Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

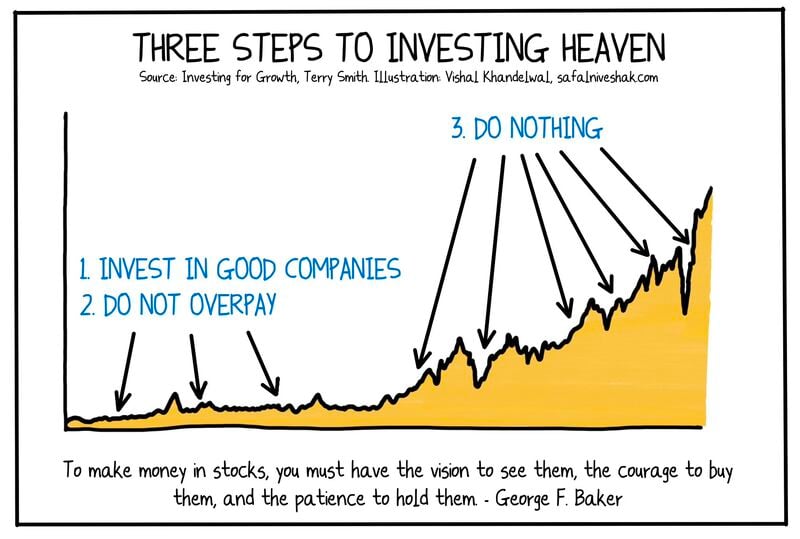

Three steps to investing heaven…

Source - Investing for Growth by Terry Smith thru Vishal Khandelwal

China's holdings of US Treasuries just reached its lowest level in 14 years

Now down almost $481B from peak levels. Source: Crescat Capital, Bloomberg

Crude Oil WTI is trying to break resistance

Crude Oil WTI is trying to break for the second time April high. Keep an eye at 84.40 resistance. Source : Bloomberg

TotalEnergies Breakout

TotalEnergies (TTE FP) is breaking out ! Massive volume yesterday (over 15 million shares). Source : Bloomberg

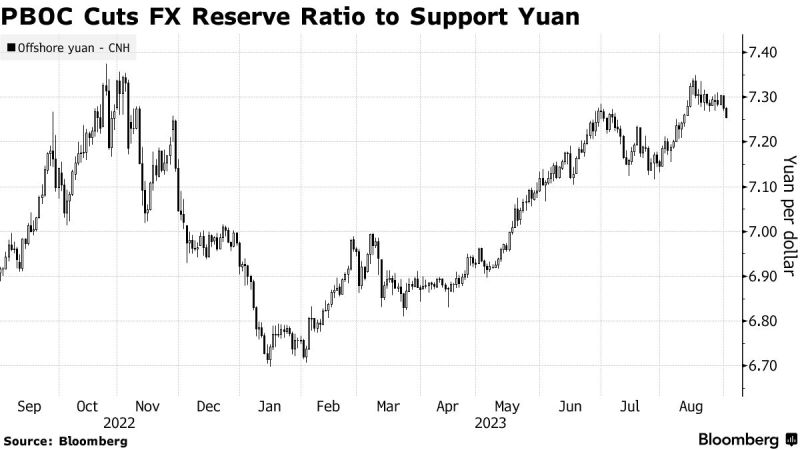

China Uses Another Tool to Aid Yuan in String of Market Support – Bloomberg

China moved to support the yuan by increasing the supply of foreign currency in its local market, part of a multi-pronged effort by Beijing to restore confidence amid sluggish growth. Financial institutions will need to hold just 4% of their foreign-exchange deposits in reserve starting Sept. 15, the People’s Bank of China said Friday, compared to the current level of 6%. The greater availability of overseas currency relative to the yuan effectively boosts the allure of the latter. The so-called FX RRR cut came on the heels of Thursday’s reduction in down payments for mortgages to help the country’s under-pressure residential property market and after policymakers lowered stamp duty for stock trading over the weekend. The combination of supportive measures is a sign that Beijing is growing uncomfortable with increasing pessimism in its financial markets.

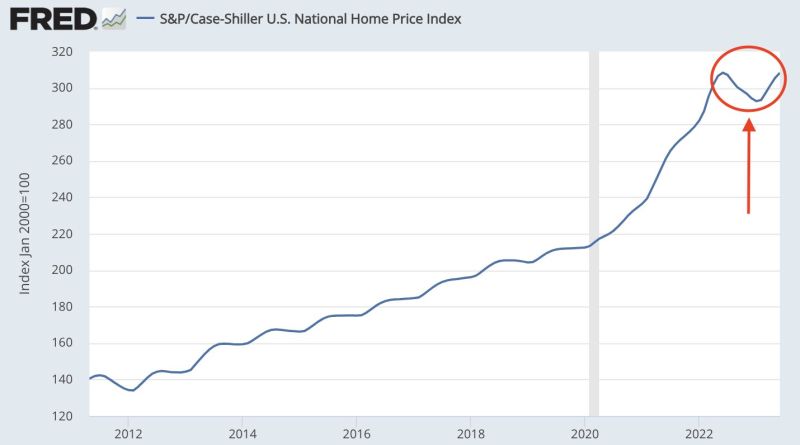

Despite surging mortage rates, US home prices are RISING to ALL-TIME-HIGHS

Higher rates are having an INVERSE effect on price. Rather than prices falling with higher rates, they are actually rising. Why is this happening? As explained by The Kobeissi Letter, as rates rise, existing home sales are falling, now down 16.6% at their lowest since 2010. Borrowers are locked-in to sub-3% mortgages and do not want to sell their homes to get a 2.5x higher rate. We need LOWER rates for LOWER prices... Truly a historic occurrence... Source: FRED, The Kobeissi Letter

After rising ~$3,000 on the Grayscale news, prices just fell $1,000 in a matter on minutes

In less than a day, Bitcoin has shed nearly all the gains it made from Grayscale Investment's court victory against the United States Securities regulator. On Aug. 29, Bitcoin popped to a two-week high after a judge ruled that the Securities and Exchange Commission was “arbitrary and capricious” when it rejected Grayscale’s spot Bitcoin ETF application. However, the SEC’s Aug. 31 decision to delay seven pending spot Bitcoin ETF applications sent Bitcoin’s price downward — falling nearly 5% in the 24 hours to 12 am UTC Sep. 1. This could brutal move coud also be a sign of drying liquidity in the market. This is indeed the 4th "flash-crash" happening on bitcoin this year Source: Cointelegraph, The Kobeissi Letter

The KBW Bank Index fell by 8.8% in August, the weakest bank in the index is Citi with a -13.4% decline

Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks