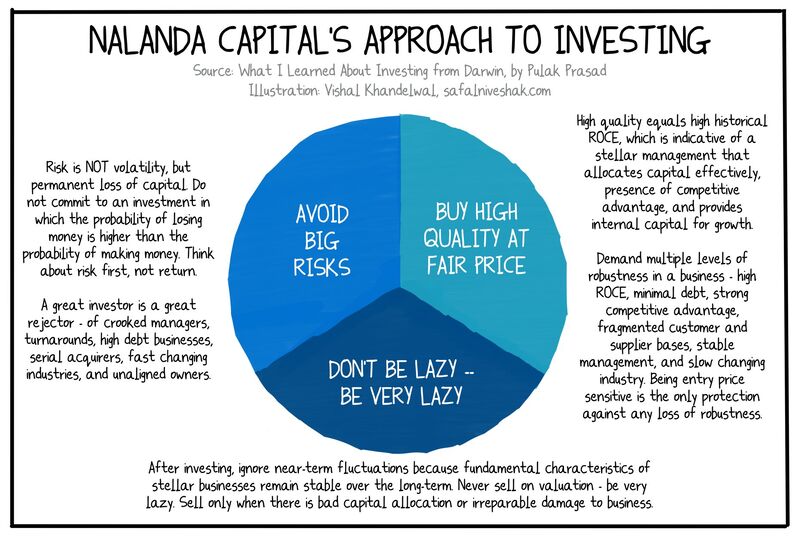

Nalanda Capital's approach to investing

Source: What I learned about investing from Darwin by Pulak Prasad Illustration: Vishal Khandelval

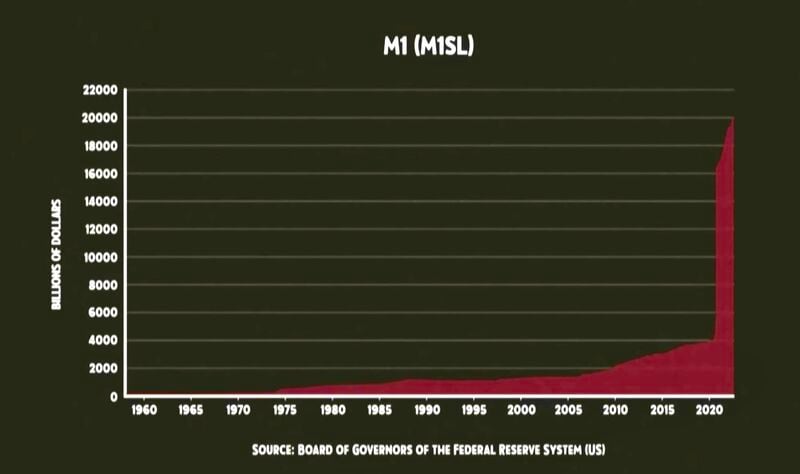

Over 80% of all US money created (US Dollars printed) took place between 2020 and 2023

Source: Win Smart

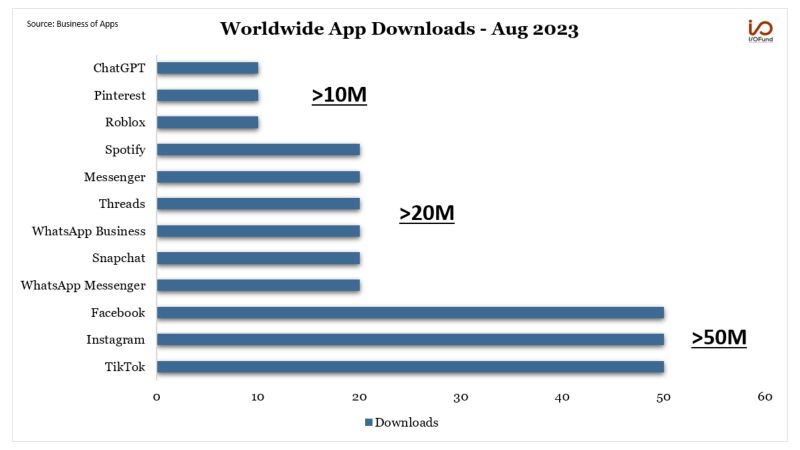

Worldwide App Downloads

Despite Chatgpt's meteoric rise this year and with over 10M app downloads in August, it still lagged behind traditional giants like TikTok, Instagram, and Facebook, each of which had over 50M downloads in the same month. Source: Beth Kindig, Business of Apps

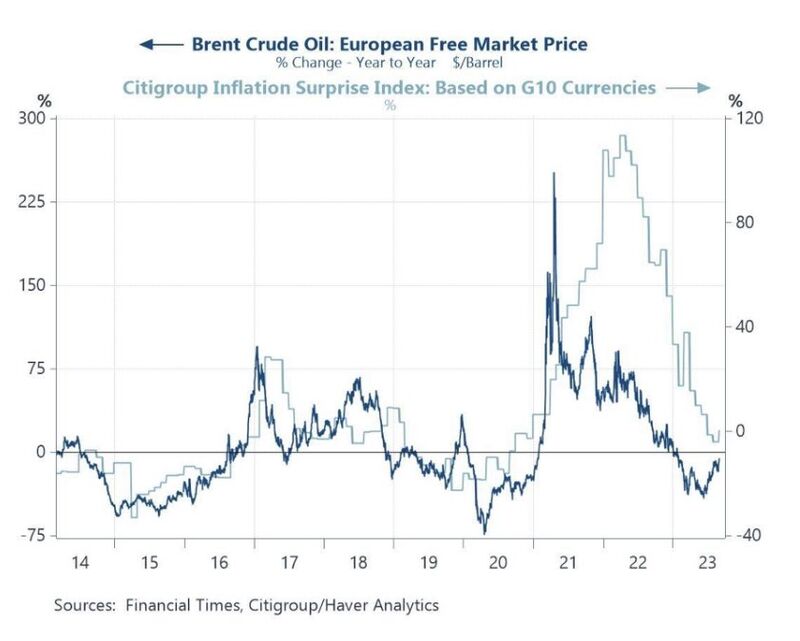

Brent oil vs. Citigroup global inflation surprises index

Oil price usually lead inflation 👇 The recent uptick in oil price will be probably not enough to materially change inflation surprises, but should oil continue to go up it would start to have an impact. Source: Michel A.Arouet

The sp500 P/E ratio used to be tightly correlated to the US 2 year yield (inverted on the chart), i.e the lower the 2 year yield, the higher the P/E ratio and vice versa

Well, this is no longer the case as a giant crocodile jaw has been forming. Which of the 2 will bind firts? Source. Jeroen Blokland, True Insights

Investing with intelligence

Our latest research, commentary and market outlooks