Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

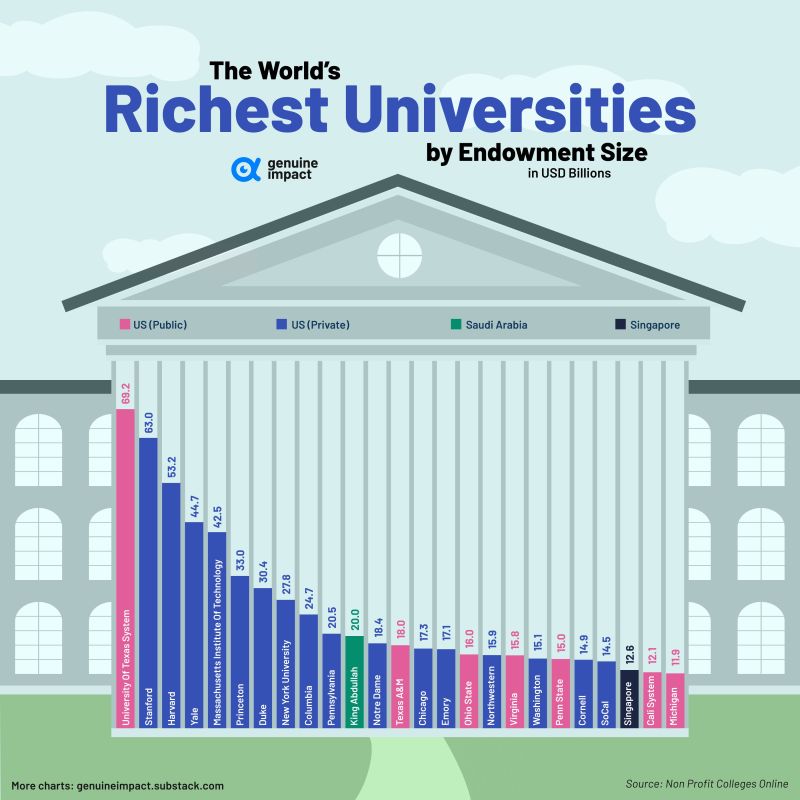

The world's richest universities

💰Of the 25 wealthiest schools worldwide🌍, only 2 are not from the United States. 💰As of 2022, the University of Texas System had an endowment value of $69 B, making it the wealthiest university in the world🤑. Source: Genuine Impact / Chris Quinn

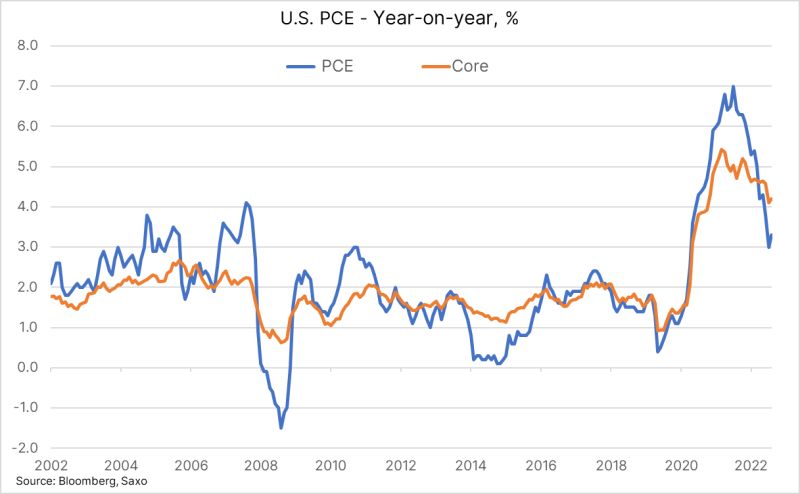

PCE Deflator, the FOMC's favorite inflation number, show a rise as expected with the YoY at 3.3% (from 3%) and the core at 4.2% (from 4.1%)

Jobless claims at 228k (235k expected) showing continued strength ahead of Friday's NFP report Source: Ole S.Hansen

Disinflation pause?

Eurozone inflation remained stuck at 5.3% in Aug, higher than the 5.1% that economists expected. Core inflation, which excl volatile energy, food, alcohol & tobacco prices & closely watched by ECB as measure of underlying inflation, tumbled to 5.3% in Aug from 5.5% in July, matching expectations. Source: HolgerZ, Bloomberg

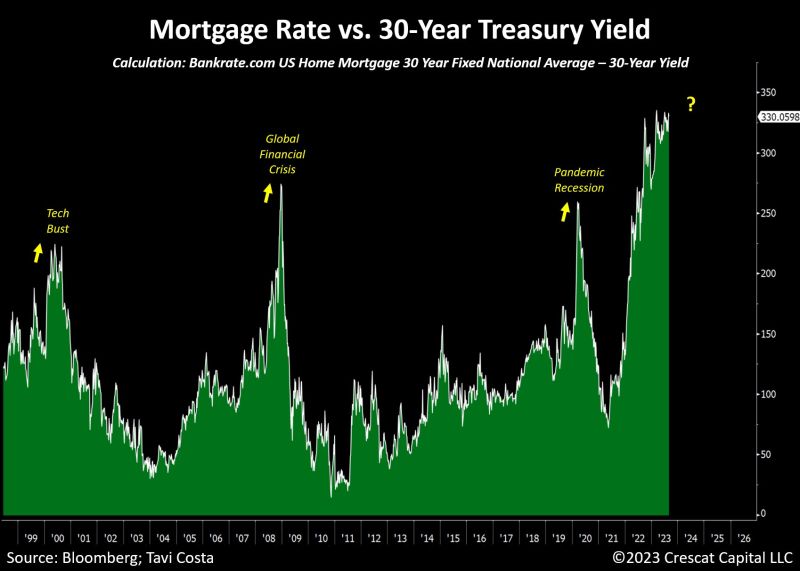

We are now seeing the widest spread between mortgage rates and 30-year risk-free rates in history

Should we see this as another barometer of credit tightness in the system? Source: Crescat Capital, Bloomberg

Is the US stock market severely mispriced?

Typically, the dividend yield on the S&P 500 is well above the US 30y real yield. That has changed. Source: Bloomberg, HolgerZ

French CPI a little hotter than expected, rising 50bp in August

This was all due to energy (including higher regulated prices) and the end of the summer sales, but services inflation is still easing driven by transports and "other services". FRENCH CPI YOY NSA PRELIM ACTUAL 4.8% (FORECAST 4.6%, PREVIOUS 4.3%) FRENCH CPI MOM NSA PRELIM ACTUAL 1% (FORECAST 0.8%, PREVIOUS 0.1%) FRENCH HICP MOM PRELIM ACTUAL 1.1% (FORECAST 1%, PREVIOUS 0.0%) FRENCH CONSUMER SPENDING MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.9%) Source: Bloomberg

UBS Group AG posted a $29 billion second-quarter profit in first results since Credit Suisse takeover.

This is the biggest-ever quarterly profit for a bank in the second quarter as a result of its emergency takeover of Credit Suisse, and confirmed that it would fully integrate the local business of its former rival by next year. Key takeaways: - UBS said the result primarily reflected $28.93 billion in negative goodwill on the Credit Suisse acquisition (i.e this huge profit is due to a huge one-off gain that reflects how the acquisition costs were far below Credit Suisse's value). Underlying profit before tax, which excludes negative goodwill, integration-related expenses and acquisition costs, came in at $1.1 billion - The accounting gain for the quarter eclipses JPMorgan Chase & Co.’s $14.3 billion profit in the first quarter of 2021, the modern record for US and European lenders; - Analysts had projected a net profit of $12.8 billion for the three months to the end of June, according to a Reuters poll. Source: Bloomberg, CNBC Source illustration: Sonntagzeitung / Melk Thalmann

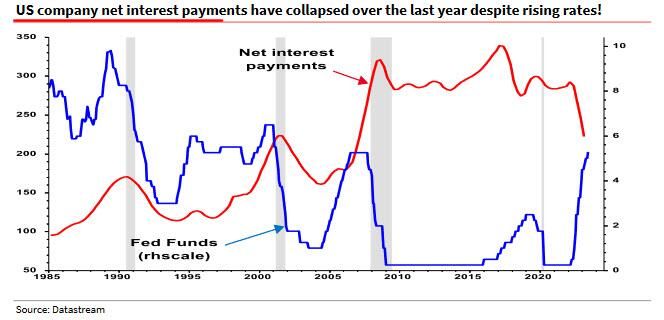

The "maddest macro chart I have seen for many years." by Albert Edwards (SocGen)

"The US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed. What on earth is going on?" asked Edwards "This chart not only explain the resilience of corporate profits, but is a key reason why this recession has been delayed – especially as companies in aggregate are now a net beneficiary of higher rates (NB: this is mainly explained by mega-caps as most of the other companies are in big trouble). Source: SocGen, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks