Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oil is up 30% this quarter but is there more to come?

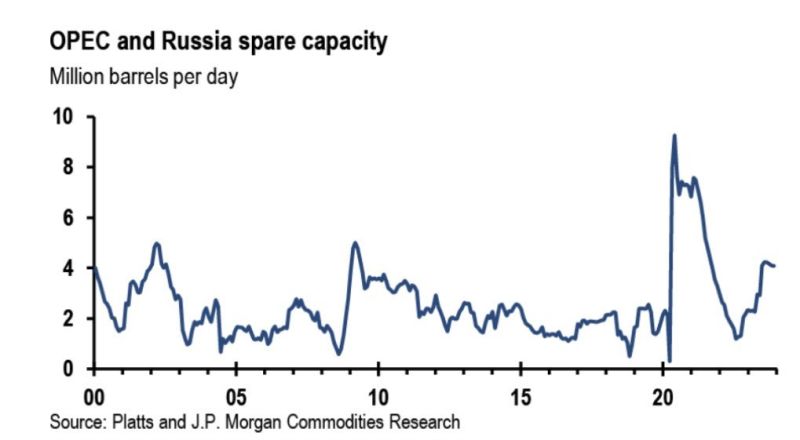

As tweeted by The Kobeissi Letter, Russia and 3OPEC are now cutting a massive 4 million barrels per day of crude oil production. This is the highest level of production cuts outside of recessions over the last two decades. As Saudi Arabia and Russia extend production cuts of 1.3 million barrels per day, supply is going to remain limited for a while. OPEC has proven multiple times over the last three years that they are committed to higher oil prices. Source: The Kobeissi Letter, JP Morgan

A tale of two type of investors...

who will be right? Hedge Funds continue to short treasuries at historic levels while asset managers are building their largest long positions ever recorded! Source: FT, Barchart

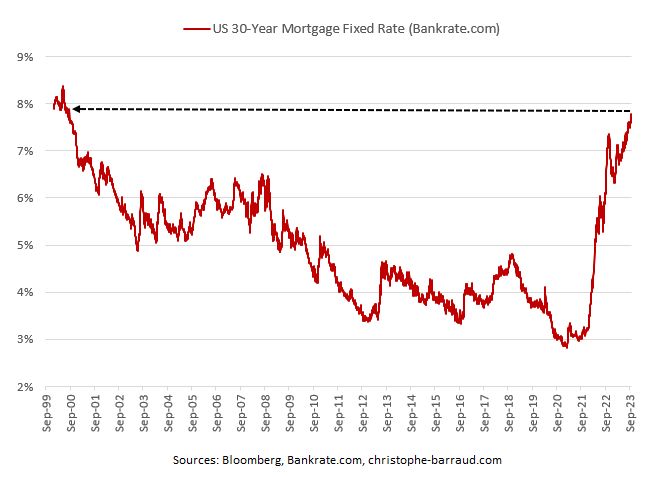

Housing | According to Bankrate.com‘s data, US 30-Year fixed-rate mortgage reached 7.78%, the highest rate since August 2000

*This situation is expected to have a significant effect on closed sales from September to November. Source: C.Barraud

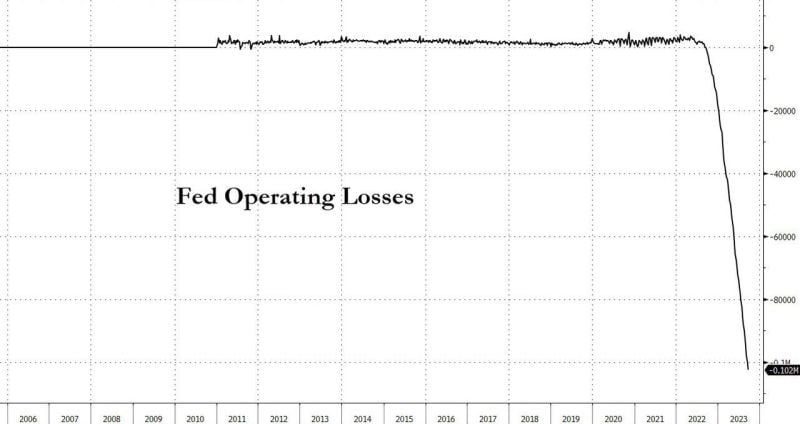

For The First Time In 13 Years, The Fed Is Cutting Workers As It Books $100 Billion In Losses

The FED has booked $100 billion in losses in recent months on operations that currently involve paying more in interest to banks on reserve deposits at the Fed than the central bank earns from its roughly $7.5 trillion portfolio of bonds and mortgage-backed securities. Source: www.zerohedge.com, Bloomberg

FTSE MIB Index testing double support

FTSE MIB Index is testing again major support zone and December uptrend. Keep an eye on this level. Source : Bloomberg

TIPS - A Revival in Focus!

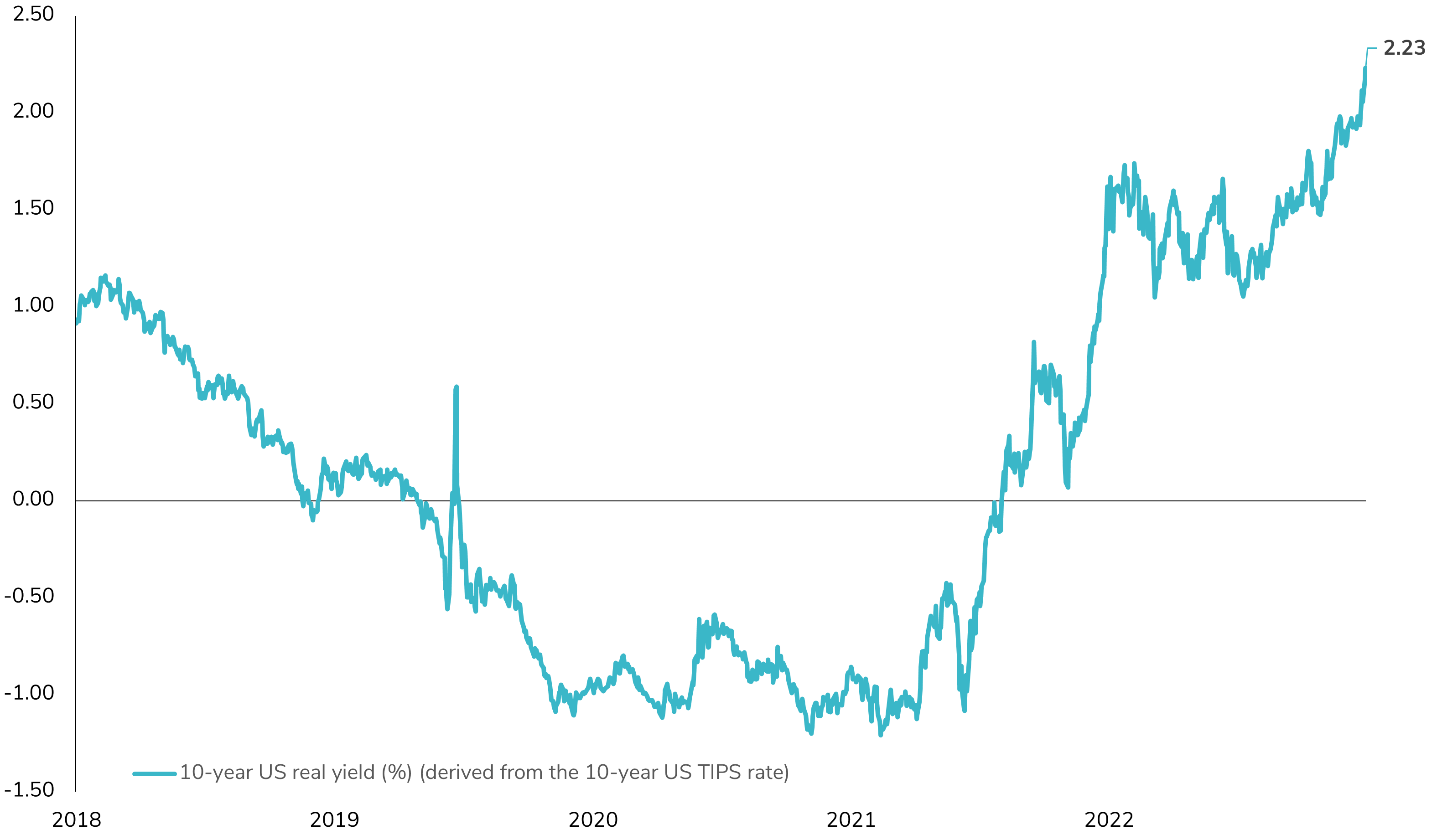

Long-term U.S. Treasury Inflation Protection Securities (TIPS) have witnessed a significant double-digit decline since the start of 2022, despite the presence of high U.S. inflation. While the inflation-linked component has acted as a safety net, providing a cushion of around 10% over 20 months, the surge in the 10-year real rate from -1.0% to 2.2% over the same period has had a marked and negative impact on the total TIPS yield (-14%). Yet, the question lingers: Is now the opportune moment to contemplate TIPS? We are currently at a level of LT real rates (2.23%) not seen since 2008. Interestingly, TIPS exhibit a lower beta compared to U.S. Treasuries (currently standing at 0.8). This attribute becomes especially valuable in light of the considerable volatility in U.S. interest rates (with the MOVE index still >100). hould we delve into the realm of inflation-linked bonds, which constitute a global market valued at over $3.5 trillion? This consideration gains significance as uncertainties surrounding inflation persist, driven by factors like de-globalization, supply shocks, increased fiscal spending, and the ongoing transition to renewable energy sources. Source: Bloomberg

The S&P 500 is now down 340 points, or 7.5%, since the Fed removed a recession from their forecast

On July 26th, the Fed raised rates and said they were not longer expecting a recession. The Fed marked the EXACT high in the S&P 500 which just hit its lowest levels since June. Since then, rate cut expectations were pushed out by a year and corporate bankruptcies hit their highest levels since the pandemic. Is the market losing faith in the Fed again? Source: The Kobeissi Letter

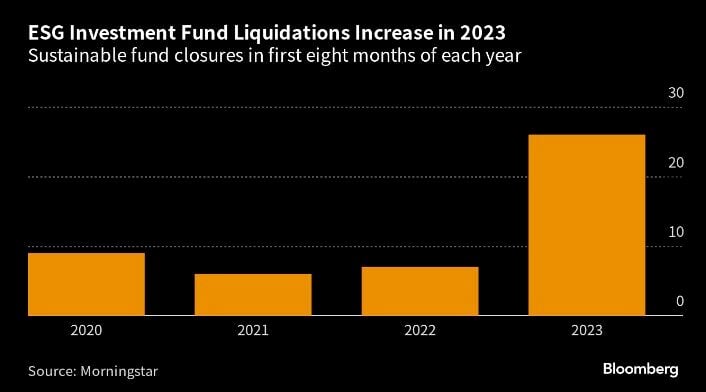

What’s the BIG SHORT right now? ESG Stocks.

Hedge funds are calling out fake green claims and overblown valuations boosted by stimulus. Blackrock & State Street are shutting down some ESG funds. Liquidation of ESG funds in 2023 is already larger than the last 3 years combined, And the year is not over.... Source: Genevieve Roch-Decter, CFA, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks