Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A government shutdown would reflect negatively on America’s credit rating, says Moody’s, the only remaining major credit grader to assign the US a top AAA rating

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years,” analysts led by William Foster wrote in a report Monday. Source: Bloomberg

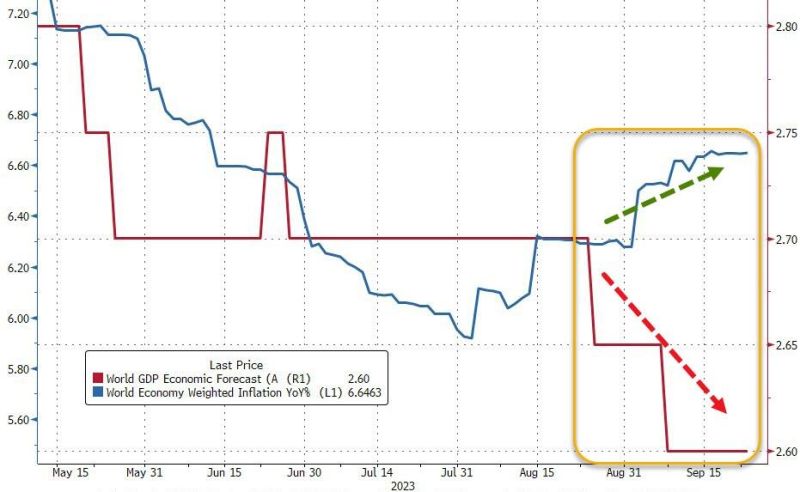

This chart explains by itself why the market mood has been deteriorating over the last few weeks:

Growth forecasts moving down / world inflation going up. What else? Source: www.zerohedge.com, Bloomberg

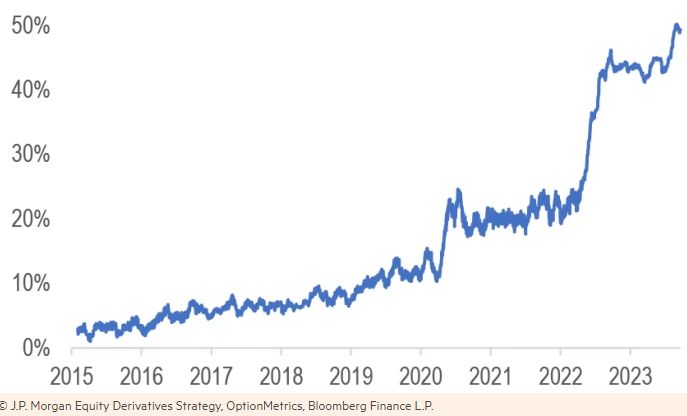

Zero Day Options (0DTE) now account for half of total SP500 options volume

Source: Barchart

$AMZN Amazon to invest up to $4B in AI startup Anthropic

💰 Largest investment ever for AWS. 🔎 Google previously invested $300M. 🤖 Anthropic's Claude LLM-based chatbots rivals OpenAI's ChatGPT. The generativeAI battle is heating up. Source: App Economy Insights

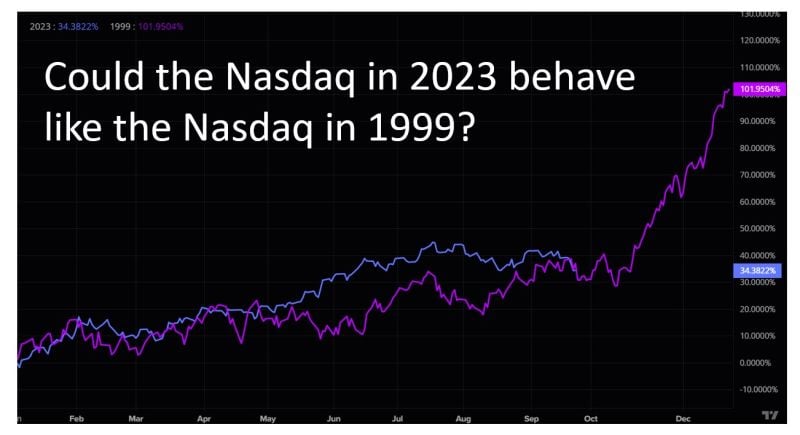

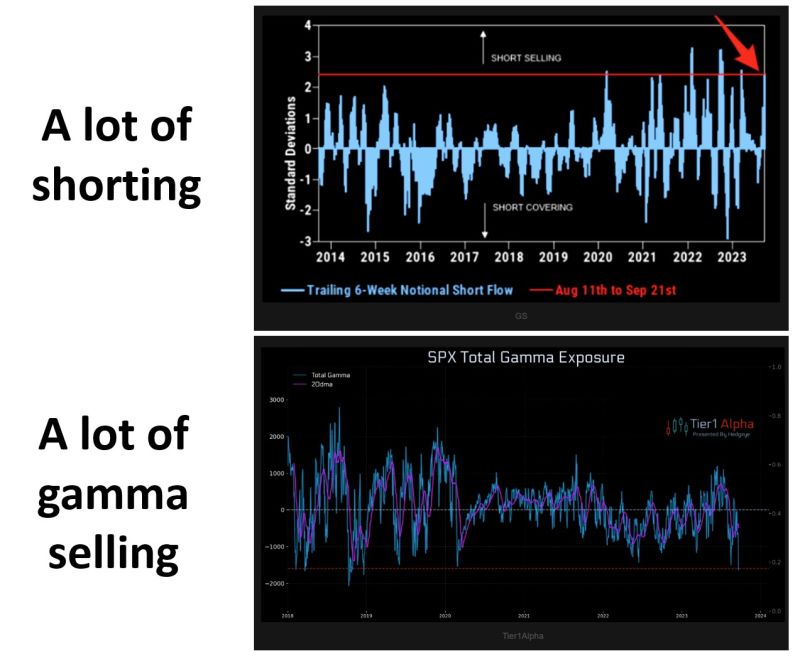

NASDAQ's 1999 analogy chart isn't perfect but given the amount of shorting by hedge funds and short gamma selling by dealers, a squeeze in Q4 (the historically strongest quarter) is a possibility

Source: TME

Is the US equity market ripe for a short squeeze?

As highlighted by Goldman Sachs PB: "the amount of shorting in US equities since mid-August is the largest in six months and ranks in the 98th percentile vs. the past decade." Meanwhile, the level of short gamma is the highest in a long time. Dealers have been forced to sell deltas as we have moved lower (chart by Tier1Alpha). This has pressured the market. But we need to keep in mind that gamma works both ways, so a possible bounce from here would force dealers to buy back all that delta they sold recently. Source: The Market Ear

US national debt 23 years later...

Source: Mayhem4Markets

💰According to Forbes, 70% of today’s billionaires are self-made

🤑The best examples are founders of companies that we all use today - Mark Zuckerberg (Facebook), Brin and Page(Google), Jeff Bezos (Amazon). Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks