Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Credit Suisse bond investors plot lawsuit against Switzerland

A group of international bond investors is drawing up plans to sue Switzerland in the US courts for expropriation over the losses they suffered after the state-orchestrated rescue of Credit Suisse. The case is being brought together by law firm Quinn Emanuel, according to people familiar with the matter. Quinn Emanuel is already suing Switzerland’s financial regulator, Finma, over its decision to wipe out $17bn of Credit Suisse bonds when the bank was taken over by UBS six months ago. Lawyers at Quinn Emanuel are laying the groundwork to sue Switzerland in the US, where they believe there is a greater chance of convincing a judge to waive the country’s sovereign immunity rights. The suit could be filed by the end of the year, though it is not certain to proceed, according to people involved in the discussions.

The e-commerce market is a winner-takes-almost-all industry in each country, with Amazon being the leader in terms of e-commerce revenue

JD follows Amazon in second place, generating significantly less e-commerce revenue. Source: Genuine Impact

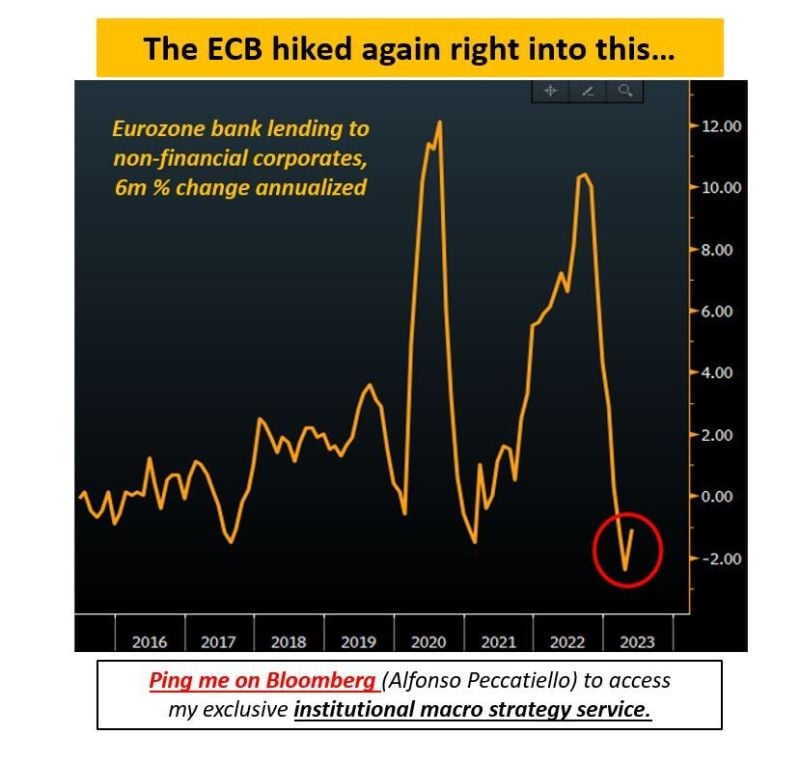

Some interresting comments by Themacrocompass.com / Alfonso Peccatiello

on yesterday's ECB hike and Lagarde's comments: "The demand for corporate loans in Europe has plummeted as borrowing costs remain prohibitively high. The Eurozone credit creation process is quite reliant on bank lending, so this matters. And indeed markets aren't reacting as if the ECB just hiked - quite the opposite: bond yields have moved lower and the EUR has taken another dip. The risks of an ECB policy mistake keep growing".

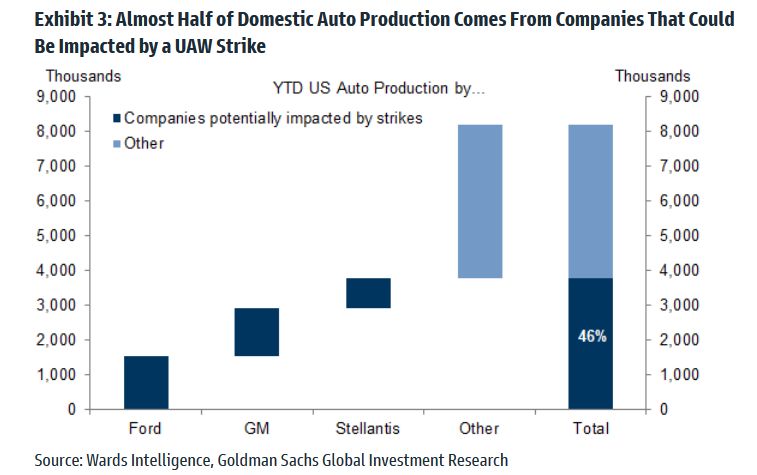

From Wall Street to Main Street (aka workers want a bigger piece of the cake) => UAW members go on strike at three key auto plants after deal deadline passes

Half of US auto production is going offline tomorrow. - Thousands of United Auto Workers members went on strike at three key plants, after Detroit automakers failed to reach deals with the union by a Thursday night deadline. - The selected plants produce highly profitable vehicles for the automakers that largely continue to be in high-demand. About 12,700 workers – 5,800 at Stellantis, 3,600 at GM and 3,300 at Ford – will be on strike at the plants in total, the union said. The UAW represents about 146,000 workers across Ford, GM and Stellantis. Source: Goldman, CNBC

China’s retail sales and industrial production picked up pace in August with better-than-expected growth, according to National Bureau of Statistics data released Friday

Retail sales grew by 4.6% in August from a year ago, beating expectations for 3% growth forecast by a Reuters poll. The increase was also faster than the 2.5% year-on-year pace in July. Industrial production grew by 4.5% in August from a year ago, better than the 3.9% forecast and faster than the 3.7% increase reported for July. Fixed asset investment, however, grew by 3.2% year-on-year in August on a year-to-date basis. That missed expectations for a 3.3% increase and was slower than the 3.4% pace reported as of July. The figure was dragged down by a steeper drop in real estate investment, and a slowdown in infrastructure investment. Only manufacturing saw the pace of investment pick up. Statistics bureau spokesperson Fu Linghui said the real estate market was still in a period of “adjustment” and noted declines in sales and investment. Source: CNBC

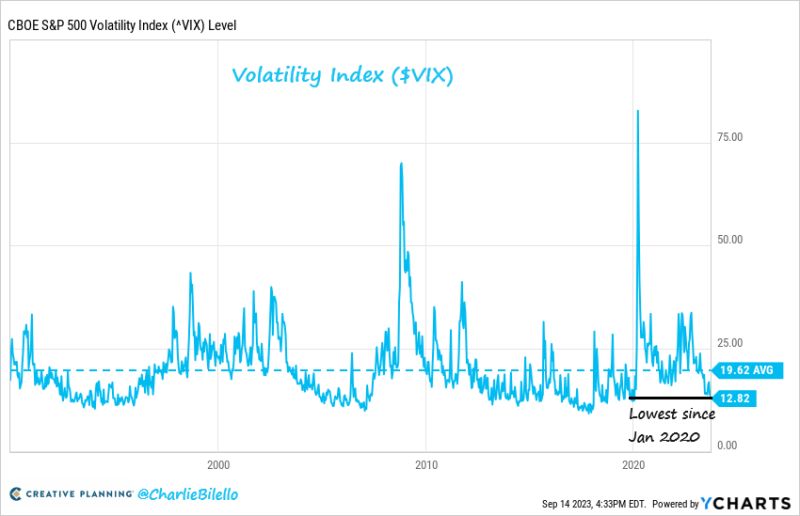

The $VIX ended the day at 12.82, its lowest close since January 2020

Source: Charlie Bilello

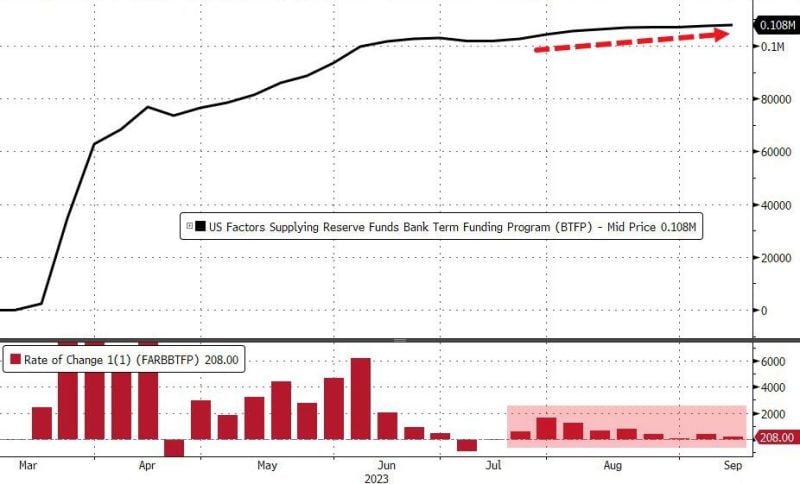

OOPS! A bank liquidity indicator sounds the alarm!

Usage of The Fed's emergency bank funding facility rose once again (+$208M) to a new record high over $108BN as long-term government bond yields keep rising... Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks