Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

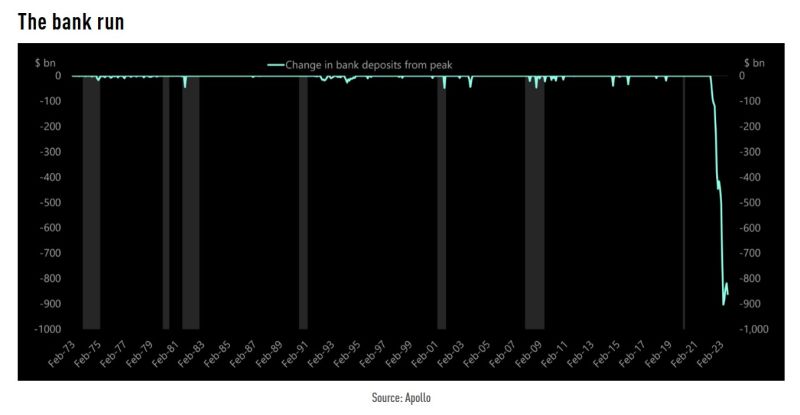

$862bn in deposits have left the banks since the Fed began to raise interest rates

Source: Apollo, TME

Trafigura says ‘fragile’ oil market may be prone to price spikes as higher interest rates and underinvestment squeeze the market according to a Bloomberg article

- The consensus view is for prices to remain near current levels, but the market is “more fragile than it looks,” Ben Luckock, the co-head of oil trading said in an interview at APPEC in Singapore. Brent crude is nearing $90 a barrel after OPEC+ heavyweights reduced supply — curbs that could continue further. - “One reason is underinvestment in new oil production,” he said on Monday. “Combined with higher interest rates, which make it more expensive to hold oil in storage, it means there isn’t much slack or flex in the system. Put all together, and you have a market that’s susceptible to price spikes.” - Oil options traders are showing confidence in the recent sustained surge in prices, bolstering wagers that crude will rally toward $100, even as questions remain over China’s outlook. However, Luckock and other attendees at the conference said it wasn’t all bad when it came to nation’s economy.

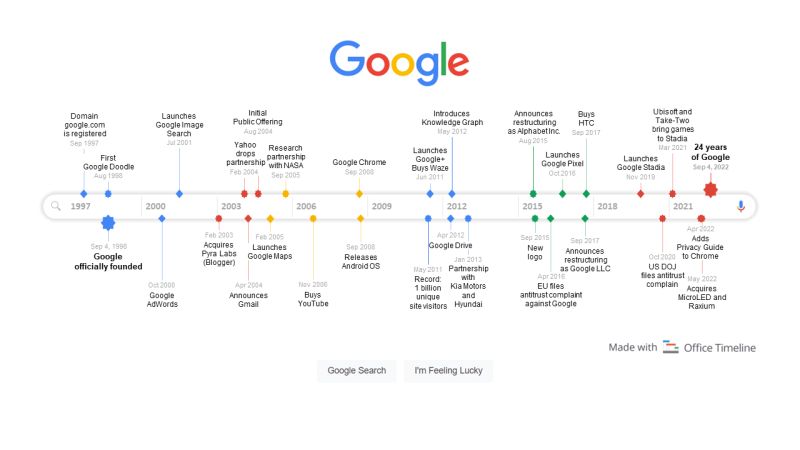

HAPPY BIRTHDAY GOOGLE!

OTD in Tech History 4 September 1998, Google was founded by Larry Page and Sergey Brin, while they were PhD students at Stanford University. Below a Timeline and FAQ about Google (by officetimeline.com): 1) When was Google created? The search engine Google started development in 1996, and it was originally named Backrub, which later became Google, a play on the term “googol”. Google Inc. was officially founded on September 4, 1998 to market Google Search. 2) What does Google mean? The name Google is a creative spelling of googol, the mathematical expression for the number 1 followed by 100 zeros. The term googol was coined back in 1930s, and is attributed to Milton Sirotta, the 9-year-old nephew of American mathematician Edward Kasner. Also, google has become a verb, meaning “to use the Google search engine to search for information about someone or something on the internet”. Today, the meaning of the term google has widened even more and is often used as “to look up information online” using any search engine.

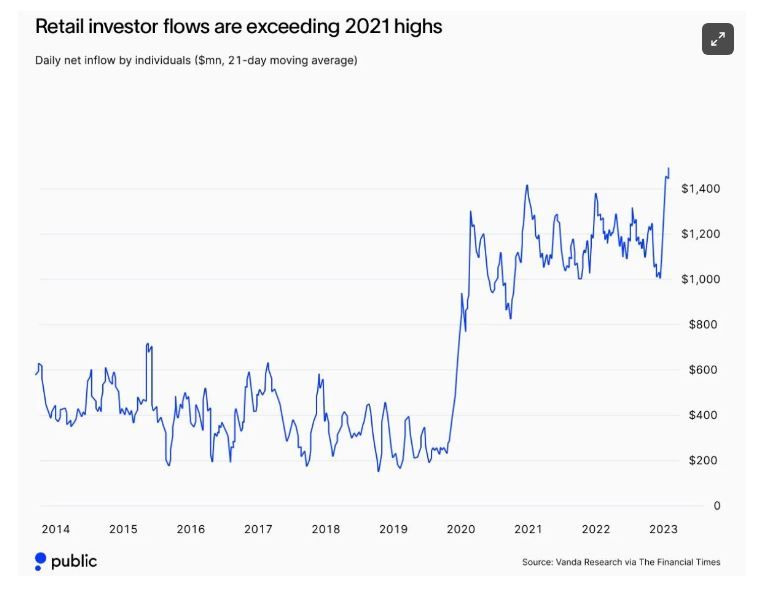

Is the market too complacent? retail investor flows are exceeding 2021 highs

Source: Topdown charts, vanda research via FT

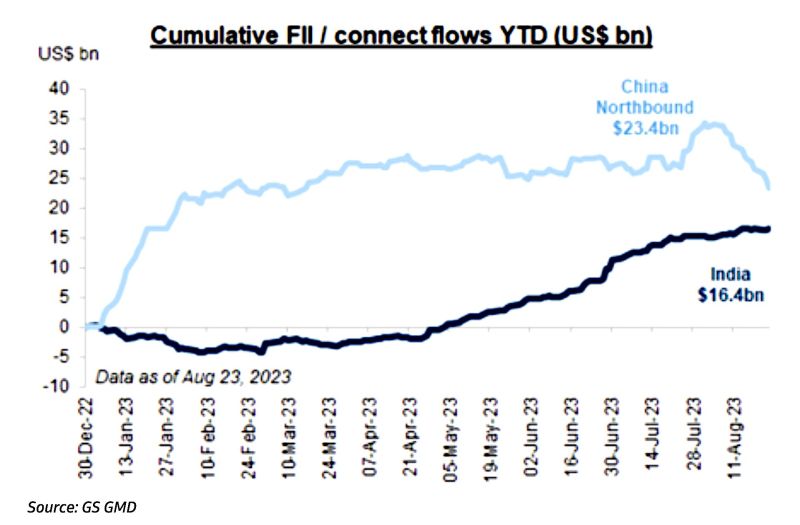

China Northbound has seen sharp outflows this month, while inflows in India remain resilient ($16.4bn)

(HolgerZ via GS)

If you think housing in the US is not affordable anymore take a look at New Zealand, Canada and Sweden 👇

BCA research through Michael A.Arouet

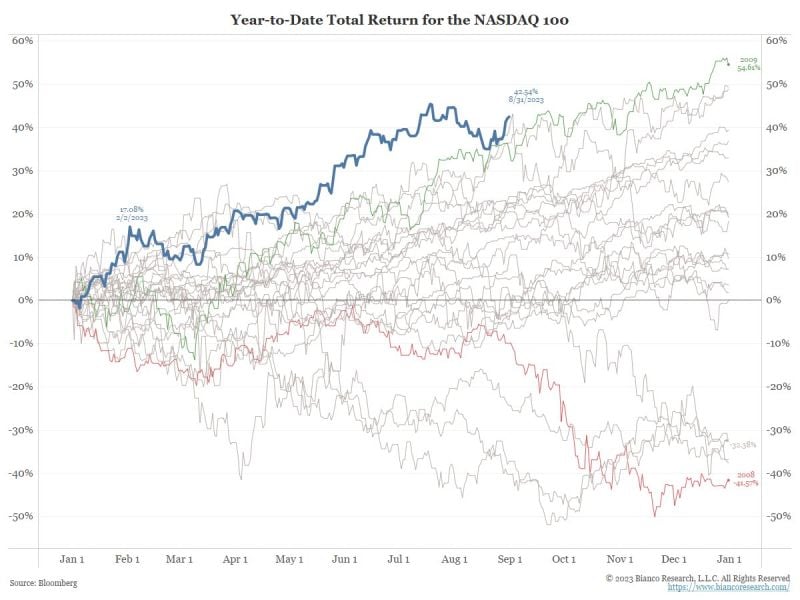

With total return data going back to March 1999, the Nasdaq 100 (NDX)’s 42.54% YTD total return is the best on record (2020’s post-Covid bounce in tech stocks came close)

Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks