Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is ADP the start of something big or an anomaly, knowledge_vital asks as ADP report for September saw a huge drop in new jobs to just 89k vs. 150k forecast, & down from +180k in Aug

The 89k is the softest number since Jan 2021. Large comps drove downside, they shed 83k jobs in September. Souce: HolgerZ, Bloomberg

Soft landing?

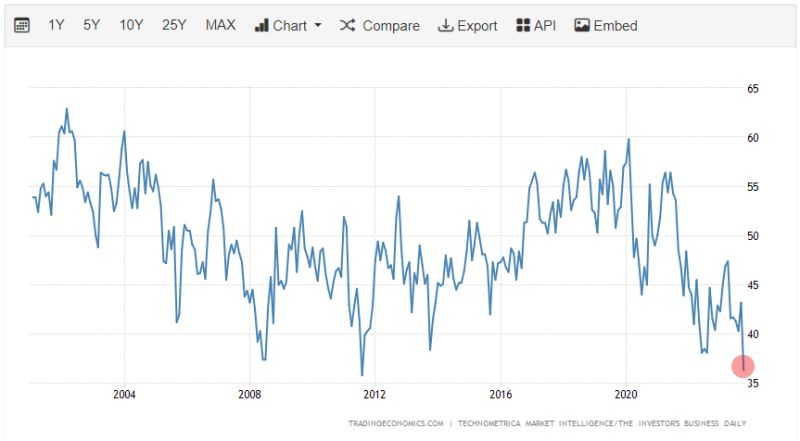

U.S. Economic Optimism Index plummeted to 36.3 in October, the lowest reading ever recorded. Source: Barchart

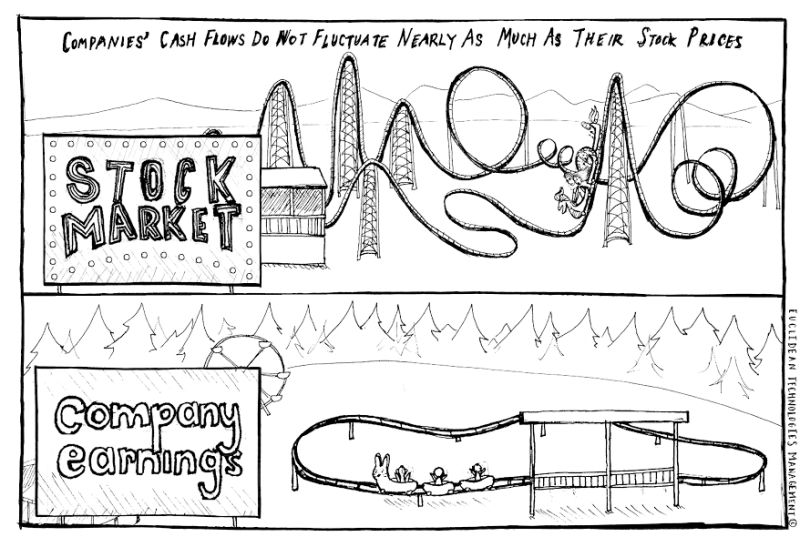

Yields on 10-year Treasuries are now almost equal to the trailing 12-month earnings yield on the S&P 500 index. This is the first time that's the case going back to 2002

Source: Bloomberg, Lisa Abramowitz

In case you missed it. Citigroup $C yesterday closed at its lowest price since the onset of Covid...

Source: barchart

Reminiscence of 1987 crash?

Carl Quintanilla posted: “When I started in the business in 1987,” reminisces Steve Sosnick of Interactive Brokers, “bonds were mired in a bear market for most of the year while stocks rallied sharply. Until, of course, that reversed ..” John Authers Comparison for bond yields bear a scarily unwelcome resemblance to 36 years ago -> Source chart: Bloomberg

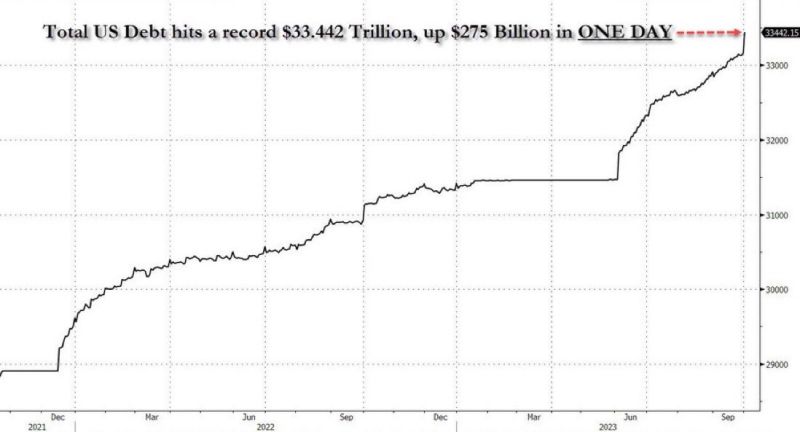

IS THE US ENTERING A DEBT SPIRAL LEADING TO A SOVEREIGN DEBT CRISIS?

Goldman, JP Morgan and BofA pull the alarm US debt is going parabolic! Total US debt rose by $275 billion in just ONE DAY. The US has added $32 billion in debt per day for the last 2 weeks. At the current pace, the US will add $1 trillion of debt in a month. Meanwhile: - David Lebovitz of JPMorgan Asset Management says something will break if rates continue to rise at the pace they've been going - "Fed hiking cycles always end with default & bankruptcy of extended governments, corporations, banks, investors." - BofA - Goldman Sachs: "There is a significant risk that FCIs continue to tighten until something breaks… (...) All roads appear to be leading to a continued sell-off in US + DM Rates as the market struggles to find the right clearing level for bonds (...) Risks are growing of a sharp, impulsive negative feedback loop in to other markets Source: Max Keiser, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks