Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US is pumping more oil than any country in history

US crude production has surpassed every record in history for six years in a row, the US Energy Information Administration wrote on Monday. Its latest peak reached in 2023 is unlikely to be broken by any near-term competitor, it said.Including condensate, last year's US crude production averaged 12.9 million barrels per day, eclipsing the 2019 global record of 12.3 million barrels per day.A monthly record also occurred in December, at over 13.3 million b/d. Source: business insider

Wall Street in Control?

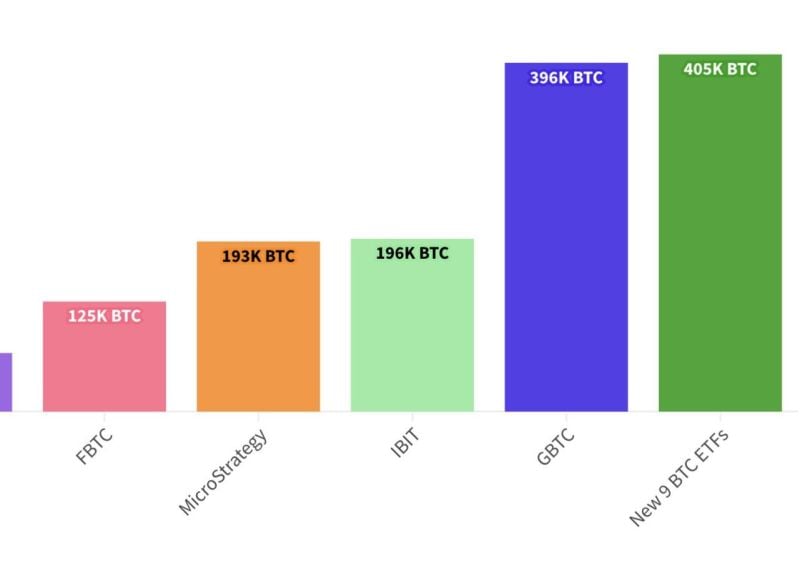

The New 9 have successfully overtaken the position previously held by GBTC, indicating a significant shift in market dynamics. Similarly, IBIT has surpassed MSTR, further emphasizing the evolving landscap... in 8 weeks' time. source : fred krueger

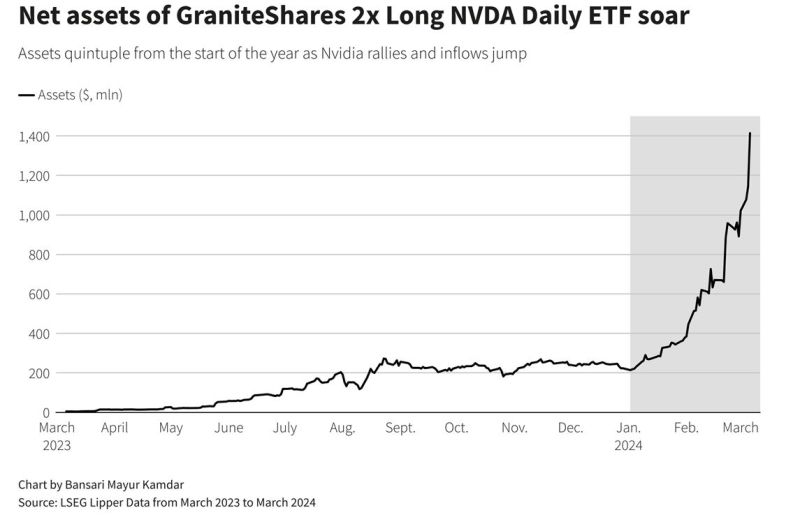

Inflows into bullish Nvidia ETF hit record

Net daily inflows into the GraniteShares 2x Long NVDA Daily ETF NVDL.O hit a record of $197 million, according to LSEG Lipper data. The assets managed by the ETF have grown to $1.41 billion from $213.75 million at the start of the year." source : reuters

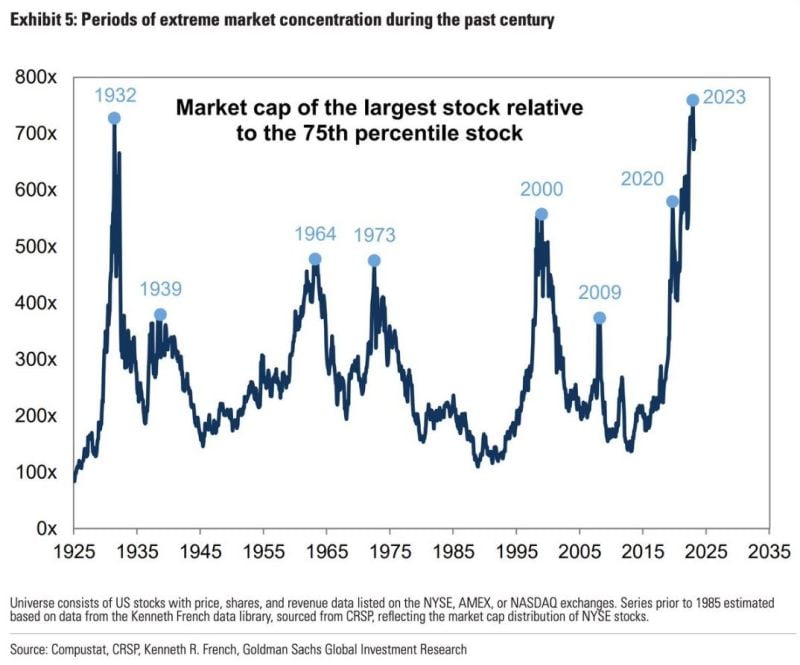

It's starting to feel a bit more crowded

Source: mayhem4markets

Europe's leading stock index reaches 500 points for the first time, 24 years following its achievement of 400 points

source : Bloomberg

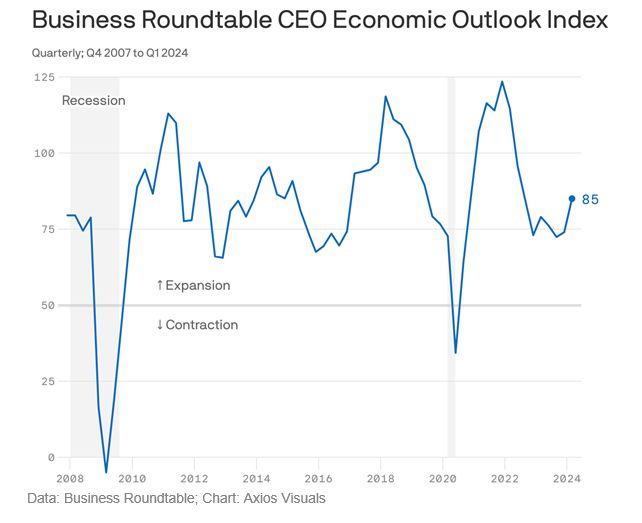

CEOs' economic outlook is surging

America's top executives are strikingly more confident about the economy, with expectations of stronger sales and capital investments. For the first time in two years, the Business Roundtable's quarterly gauge of CEO sentiment is above its historical average. By the numbers: The lobbying group's index jumped by 11 points in the first quarter to 85 — topping the long-running average by 2 points. source : axios

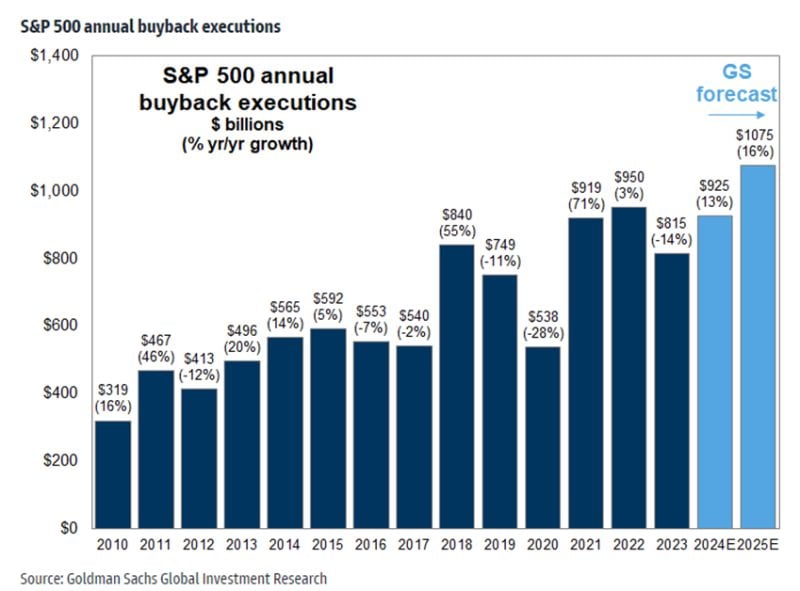

Goldman Sachs has upgraded its buyback forecast for 2024, anticipating a total of $925 billion in buybacks for S&P 500 companies, marking a 13% year-over-year increase.

They also took the opportunity to introduce a prediction for 2025: $1.075 trillion in buybacks, thus surpassing the trillion-dollar mark, setting a new historical record, and representing a 16% year-over-year growth. source : GS

Investing with intelligence

Our latest research, commentary and market outlooks