Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

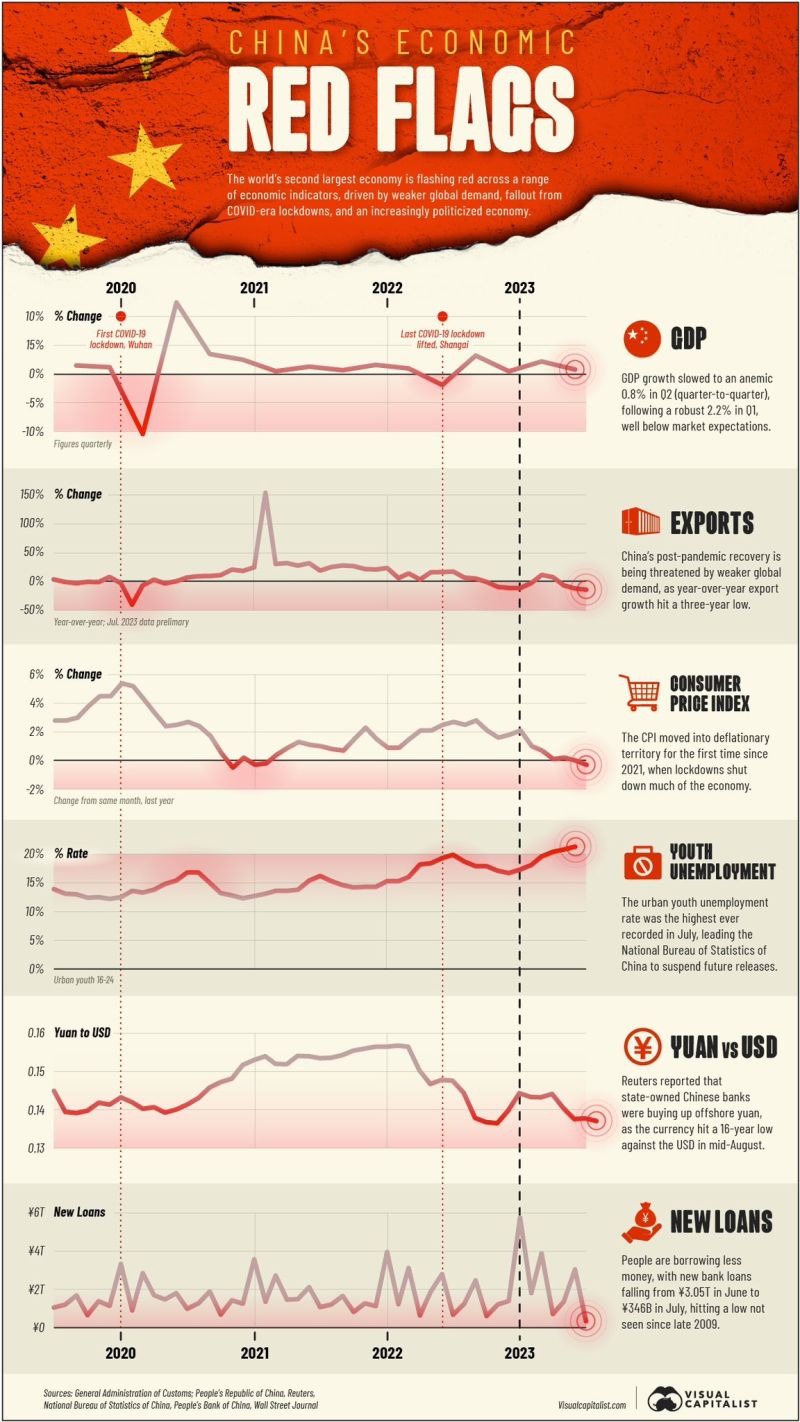

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Shares of Chinese property developers Evergrande soared as much as 82% on Wednesday

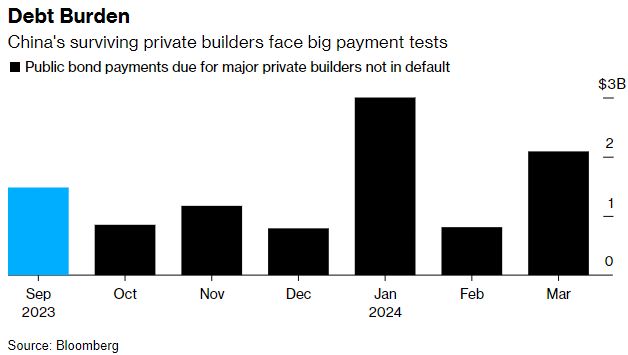

Other stocks like Country Garden Holdings and Logan Group also surged, gaining as much as 26% and 28% respectively. The gains come after Country Garden reportedly managed to pay $22.5 million in bond coupon payments on Tuesday, narrowing avoiding default. Let's keep in mind though that the sector is far out of the wood. According to Bloomberg, 34 out of the top 50 private real estate developers in China are suffering delinquencies. The remaining 16 developers face a combined $1.5 billion of bond payments this month. In January 2024, these remaining 16 Chinese developers will face a massive $3.0 billion in bond payments. Source: The Kobeisi Letter, CNBC

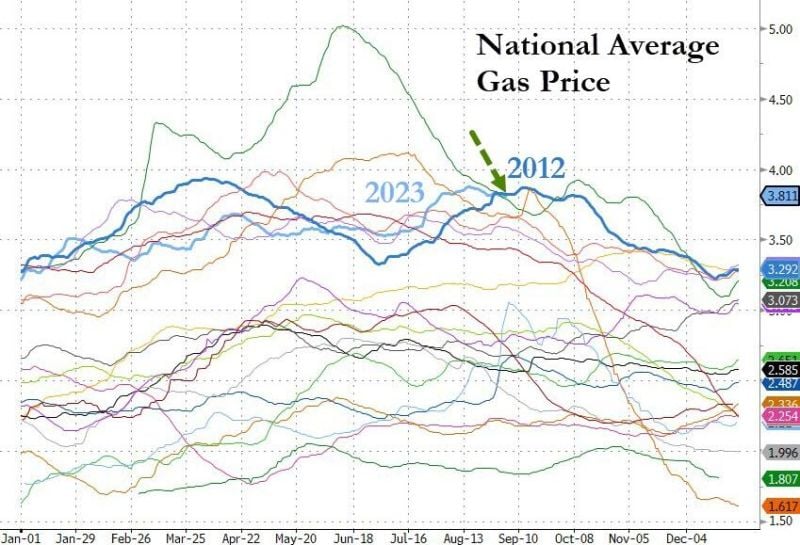

An immediate consequence of soaring oil prices mean -> Soaring gas prices in the US

Now at their highest for this time of year since 2012 (and 2nd highest ever)... not great for headline inflation and consumer purchasing power Source: Bloomberg, www.zerohedge.com

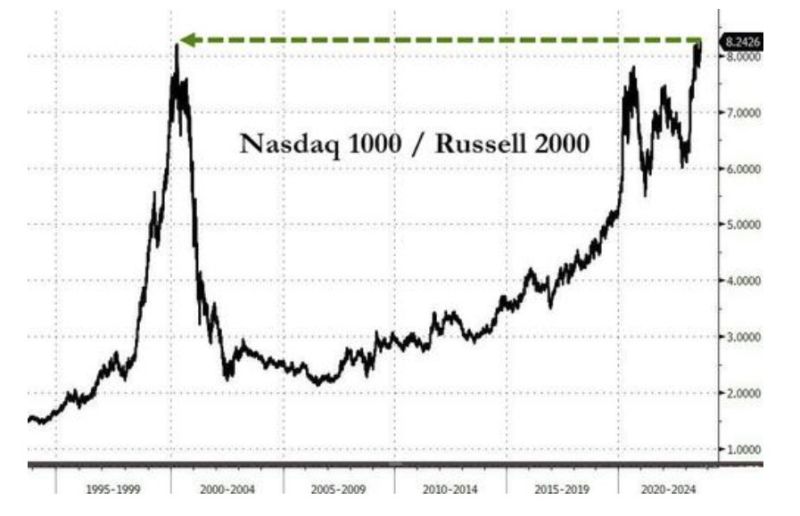

Despite the rise in bond yields, the Nasdaq 100 held up better than the Dow and other US indices on Tuesday

Tuesday was the way the Nasdaq's second best performance relative to the Russell 2000 since November 2021, breaking out to a new cycle high. The last time Nasdaq/Russell 2000 traded here was March 2000 - the very peak of the dotcom bubble... Source: Bloomberg, www.zerohedge.com

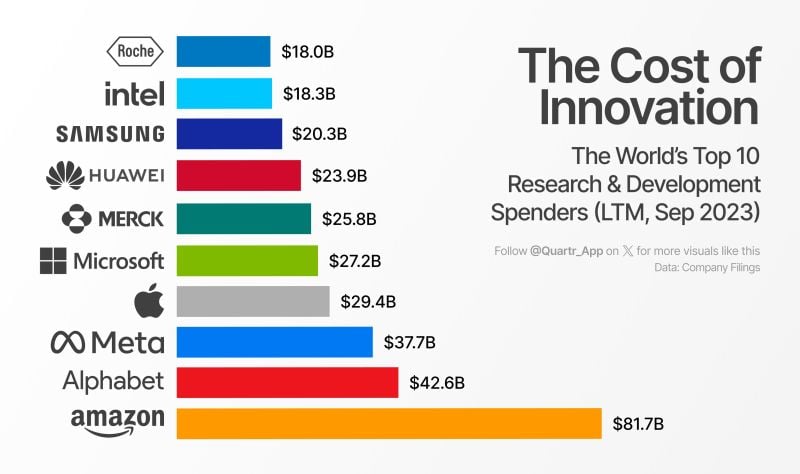

The cost of innovation

Did you know that $AMZN has spent more on R&D over the last twelve months than $AAPL, $MSFT, and $INTC *combined*? See below the World’s Top 10 R&D Spenders Source: Quartr

The most valuable listed company in Europe now comes from Denmark

Novo Nordisk has overtaken luxury goods group LVMH on the stock market. It is now worth >€400bn, LVMH 'only' €382bn. The Danish drugmaker on Monday introduced Wegovy in Britain after launching it in the US in June 2021. Soaring demand in the world’s largest drug market subsequently delayed marketing in Europe. The drug is already available in Norway, Denmark and Germany. The company said on Monday that the drug would be introduced to the UK “through a controlled and limited launch”. Novo Nordisk is the largest producer, by sales, in a market for diabetes and new weight-loss drugs that analysts forecast would reach $130bn to $140bn in annual sales worldwide. The company’s biggest competitor in the market, Indianapolis-based Eli Lilly, has applied for regulatory approval to use its diabetes drug Mounjaro to treat obesity. Source: FT

Brent Oil hits $90/bbl for 1st time since Nov as Saudi Arabia extended its unilateral oil production cut by another three months

Source: Bloomberg, Holger

Investing with intelligence

Our latest research, commentary and market outlooks