Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitcoin breakout ?

Bitcoin (XBTUSD) is trying to breakout July downtrend resistance. Keep an eye at these levels. Source : Bloomberg

As highlighted in a tweet by HolgerZ, the S&P 500 is running in tandem with the Fed net liquidity

So it's not so much the peak or pause in rate hikes that matters, but rather what happens to the Fed balance sheet & reverse repo operations. Source: HolgerZ, Bloomberg

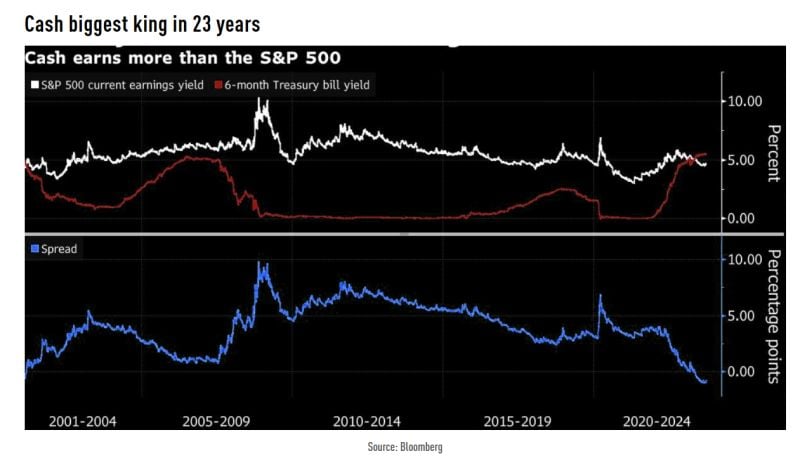

Cash now earns more than the S&P 500 by the largest margin in 23 years

Source: TME, Bloomberg

HAVE YOU EVER HEARD ABOUT DE-EUROIZATION ?

Based on SWIFT international payments, we are witnessing 'de-euroization' and not 'dedollarization. The euro's share in SWIFT global payments has dropped to 23% from 38% at the start of the year. Are Russia's SPFS and China's CIPS eating up the euro? Meanwhile, China's share in SWIFT payments reached an all-time high of 3.47% in August. Source: HolgerZ, Bloomberg

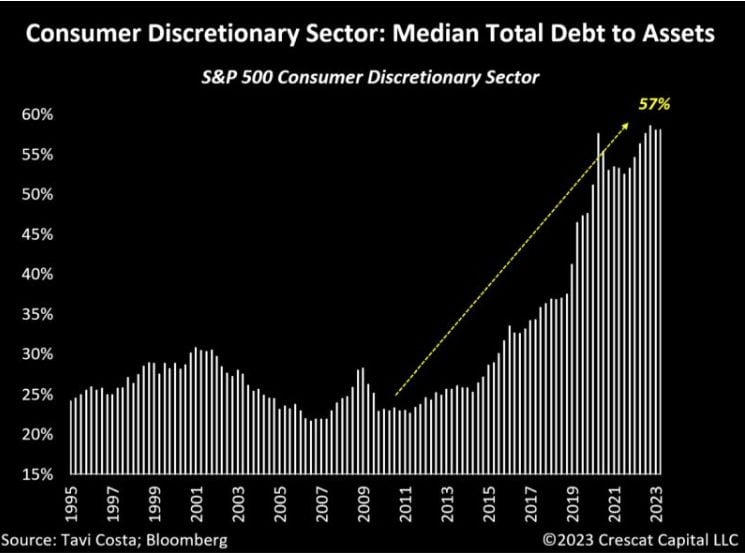

Consumer balance sheets are getting stretched

Accumulating debt during a low interest rates environment is one thing. But in light of the continuous surge of the price of money, the US consumer is probably starting to feel the pain Source: Crescat Capital, Bloomberg

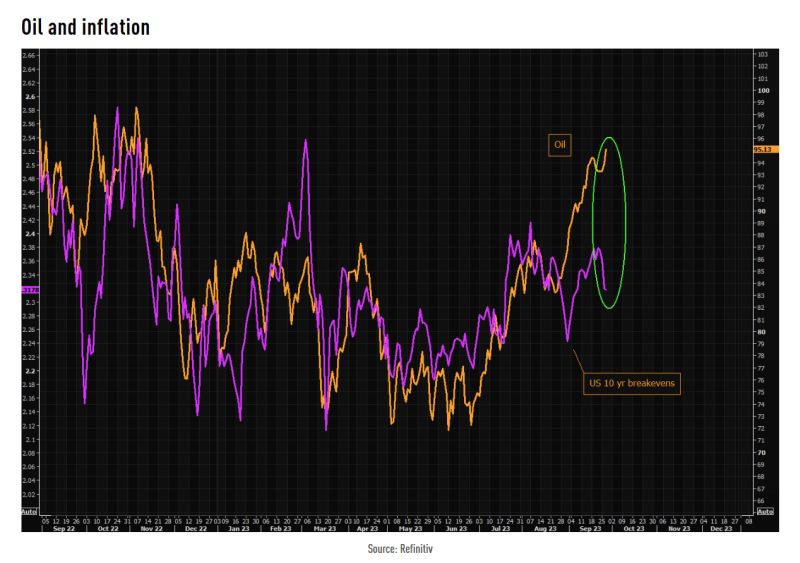

The gap between oil and 10 year breakevens is huge...

Does it mean that the market sees higher oil prices as a "growth killer" and thus disinflationary at some stage? Source chart: TME, Refinitiv

GS Financial conditions index is tightening significantly, now at the tightest since November 2022...

This is probably what the FED wants to see...until something breaks... Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks