Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

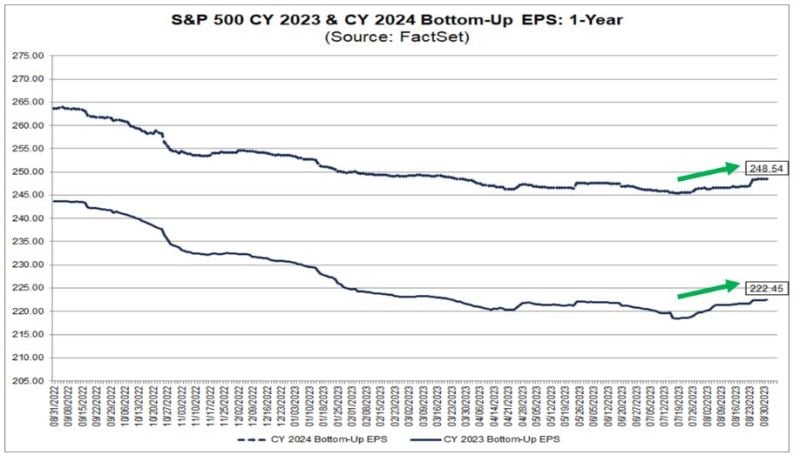

ANALYSTS ARE RAISING QUARTERLY S&P 500 EPS ESTIMATES FOR THE FIRST TIME SINCE Q3 2021

At the end of the earnings season for the second quarter, have analysts lowered EPS estimates more than normal for S&P 500 companies for the third quarter? The answer is no. During the months of July and August, analysts increased EPS estimates for S&P 500 companies for the third quarter. The Q3 bottom-up EPS estimate increased by 0.4% (to $56.10 from $55.86) from June 30 to August 31. While analysts were raising EPS estimates in aggregate for the third quarter, they were also increasing EPS estimates for the fourth quarter. The bottom-up EPS estimate for the fourth quarter increased by 0.6%. Source: Factset

US stocks are on track for their 8th annual outperformance vs Stoxx 600 in 10 years

Source: Bloomberg

Peter Lynch advice was to avoid trying to predict the economy, interest rates or the stock market

"Don't focus on macroeconomic factors to make investment decisions. Focus on the growth of the intrinsic value per share of the companies you own". by Compounding Quality

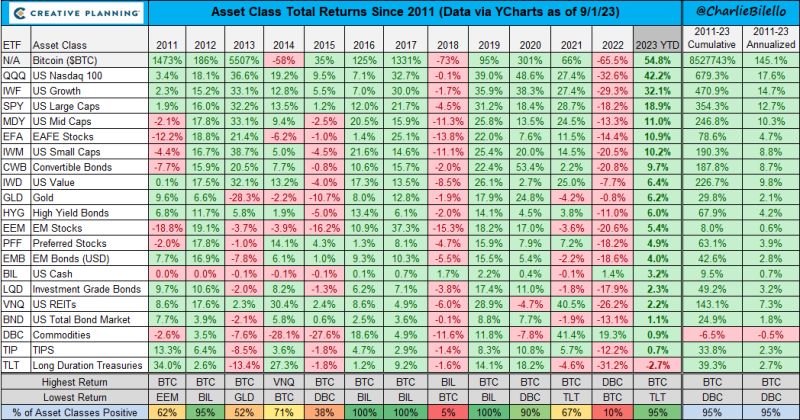

Asset class returns during previous years and 2023 ytd as of 1st of September

Bitcoin is still the best asset class so far this year. Source: Charlie Bilello

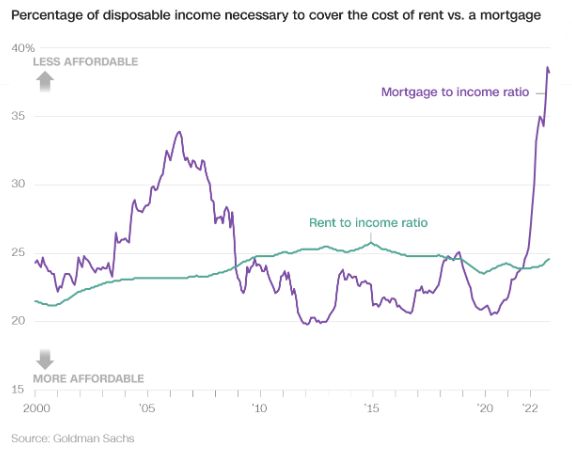

The US mortgage to income ratio (% of disposable income needed to cover the cost of a mortgage) is at its highest level in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks