Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

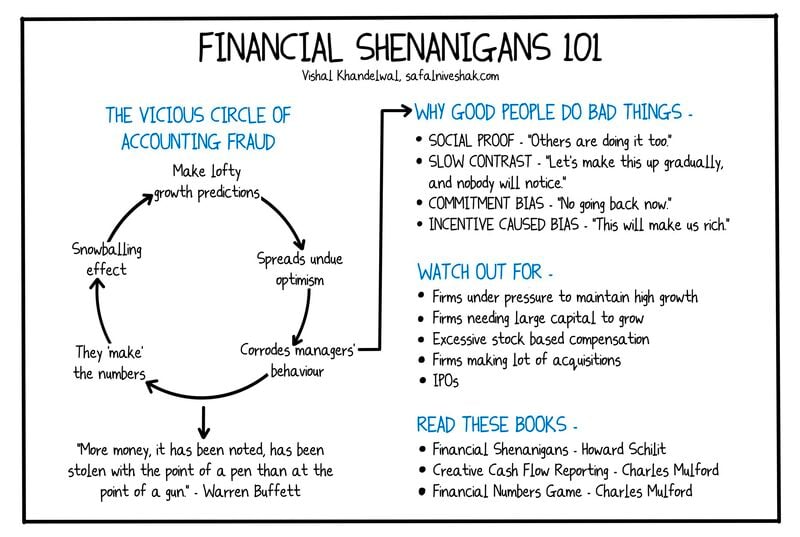

Financial Shenanigans 101

“More money, it has been noted, has been stolen with the point of a pen than at the point of a gun.” - Warren Buffett Source: Vishal Khandelwal

“Life is like riding a bicycle. To keep your balance you must keep moving.” — Albert Einstein

Source: Philosophy Quotes

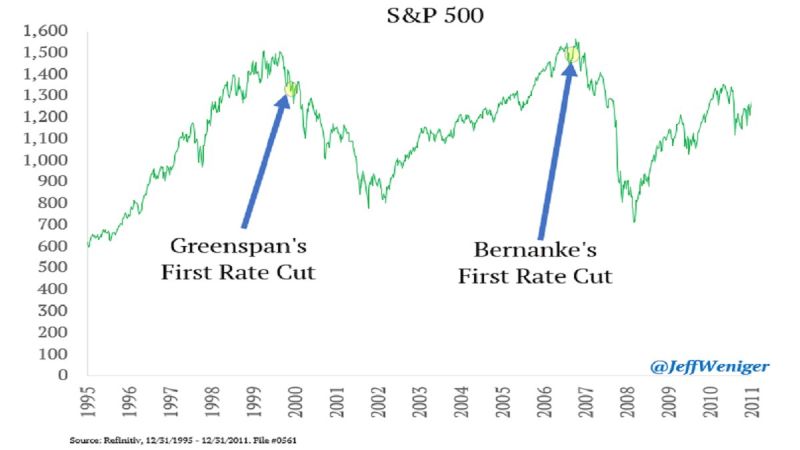

If the Fed cuts rates next year, is that a good thing?

Source: Jeff Weniger

Regulation: this is where Europe want to take lead globally...

the rest of the world (especially the #us) wants to lead on #innovation and #growth but Europe wants to become the champion of #regulation... Indeed, U.S. tech giants are facing stricter rules in Europe with more regulation (the Digital Markets Act or DMA) announced this week. The European Commission, the executive arm of the EU, named six “gatekeepers” on Wednesday — these are companies that have an annual turnover above 7.5 billion euros ($8 billion) or 45 million monthly active users inside the bloc. They are Amazon, Alphabet, Apple, Microsoft, Meta and ByteDance, who now have six months to comply with stricter market rules — such as not being able to prevent users from uninstalling any pre-installed software or apps, or treating their own services more favorably. Source: CNBC, politic.eu

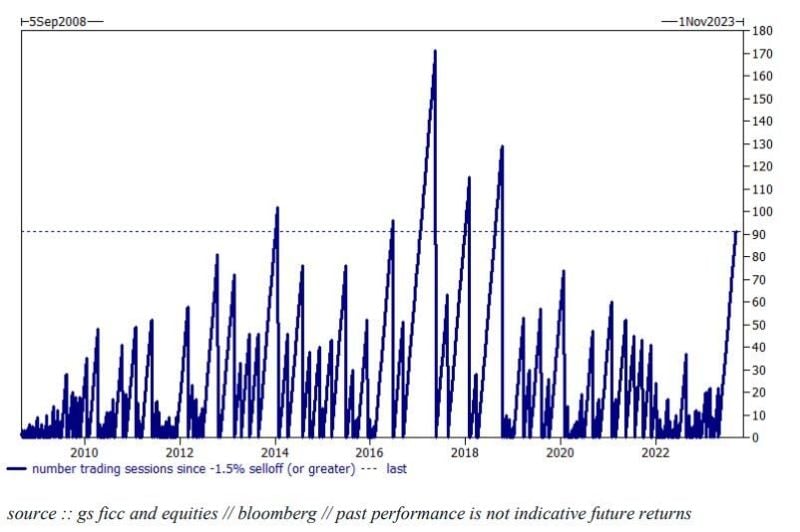

As Goldman's Brian Garrett noted yesterday, it has been 91 days since the sp500 suffered a 1.5% loss or greater in a day...

That's unusual - it has happened only 5 times in the last 15 years. As we have discussed recently, Sep + Oct are seasonally-volatile months... Source: Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks