Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FED'S POWELL:

"I WOULD NOT CALL SOFT LANDING A BASELINE EXPECTATION"

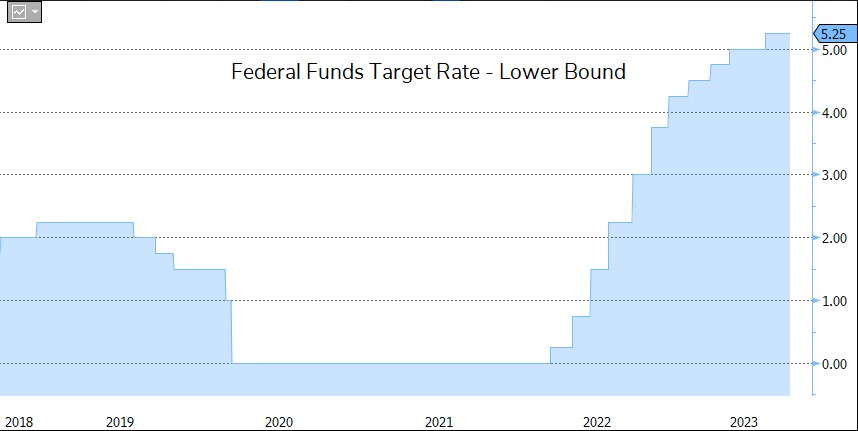

BREAKING: A HAWKISH PAUSE BY THE FED

FOMC KEEPS RATES UNCHANGED AS EXPECTED BUT MAKES CLEAR THAT HIGHER RATES ARE THE NEW NORMAL...US 2y yields hit highest since 2006 after somewhat hawkish Fed. Bottom-line: #Fed futures now no longer show rate CUTS beginning until September 2024. To put this in perspective, three months ago futures were expecting 4 rate CUTS in 2023. Now, interest rates are expected to PAUSE for at least 1 year... One remark: Fed estimates that r* (the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable) remains at 0.5%, and yet rates in 2026, when US debt may hit $50 trillion will be 3%. This means that blended interest on US debt will be ~$2 trillion, double where it is now. Source: Bloomberg, The Kobeissi Letter, HolgerZ, www.zerohedge.com

FED leaves rates unchanged, signals one more hike this year

The Federal Reserve left its benchmark interest rate unchanged while signaling one more hike this year. FOMC repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.” The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while projections showed 12 of 19 officials favored another rate hike in 2023.

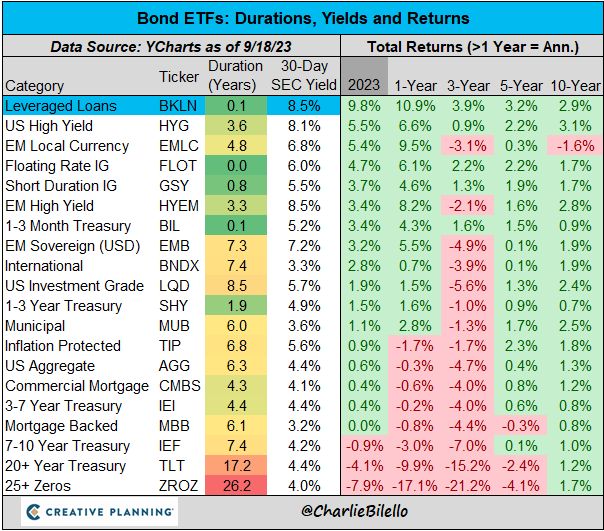

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

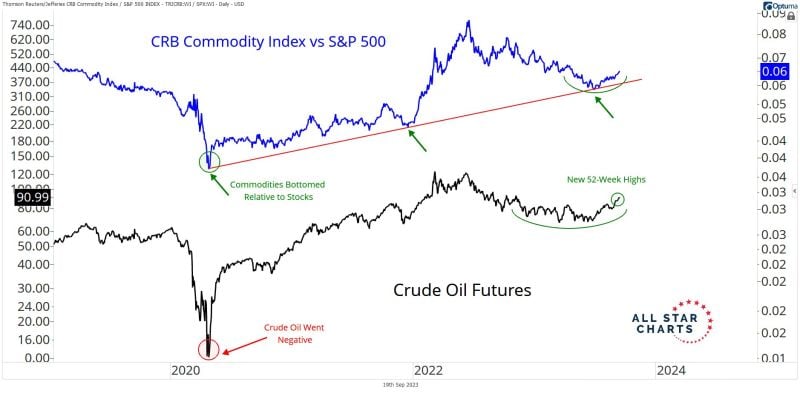

With the rise of oil prices, there is currently a revival of the "commodities super-cycle thesis"...

Source: J-C Parets

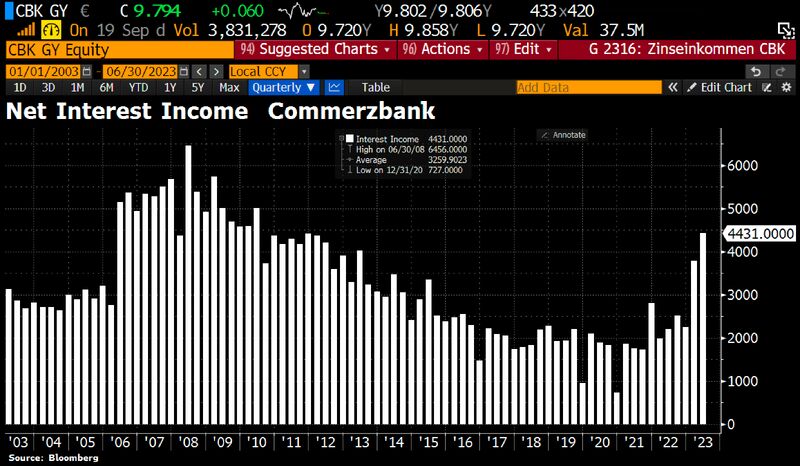

German banks are NOT passing on the increased interest rates to their customers

Commerzbank, Germany's 2n-largest retail bank, has announced it will increase net interest income to €8bn. Commerzbank has increased its deposit beta - a measure of how much of a rate increase it passes along to savers - slower than initially expected. The bank will end this year with something around a deposit beta of avg 40%. Source: HolgerZ, Bloomberg

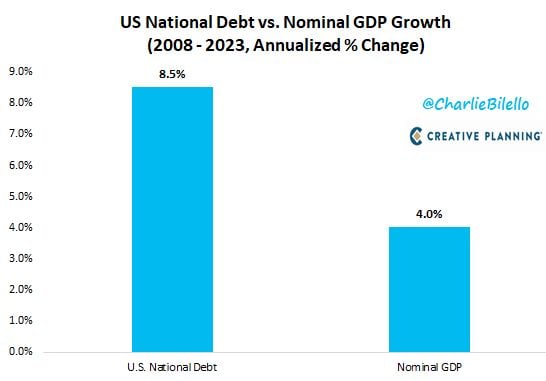

Over the last 15 years, the US National Debt has increased at a rate of 8.5% per year versus an increase in economic growth (nominal GDP) of 4.0% per year

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks