Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

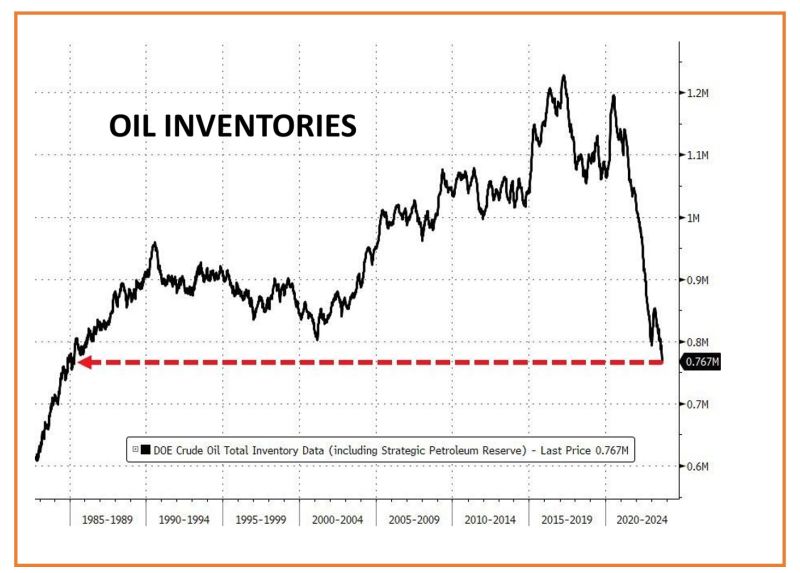

Is oil going to $100?

U.S Crude inventories fell by WAY more than expected ( -6.3mm (-2.1mm expected) to their lowest since early December - and are well below their five-year average for this time of year as the summer driving season ends. Including the SPR (Strategic Petroleum Reserve), this is the lowest level of total crude inventories in America since 1985... Source: Bloomberg, www.zerohedge.com

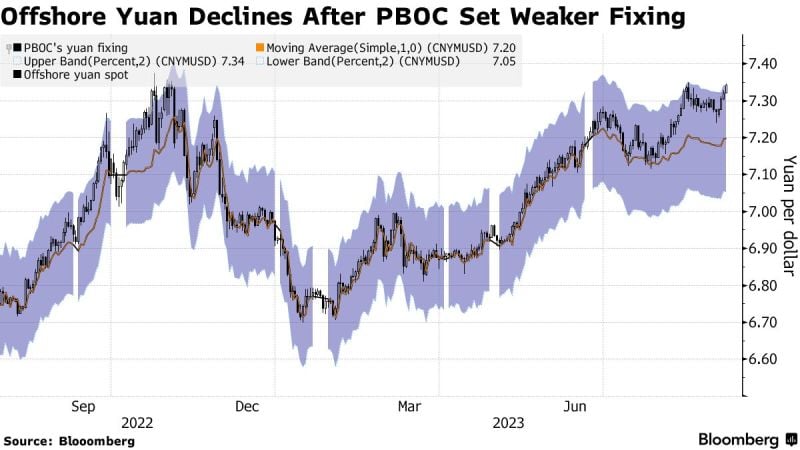

China Budges in Fight With Bears, Sending Yuan Toward Record Low – Bloomberg

The offshore yuan weakened toward its lowest on record against the dollar, as a cut to the daily reference rate for the managed currency stoked bets China is comfortable with a gradual depreciation. China’s currency declined to about 7.36 per dollar in overseas trading, beyond the psychologically important level of 7.35 and close to the weakest since the creation of the offshore yuan market in 2010. The move came after the People’s Bank of China set its so-called fixing at a two-month low on Friday.

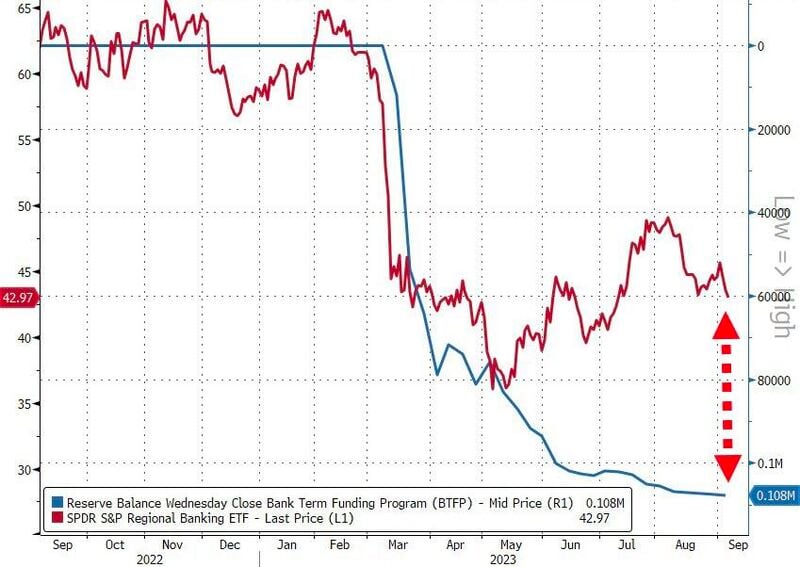

Usage of the Fed's emergency bank funding facility jumped by $328 million last week

It now stands at a new record high of $108 billion, even as the regional bank crisis is "over." The current rate banks are paying the Fed on these loans is an alarming ~5.5%. i.e . the banks that almost collapsed are now borrowing record levels of expensive debt from the Fed. Is the US regional banks crisis really over? Source: zerohedge, Bloomberg, The Kobeissi Letter

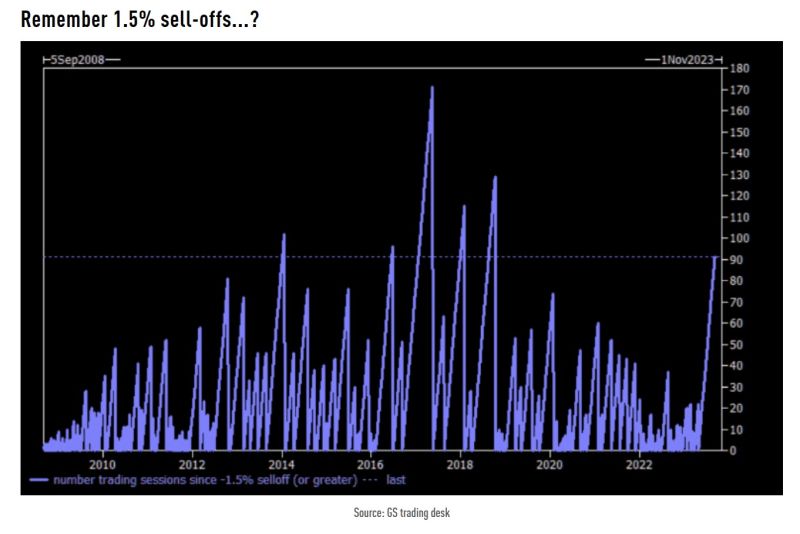

91 is the number of trading sessions since at least a 1.5% sell off session in SPX

This length of time without a 1 day equity shock is rare ... has happened ~five times in the last 15 years. Source: Goldman Sachs, TME

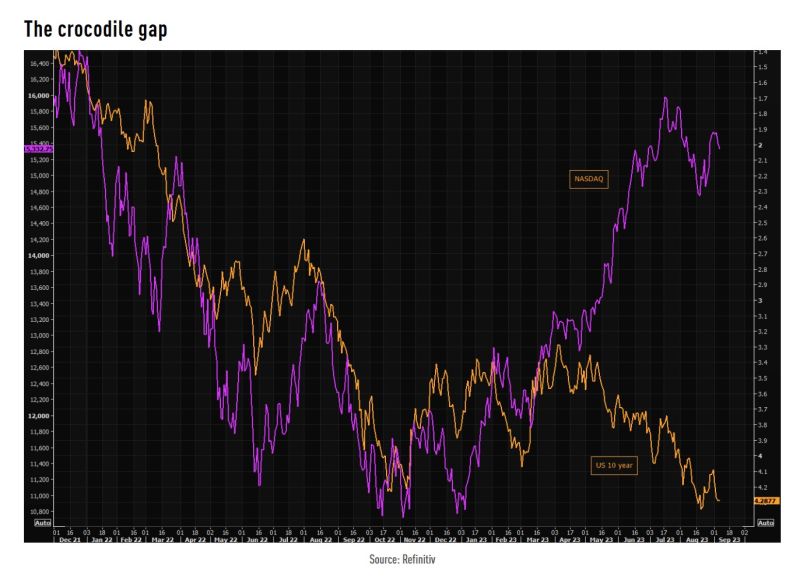

The longer term gap between NASDAQ and the US 10 year remains huge

Source: TME, Refiitiv

Over the years, 'soft consumption' such as entertainment has gained lots of traction, thanks to on-demand streaming services

Source: Genuine Impact

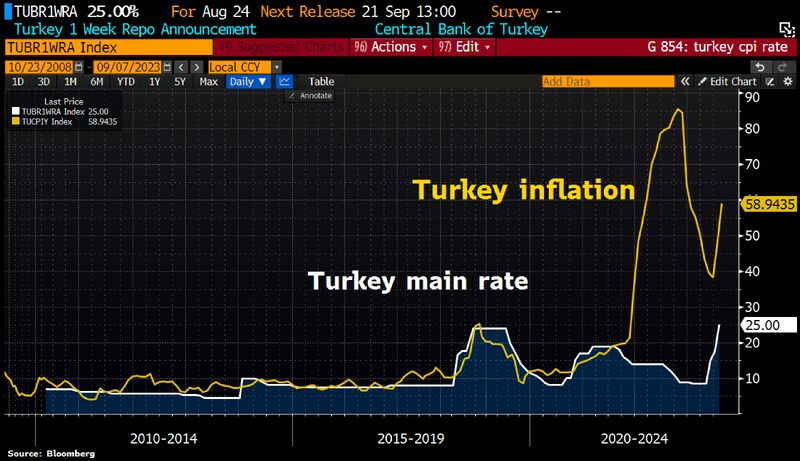

Turkey inflation has reaccelerated despite sharply increased key interest rates.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks