Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Maybe this is why Powell said that a soft landing is not the core scenario...

Recession confirmed?

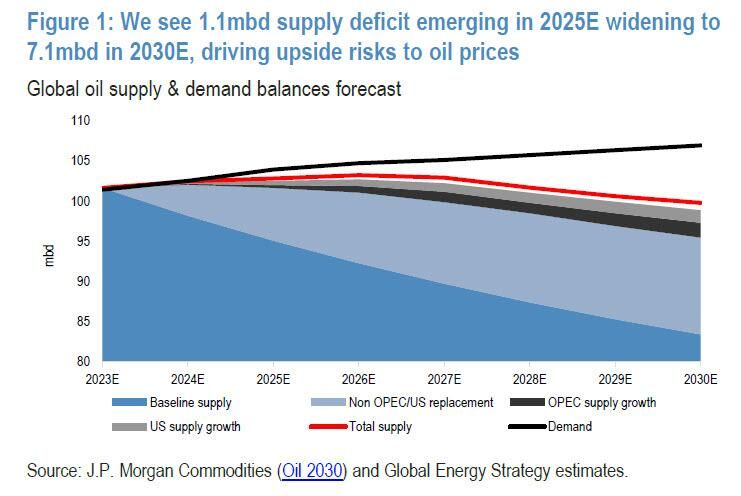

JP MORGAN is making a big bullish call on oil and energy stocks.

The largest US bank expects the global oil deficit hitting a record 7mmb/d in 2030, a staggering shortfall which would require prices to rise higher... much higher. In a nutshell: JPM is reiterating their $80/bbl LT target and their view framed in Supercycle IV that the upside risk to oil is $150/bbl over the near to medium term term and $100/bbl LT. The primary drivers of their structural thesis are : 1) higher for longer rates tempering the flow of capital into new supply, 2) higher cost of equity driving elevated Cash Breakevens of >$75/bbl Brent (post buybacks) as companies return structurally more cash to shareholders, in turn, pushing the marginal cost of oil higher, 3) Institutional and policy led pressures driving an accelerated transition away from hydrocarbons and peak demand fears. Taken together, their corollary is a self-reinforcing ‘higher-for-longer’ energy macro outlook as the industry struggles to justify large investments beyond 2030. Consequently, they forecast a 1.1mbd S/D gap in 2025 widening to 7.1mbd in 2030 driven by both a robust demand outlook and limited supply sources.

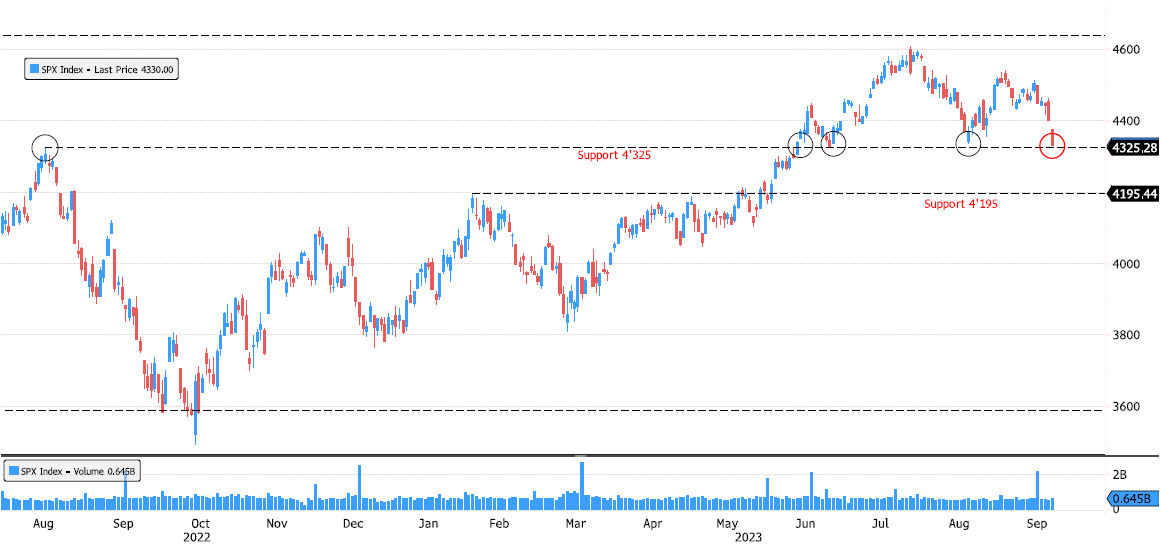

The worst weekly performance since March for the sp500...

Markets like clarity and hate confusion. The first half of the year was about disinflation + AI buzz. Now the markets are not sure about what's next. And some of the confusion seems to be coming from central banks... This week we got a very confusing message from the #fed: a pause in rates, higher dot plots in 2024 but also calling a soft landing NOT a base line expectation, hence sharing fears that keeping real rates for a long period of time creates some downside risks for the economy and the markets... The combo higher inflation risk + downside growth risk is not a great value proposal for Mr Market at the time you can nicely paid by keeping your assets in money markets funds... Source chart: Bloomberg

Deere is back on March 2020 uptrend support

Deere (DE US) is back again on March 2020 uptrend support. Are we going to see a rebound once again ? Source : Bloomberg

S&P 500 Index back on major support 4'325

S&P 500 Index (SPX) is back once again on major support 4'325. Keep an eye on this important level. Next support at 4'195. Source : Bloomberg

BOJ Update

Japan | BOJ left its monetary settings unchanged and offered no clear sign of a shift in its policy stance, putting a damper on market speculation over the prospects for a near-term interest rate hike and adding pressure on the yen. The Bank of Japan kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg. It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it. Japan’s currency weakened as much as 0.4% after the decision to around the 148.20 mark against the dollar. This helped stocks, which trimmed about half of their losses for the day. The benchmark 10-year bond yield was down half a basis point from Thursday’s closing level at 0.74%. Source: Bloomberg

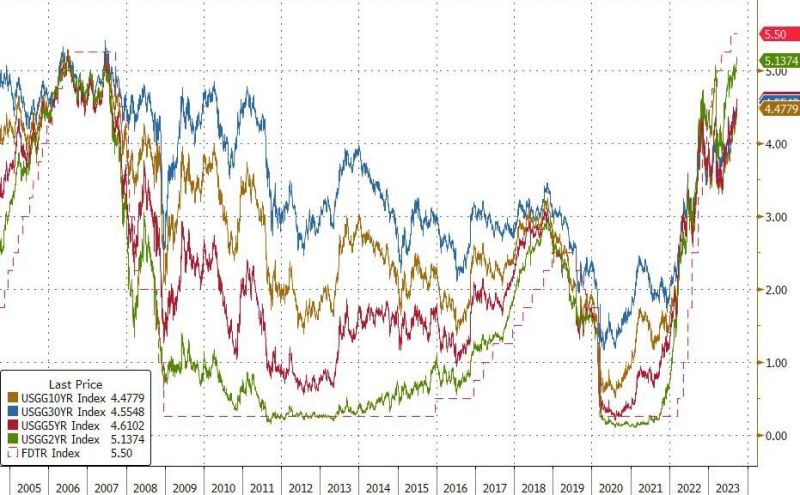

Yields pushing higher

US 2Y yields hit their highest since July 2006 US 5Y yields highest since Aug 2007 US 10Y highest since Nov 2007 US 30Y highest since April 2011 Source: Bloomberg, www.zerohedge.com

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks