Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

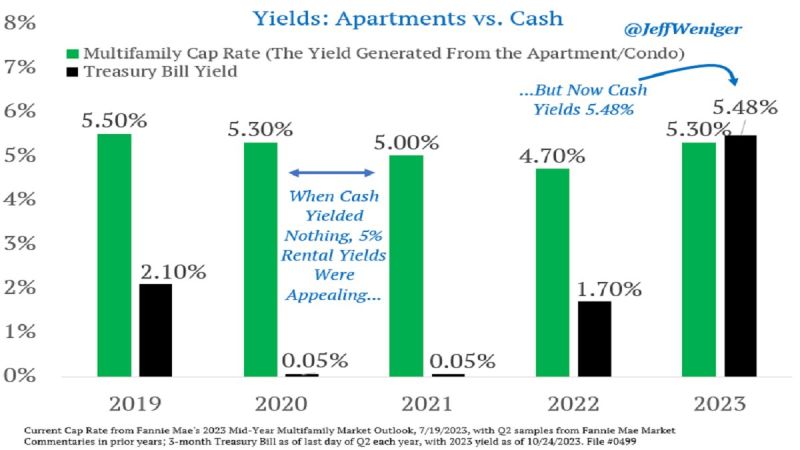

The money market yield spike upends a ton of business models. In this case, landlording in the US

Inded, multifamily cap rate is now BELOW cash rate... Source: Jeff Weniger

Bitcoin has outperformed equities, gold and USD year-to-date It has increased by more than 100% this year, despite:

- War Conflict - Elevated inflation - Rising oil prices - High-interest rates This is what happens when institutions like Blackrock jump on board Institutional adoption is going to be a major theme for this asset class. Source: Game of Trades

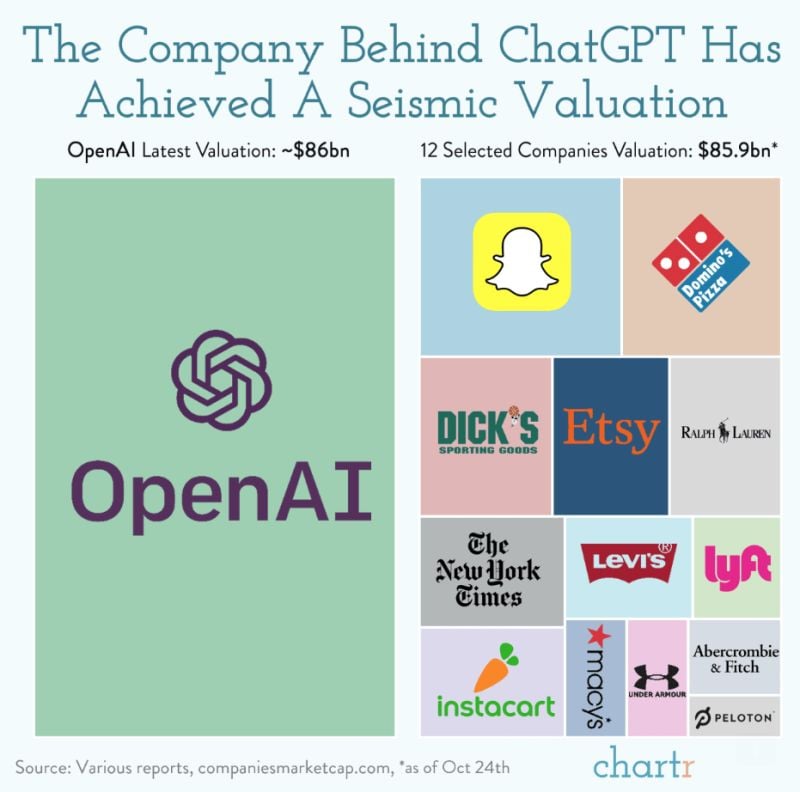

OpenAI valuation in perspective - chart by Chartr

Talk is meant to be cheap, but OpenAI, the force behind the viral hit ChatGPT, has turned it into an absolute goldmine, with the company currently in discussions to sell shares at a valuation of $86 billion. That's a remarkable three-fold increase from just 6 months ago, with the WSJ reporting an initial range of $80-90bn, before Bloomberg narrowed the figure to around $86bn, citing sources familiar with the matter. That would place OpenAI among the most valuable tech startups in the world, only behind giants like ByteDance (TikTok owner) and SpaceX. For context, it’s also roughly equivalent to the value of 12 of the biggest consumer brands in America combined — a theoretical corporate frankenstein including SNAP, The New York Times, Etsy, Domino’s and 8 others.

Meta’s ad rebound gets huge assist from China even though its services are banned there

Meta may be banned from operating in China, but the company is counting on advertisers there to boost its growth. Finance chief Susan Li told analysts on Wednesday’s earnings call that Chinese companies played a major role this quarter. Online commerce and gaming “benefited from spend among advertisers in China reaching customers in other markets,” Li said. Source: CNBC

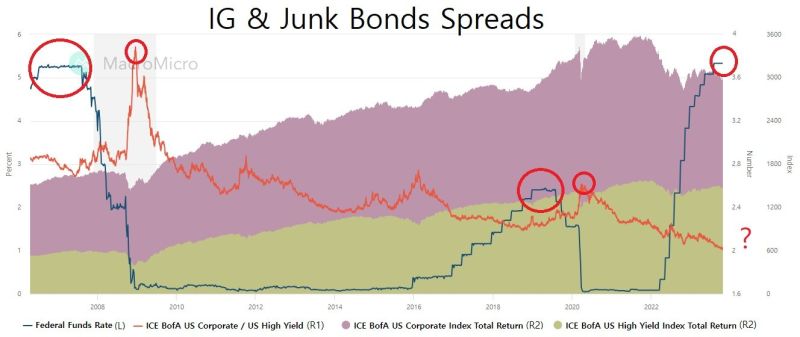

How long does it take for the FED to break the corporate bond market?

2008 : 1 year of plateau, resulted in credit event after another 1 full year. (Total 2 years) 2020 : 7 months of plateau, resulted in credit event after 6 months. (Total 13 months, 54% of 2008) 2023 : it's been 3 months into plateau so far. Chart made from MacroMicroMe - source: James Choi

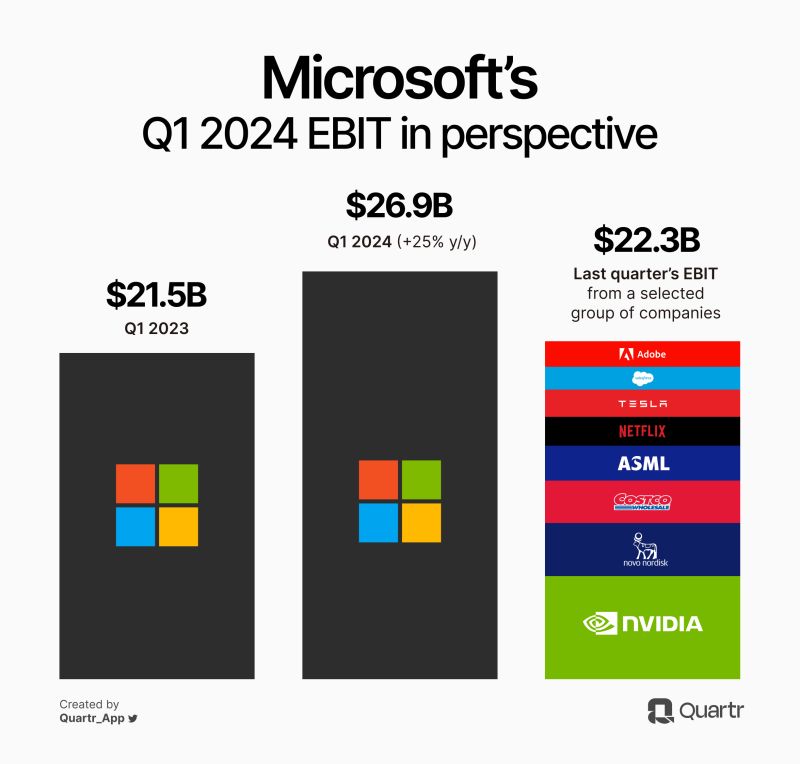

$MSFT FY Q1 2024 in perspective

Revenue +13% *Prod. & Business +13% *Intelligent Cloud +19% *Pers. Computing +3% *Azure +29% *LinkedIn +8% *Xbox C&S +13% EBIT +25% *marg 48% (43) EPS +27% Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks