Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

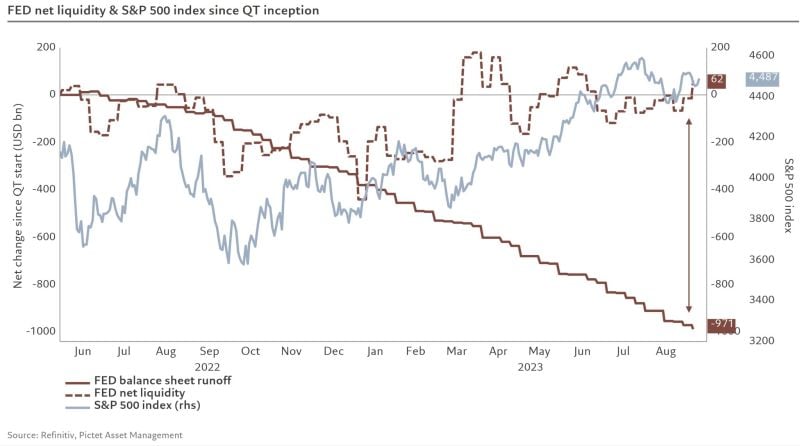

Despite QT of almost 1T$, Fed net liquidity* actually increased fueling the rally in big tech

Remarkable chart from Steve Donze at Pictet Asset Management thru Michel A.Arouet. *Net liquidity is a term that refers to the amount of cash and credit available for transactions, purchases, or investments. It is calculated by adding up the money supply and the outstanding credit in a given currency or region. Source: Pictet Asset Management, Michel A.Arouet

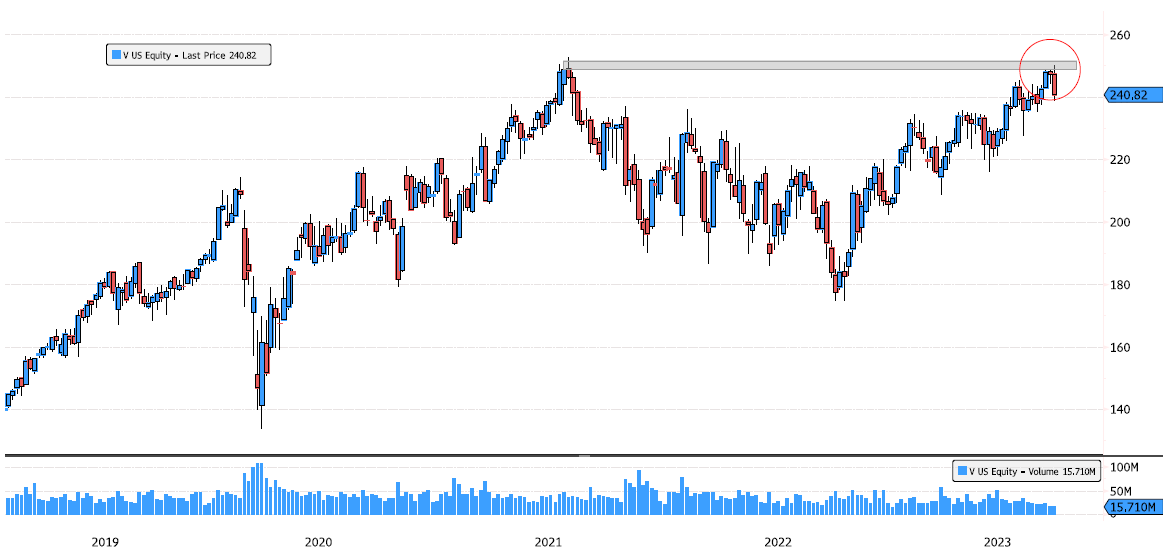

Visa under selling pressure after testing resistance level

Visa (V US) is under selling pressure after testing resistance level 249-252. Strong volume today (4 million shares in 40 min trading). Source : Bloomberg

EURUSD pair continues a bearish trend after ECB hike

EURUSD stays on a rather bearish EUR bullish USD trend which wasn’t helped by today’s ECB decision to increase rates by another 25bps. Shortly after the ECB’s announcement, US PPI came out slightly higher than expected which led the pair to reach a low of 1.0656 before stabilizing around 1.0675.

Support: 1.0650, 1.0605, 1.0560

Resistance: 1.0720, 1.0770, 1.0810

Source: Bloomberg

Amazon reaching strong resistance level

Amazon (AMZN US) just reached strong resistance zone 144-147. After a 78% rallye since January, will it be able to breakout that level ? Source : Bloomberg

Rising Italian Yields and the Looming Debt Question: What Lies Ahead for Eurozone?

The 10-year Italian yield has reached its highest level since March, while the difference between the 10-year Italian and German yields is trading above 180bps for the first time since June. Beyond speculating on whether the ECB will raise interest rates to 4% or not, the significance of Italy's debt burden should be a fundamental concern, especially if they announce a new tightening of their monetary policy by ending reinvestments in their PEPP program or, worse still, making further disinvestments under the APP program.

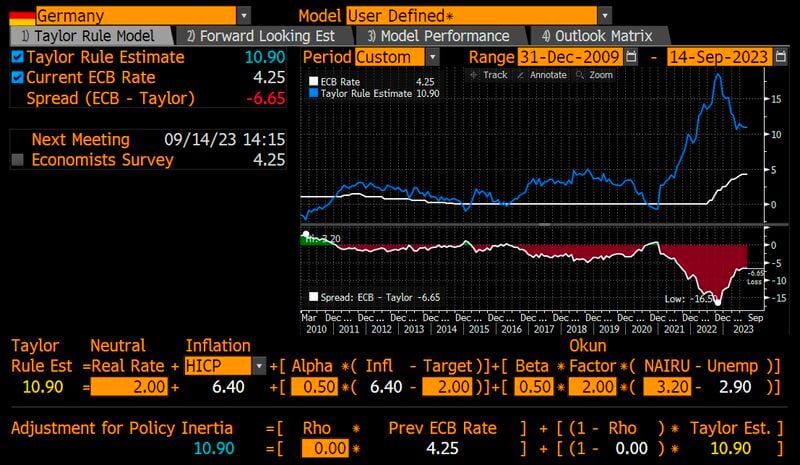

Today is ECB day

What is the Taylor rule telling us when it comes to theoretical interest rates based on German data? Key interest rate should be at 10.9%, so 6.6% higher than current rate, according to Taylor Rule with German inflation at 6.4% & unemployment below NAIRU. Howeverm the spread between Taylor Rule rate & ECB key rate is lower than it has been since 2021. This might suggest that hike cycle could soon come to an end. Source: Bloomberg, HolgerZ

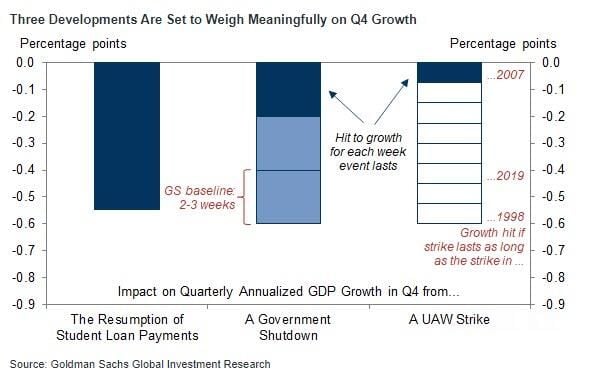

Goldman expects the resumption of student loan payments, a potential temporary federal government shutdown, and reduced auto production from a potential UAW strike to slow US GDP growth in 4Q23

Source graphic: GS

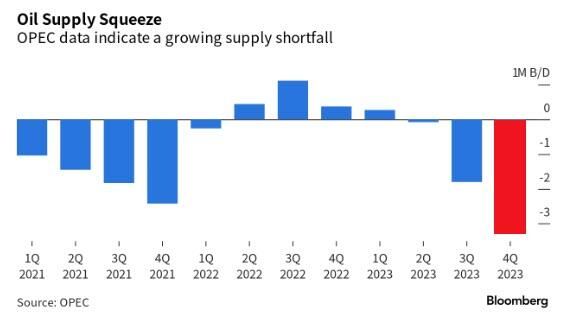

This chart from Bloomberg shows the massive supply shortfall oil markets will face next quarter

OPEC expects a supply shortfall of more than 3 million barrels per day. If OPEC is correct, it would result in the biggest inventory drawdown since 2007. Voluntary production cuts by OPEC members are removing 1.3 million additional barrels of oil supply every day. Higher oil prices are back and the US reserves are at record lows. Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks