Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The importance of Nvidia and Tesla for the US equities market

Source: Mac10

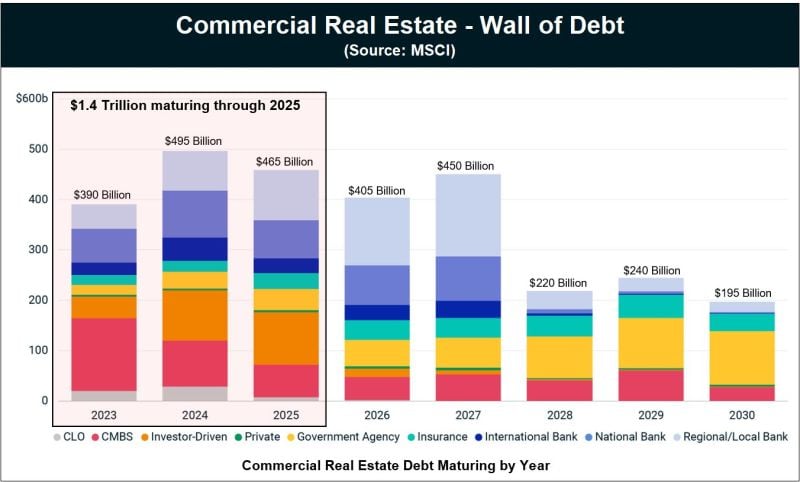

US commercial real estate prices prices are down sharply this year with offices building prices down ~30%

On top of declining prices, there are nearly $1.4 TRILLION of commercial real estate loans coming due by 2025. Meanwhile, rates on the commercial real estate loans have more than doubled since they were issued. Last but not least, vacancies in commercial real estate are skyrocketing (which means rent revenue is down). The coktail of rising rates on loans that need to be refinanced and declining income looks like a rather toxic one. Source: The Kobeisi Letter

Here's a chart showing mentions of "AI" on earnings calls and transcripts

Mentions of "AI" in 2023 have basically broken this chart. We went from ~500 mentions in 2015 to ~30,000 this year and we still have 4 months left. Corporations really want to cash-in on the artificial intelligence hype. Source: Bloomberg, The Kobeissi Letter

BREAKING; Elon Musk’s X (Twitter) obtains license for Bitcoin and €crypto services to store, transfer, and exchange digital assets on behalf of its users

Elon Musk has decided to make X (formerly Twitter) an “everything app” with multiple functionalities, including a payment hub processor integrated with the microblogging social network and other tools from the building ecosystem. Musk already stated that X is a “DOGE-friendly place”. Part of the work of becoming a payment hub, or a cryptocurrency-friendly place, in the United States lies in obtaining the required licenses to operate such a business legally. Elon Musk’s company has been gradually doing that in different states but mostly focused on fiat payments under the “Money Transmitter License.” In particular, this license will enable X to store, transfer, and exchange digital assets on behalf of its users. Source: Finbold, Bitcoin Archive

Hedge funds exposure to mega cap tech stocks reaches highest level EVER RECORDED

Source: Barchart, Bloomberg

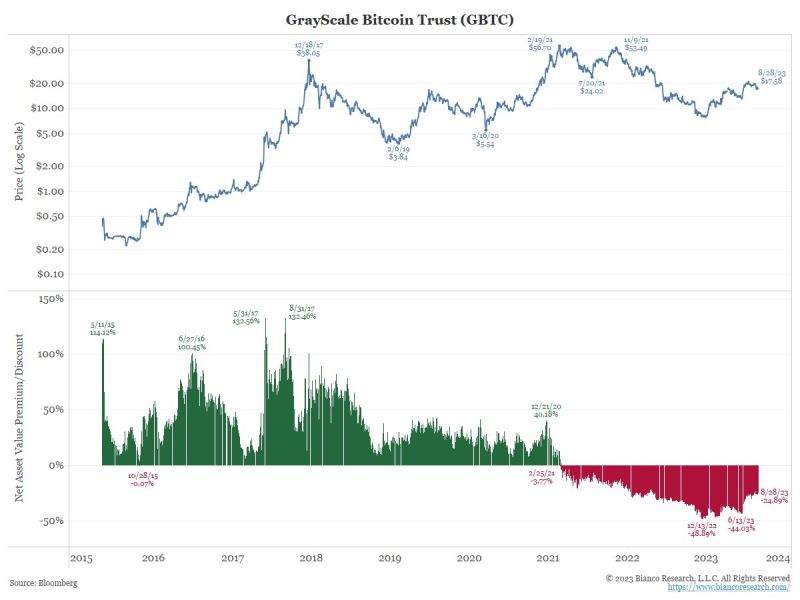

What's going on with Grayscale ($GBTC) and bitcoin? As summarized by James Bianco:

1) Grayscale is closed-end fund that owns Bitcoin (BTC). It currently owns the equivalent of $16 billion in BTC. 2) Because GBTC is a closed-end fund, it can and does trade at huge discounts and premiums (see the bottom panel on the chart). As of yesterday's close, GBTC traded at a 25% discount to its Net Asset Value (NAV). 3) Many years ago, Grayscale filed with the SEC to convert its closed-end fund to an ETF in order to be able to create and redeem shares. This makes it easy to keep the price and NAV at nearly the same level. Until now, this conversion never got approved (the SEC has so far denied all spot bitcoin ETF applications) 4) Today, The Court of Appeal ruled IN FAVOR of Grayscale in their lawsuit challenging the SEC's decision to deny $GBTC's conversion to an ETF. This paves the way for the first "spot" bitcoin ETF. Source: James Bianco

Investing with intelligence

Our latest research, commentary and market outlooks