Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The longest duration bond ETF is now down 60% from its peak in March 2020

How is that possible? The 30-Year Treasury yield has moved from an all-time low of 0.8% in March 2020 up to 4.6% today. Long duration + Rising interest rates from extremely low levels = Pain $ZROZ Source: Charlie Bilello

In case you missed it...

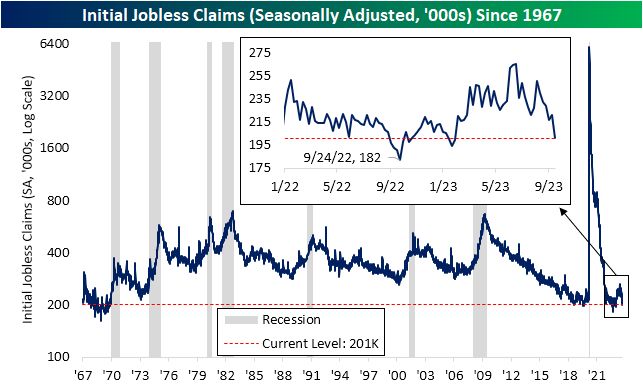

US Jobless Claims Fall to 201,000, Lowest Level Since January...There haven't been many times in the last 50+ years that #us initial jobless claims have been lower. Source: Bespoke

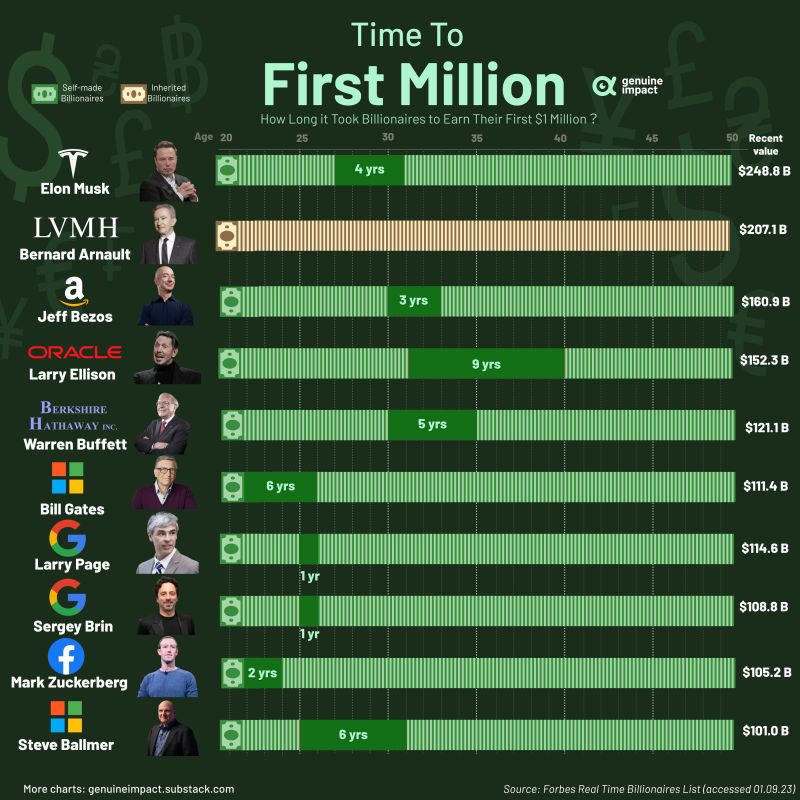

How long it took to Billionaires to earn their first $1 million?

Source: Genuine Impact, Forbes

Turkey CenBank raised main interest rate to 30% from 25%, but w/inflation at ~60%, real rates are still very heavily negative

The hike continues what many see as a return to more orthodox monetary policy under Governor Hafize Gaye Erkan, a former executive of First Republic Bank & Goldman Sachs, who was appointed in June after President Recep Tayyip Erdogan won a close-fought re-election. Erkan now hiked rates by a cumulative 2150bps. Source: Bloomberg, HolgerZ

Dollar Index reaching major resistance

Dollar Index (DXY) is reaching major resistance zone 105.60-105.90. Will it have enough strenght to break that level ? Source : Bloomberg

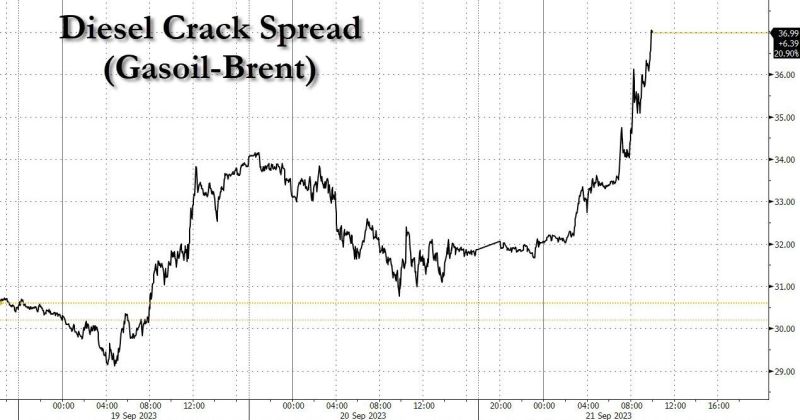

Oil, diesel crack sread soar after Russia bans diesel, gasoline exports

With Diesel prices already soaring, recently sending the diesel crack to 2023 highs and assuring that refiners have another blowout quarter, Russia just handed a gift to the Exxons of the world when it "temporarily banned" exports of the diesel in a bid to stabilize domestic supplies, adding pressure on already tight global fuel markets. “Temporary restrictions will help saturate the fuel market, that in turn will reduce prices for consumers” in Russia, the government’s press office said on its website. The "temporary" ban, which also applies to gasoline, comes into force today, Sept. 21, and doesn’t have the final date, according to the government decree, signed by Prime Minister Mikhail Mishustin. Source: www.zerohedge.com, Bloomberg

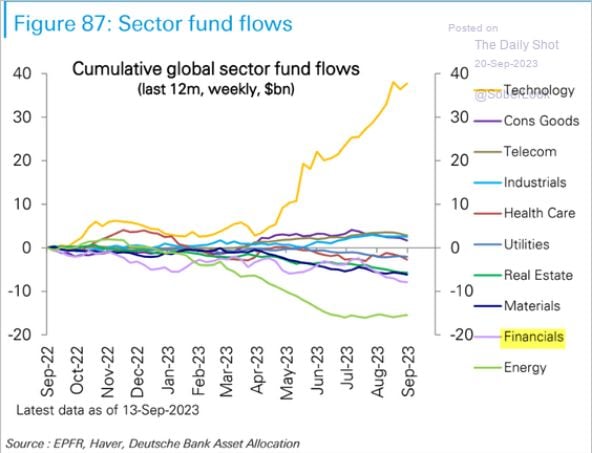

Sector fund flows

Long-only institutional & retail investors are all-in overweight tech and meaningfully underweight energy. Will elevated tech valuations, rising long-end yields, and rising oil prices trigger a squeeze in positioning? Source: The Daily Shot, EPFR, DB

Investing with intelligence

Our latest research, commentary and market outlooks