Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

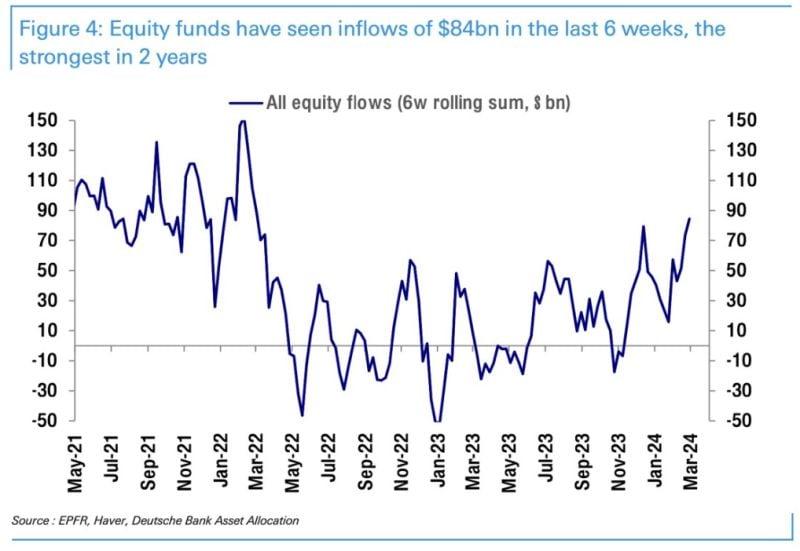

Global Equity Funds have seen inflows $84 billion over the last 6 weeks, the highest amount in 2 years

source : deutsche bank, barchart

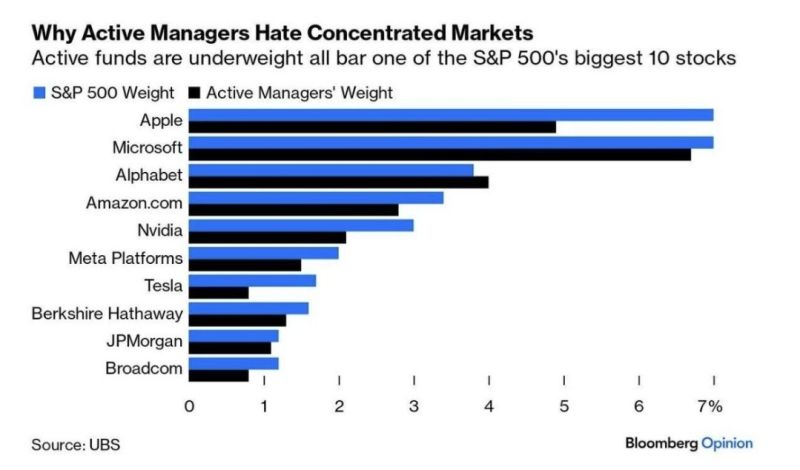

Active Funds are underweight all of the S&P 500's largest 10 stocks except for Alphabet $GOOGL. The underweights are most likely driven by diversification / regulatory rules

Source: Bloomberg

New York Community Bank $NYCB crashed 20% in after hours trading citing "material weakness in internal controls."

The weakness is reportedly related to loan review resulting from ineffective oversight and risk assessment. NYCB is the same bank that acquired the collapse Signature Bank during the regional bank crisis. This comes just weeks after the bank posted an unexpected $260 million loss in Q4 2023. The stock is now at its lowest level since 1997. Source: The Kobeissi Letter

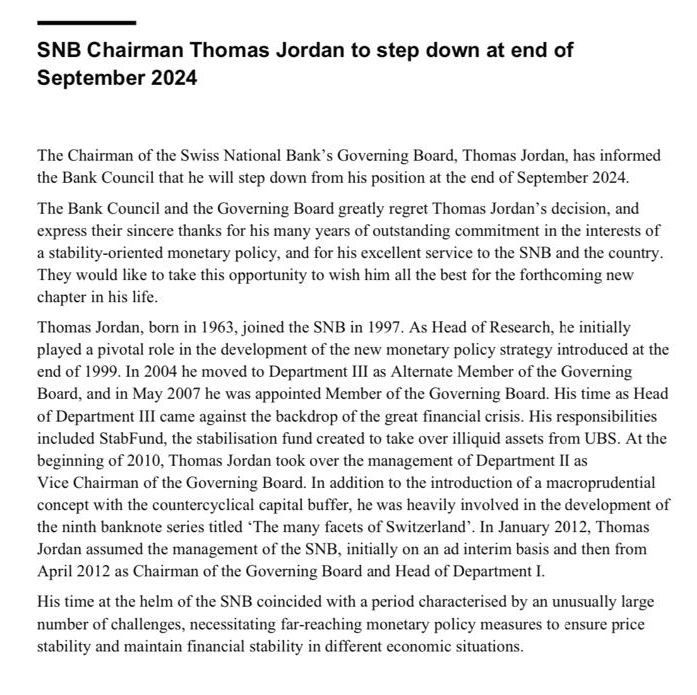

BREAKING >>> SNB Chairman Thomas Jordan to step down at the end of September 2024

.

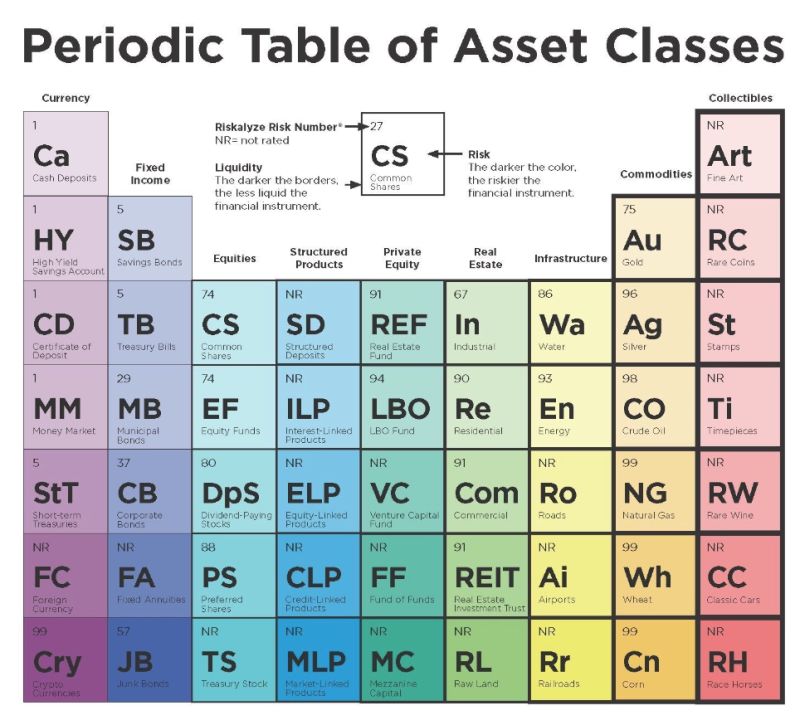

Here's the periodic table of asset classes👇

The darker the color - the higher the risk 🚨 The more on the right the asset is - the less liquid it is Source: Linas Beliunas h/t John Kador & Kathleen Kowal

Investing with intelligence

Our latest research, commentary and market outlooks