Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

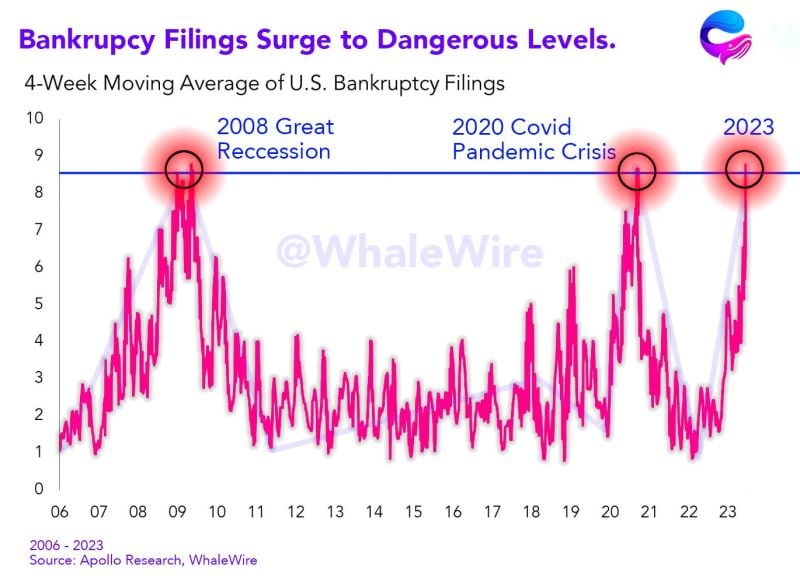

Bankruptcy filings have recently reached levels on par with the 2008 Great Recession and the 2020 COVID-19 pandemic

This indicator often suggests that the economy isn't performing well, and has historically always been followed by massive stock market crashes. Source: whalewire

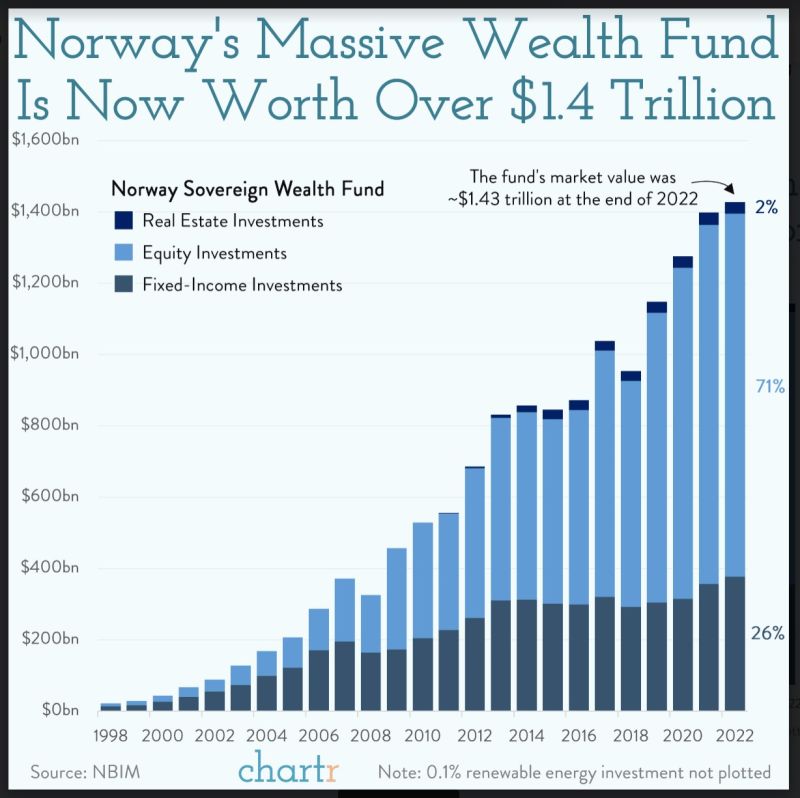

Norway sovereign fund’s assets have ballooned to over $1.4 trillion

That puts Norway's sovereign fund at a similar size to that of China's — yes, the same China that has more than 260x as many people as Norway has. Source: Chartr

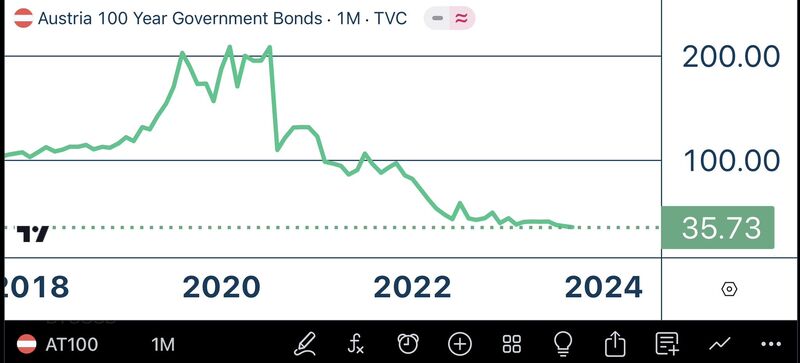

The Power of Duration! This is not the chart of an altcoin, this is the chart of Austria’s 100-year bond, down 82% from its 2021 peak!

Source: Jeroen Blokland

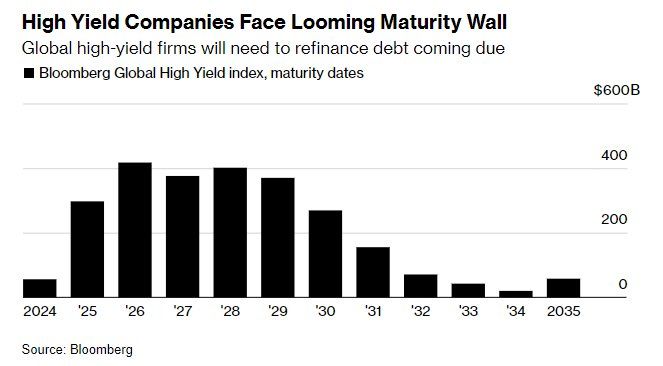

HIGH YIELD BONDS, THE BILL COMES DUE...

Global high yield bonds have been quite resilient so far in this cycle but the reality is that they will hit the maturity wall starting next year. And things will probably become more challenging whatever the economic scenario. If the economy does well and interest rates stay high for longer, the refinancing cost is likely to become more expensive. If the economy moves into recession, credit spreads are likely to go up hence still putting upward pressure on refinancing cost. So either way delinquencies are likely to increase. Source: Bloomberg

The main driver for stock returns

Source: BCG, Morgan Stanley Research thru Compounding Quality

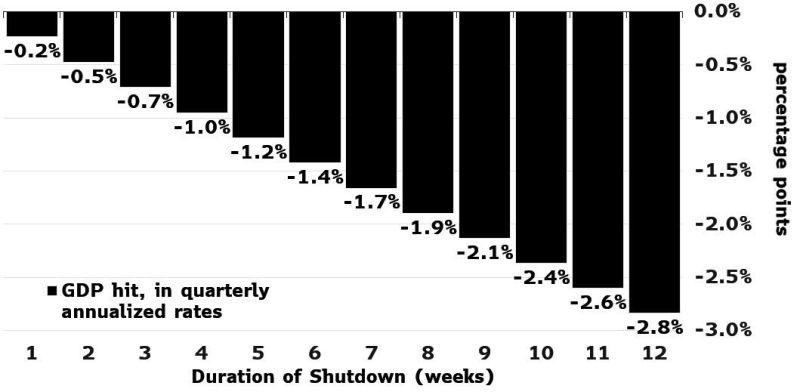

According to Bloomberg chief economist Anna Wong, online betting markets see a 69% chance of a federal government shutdown starting Oct. 1st

So what could be the effects on the US economy and job market? Below chart shows the effects on GDP depending on the duration of the shutdown. - According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Goldman's baseline is that a shutdown could last for 2-3 weeks (the Trump government shutdown, the longest in history, lasted 35 days, from Dec 22, 2018 to Jan 25, 2019). - Meanwhile, Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter. Source: Goldman Sachs, Bloomberg, www.zerohedge.com

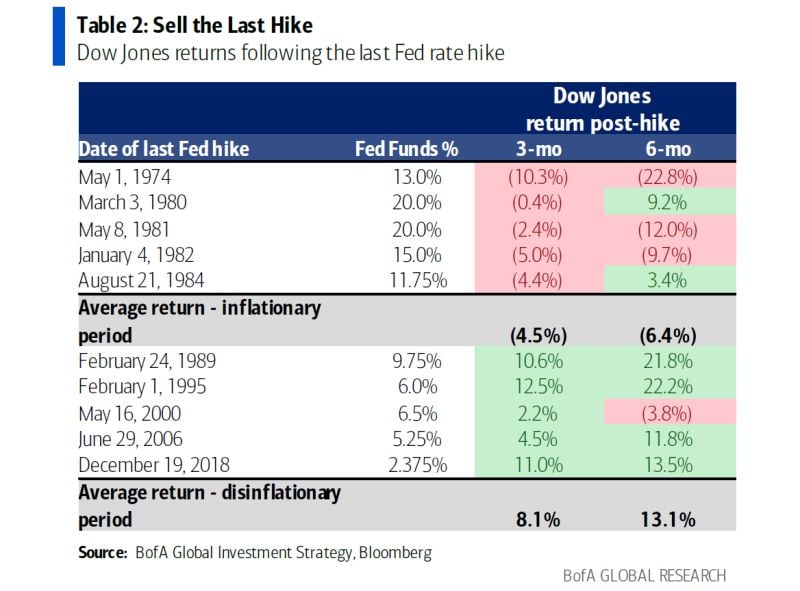

How to trade equity markets following the LAST FED rate hike?

BofA Harnett says it depends whether the economy is in inflationary or an inflationary period. When monetary policy needs to work harder to slow economy in inflationary era (e.g. 1970s/1980s), Dow Jones returns were most of the time negative in the 3 months and 6 months that followed the last Fed hike... However, in disinflationary period, markets returns were quite strong. So do you believe we are in an inflationary or disinflationary period? Source: BofA Global Research

Investing with intelligence

Our latest research, commentary and market outlooks