Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Concerns over Italy's ability to cut the budget deficit have increased Italy's 10y risk spread over German bunds

The risk spread may expand more if the ECB raises rates 25bps on Thursday. As highlighted by HolgerZ, Italian banks' €380bn of BTPs are central to the €1.6tn so-called sovereign "doom loop." Source: Bloomberg, HolgerZ

There is always a bull market somewhere...

Tesla’s recent acquisition of German wireless #EV startup puts the company at the forefront of the wireless EV charging sector. The global wireless EV charging market, currently valued at $30M, is anticipated to grow at an 89% CAGR, reaching close to $10B by 2032. This growth is largely attributed to ongoing R&D and supportive government incentives (source: Beth Kindig). So what is global wireless EV charging about? For electricvehicles, traveling range and charging process are the two major issues affecting it’s adoption over conventional vehicles. With the introduction of Wire charging technology, no more waiting at charging stations for hours, now get your vehicle charged by just parking it on parking spot or by parking at your garage or even while driving you can charge your electric vehicle

Egypt inflation soars to 37.4% y/y in August as higher food costs add to currency angst

Another month, another record inflation number. Consumer prices in Egypt rose 37.4% in August compared with a year earlier. This is the highest number since 2010 -- higher than even the levels reached after the 2016 currency crisis. Note that food costs were up 71.4%

Steack-flation...Cattle Futures have once again closed at an all-time high. Steaks are going to be getting expensive!

Source: Barchart

Jamie at Barclays conference on Monday - some key takeaways:

- JPMorgan Chase CEO Jamie Dimon said Monday that while the U.S. economy is doing well, it would be a “huge mistake” to believe that it will last for years. - Topping his concerns include central banks reining in liquidity programs via “quantitative tightening,” the Ukraine war, and governments around the world “spending like drunken sailors,” the CEO said. - “To say the consumer is strong today, meaning you are going to have a booming environment for years, is a huge mistake,” Dimon said. - JPM's Dimon doesn’t find fixed income attractive despite the rise in rates: “I would not be a buyer of Treasuries at 4.2%, nor would I be a buyer of credit spreads at these spread levels,” Dimon said at the Barclays conf. He wouldn’t be surprised to see 10yr Treasury yields at 5.5% or oil at $120-150. Source: CNBC, HolgerZ

FAT over AI: the match...

while headlines are all about artificial intelligence darling Nvidia, the weight-loss drugs champions Eli Lilly and Novo Nordisk stocks performance has been spectacular as well. Two year chart shows that $LLY is well ahead of "hot" $NVDA...and $NVO is practically "there"... Source: The Market Ear, Refinitiv

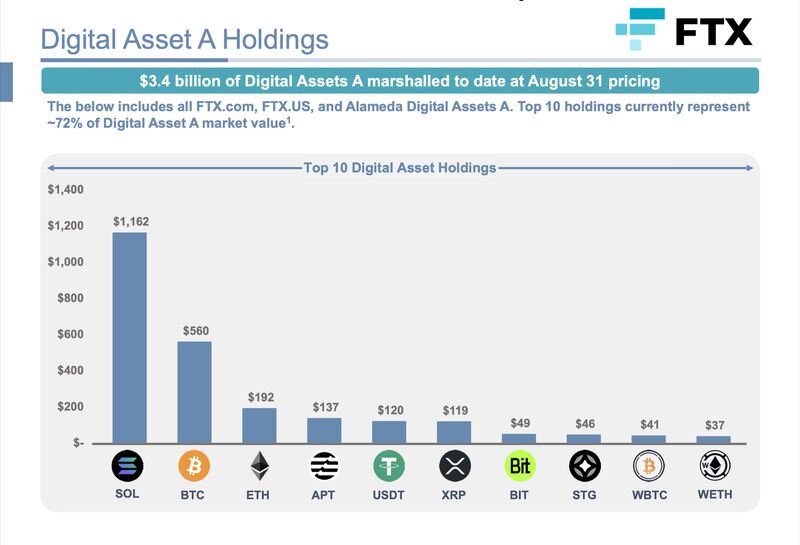

The updated FTX asset report that scares the altcoins / crypto community... A $3.4bn selling tsunami?

Source: Crypto Rower

Investing with intelligence

Our latest research, commentary and market outlooks