Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

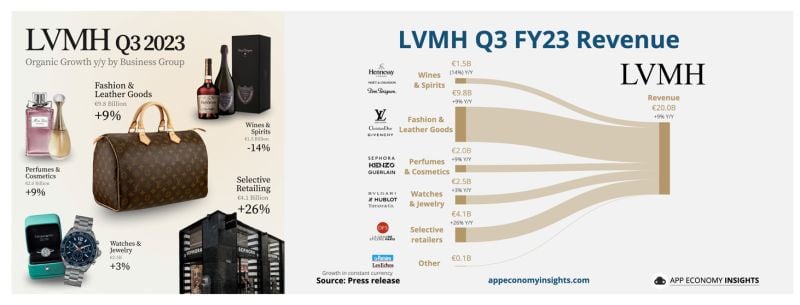

LVMH Louis Vuitton Moët Hennessy. Q3 results in one image

Q3 Revenue +9% Y/Y to €20.0B (in cc). 🍷 Wines & Spirits -14% to €1.5B. 👜 Fashion & Leather goods +9% to €9.8B. 💅 Perfumes & Cosmetics +9% to €2.0B. 💍 Watches & Jewelry +3% to €2.5B. 🛍️ Selective retailers +26% to €4.1B. Source: Quartr, App Economy Insights

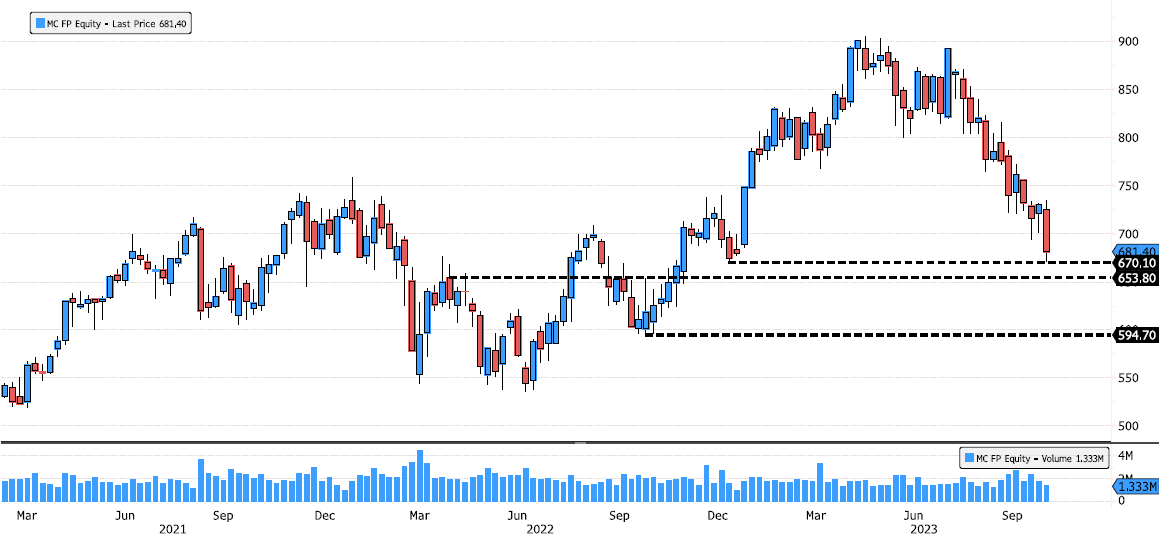

LVMH desperately trying to find support

LVMH (MC FP) is now dropping 25% since April high. Stock is trying to find some support for a technical rebound in this bearish trend. Keep an eye at 670 support. If broken next support is 654. Source : Bloomberg

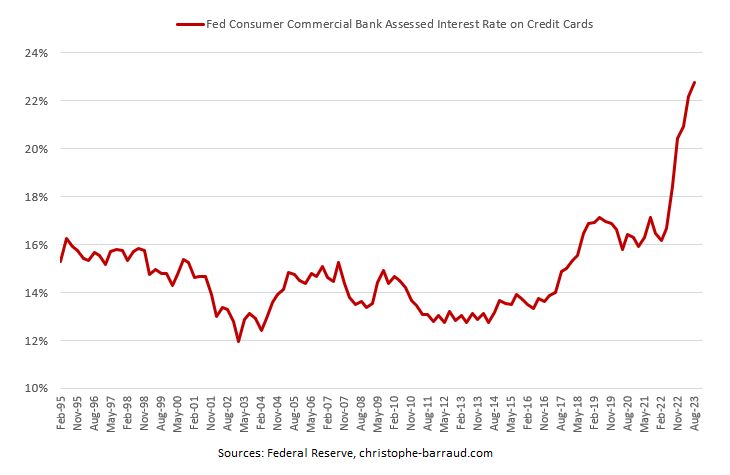

US average interest rate on credit cards is now close to 23% ⚠ (hitting a new record high since data are recorded)

Source: C.Barraud

WIth the Vix <17, Brent oil<$90/bbl and S&P 500>4350, do you feel that risk is currently mispriced?

Source: HolgerZ, Bloomberg

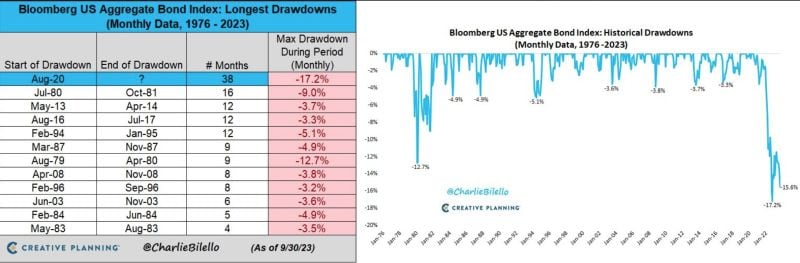

This is by far the longest bond bear market in history, at 38 months and counting...

Source: Charlie Bilello

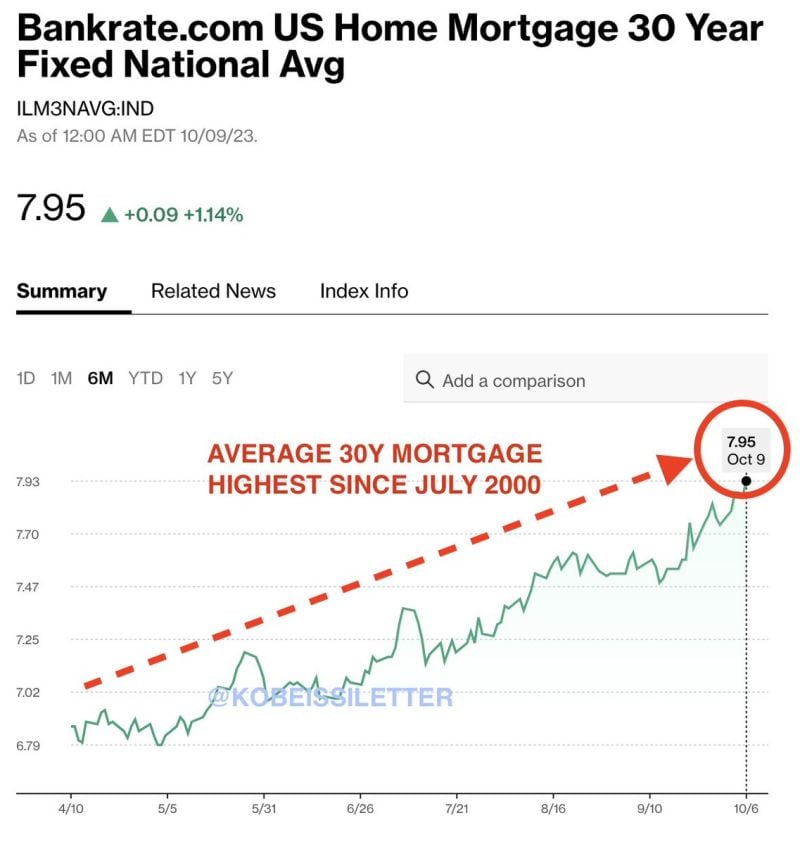

Average interest rate on a US 30-year mortgage rises to 7.95%, its highest since July 2000

Mortgage demand also just fell to its lowest level since 1995. 8% mortgages are the new normal. Source: The Kobeissi Letter

Fighting the Fed has transformed bond ETFs into cash incinerators..

$TLT has come out of nowhere to hit #3 on the Top 20 Cash Burning ETFs list (lifetime flows minus aum today) with over $10b lost. Top of list used to be -2x/-3x, VIX, commodity ETFs. Now its vanilla bond ETFs... Great table from psarofagis thru Eric Balchunas, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks