Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

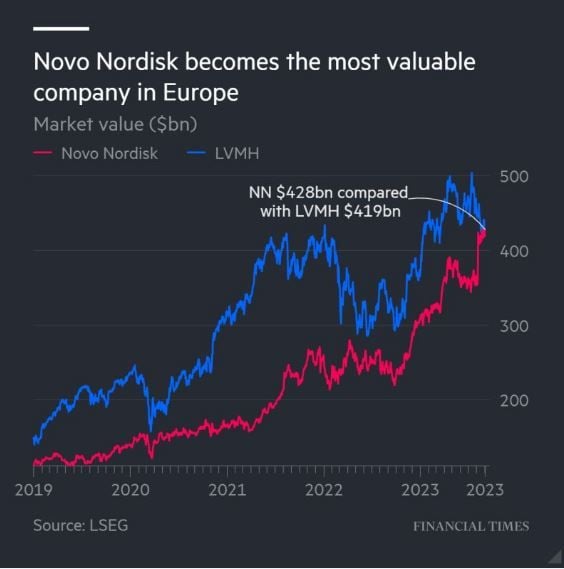

The most valuable listed company in Europe now comes from Denmark

Novo Nordisk has overtaken luxury goods group LVMH on the stock market. It is now worth >€400bn, LVMH 'only' €382bn. The Danish drugmaker on Monday introduced Wegovy in Britain after launching it in the US in June 2021. Soaring demand in the world’s largest drug market subsequently delayed marketing in Europe. The drug is already available in Norway, Denmark and Germany. The company said on Monday that the drug would be introduced to the UK “through a controlled and limited launch”. Novo Nordisk is the largest producer, by sales, in a market for diabetes and new weight-loss drugs that analysts forecast would reach $130bn to $140bn in annual sales worldwide. The company’s biggest competitor in the market, Indianapolis-based Eli Lilly, has applied for regulatory approval to use its diabetes drug Mounjaro to treat obesity. Source: FT

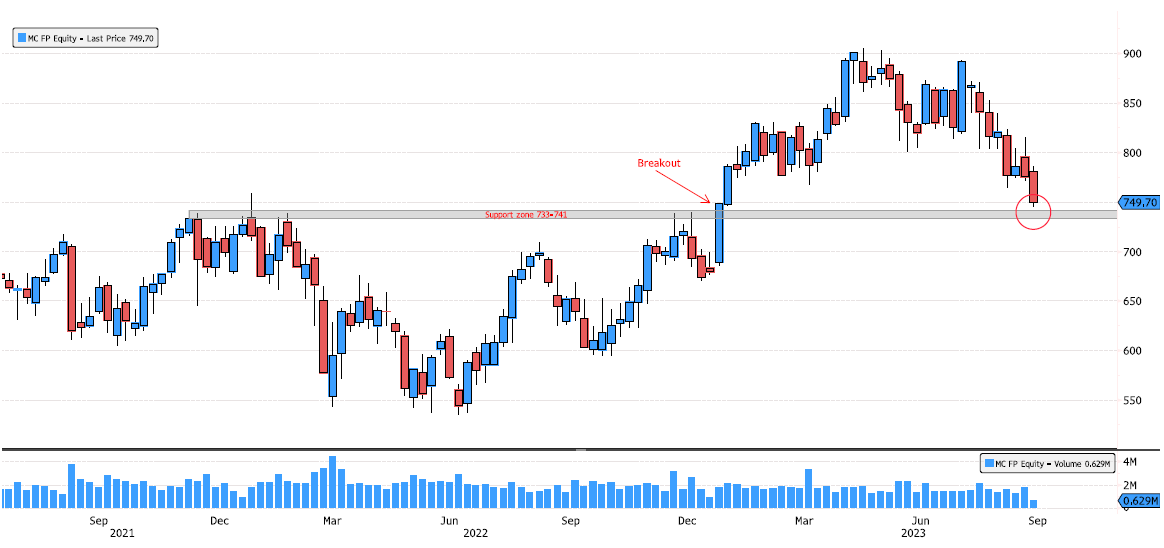

LVMH approaching major breakout support zone

LVMH (MC FP) is approaching major support level 733-741, represented by November 2021 to December 2022 highs but also January 2023 breakout. Keep an eye on it. Source : Bloomberg

Brent Oil hits $90/bbl for 1st time since Nov as Saudi Arabia extended its unilateral oil production cut by another three months

Source: Bloomberg, Holger

Do you remember these Covid darlings?

Below 4 examples of "Pandemic boom and bust" companies (they are not necessarily bad companies but they exemplify how extreme valuations get corrected over time and how painful it can be for shareholders who bought at the top) Zoom $ZM -> Market capitalization: $21 billion today vs $168 billion at the peak. Peloton $PTON -> Market capitalization: $2 billion today vs $58 billion at the peak. Moderna $MRNA -> Market capitalization: $42 billion today vs $172 billion at the peak. Rivian $RIVN -> Market capitalization: $22 billion today vs $123 billion at the peak. Source: Simpel Investing

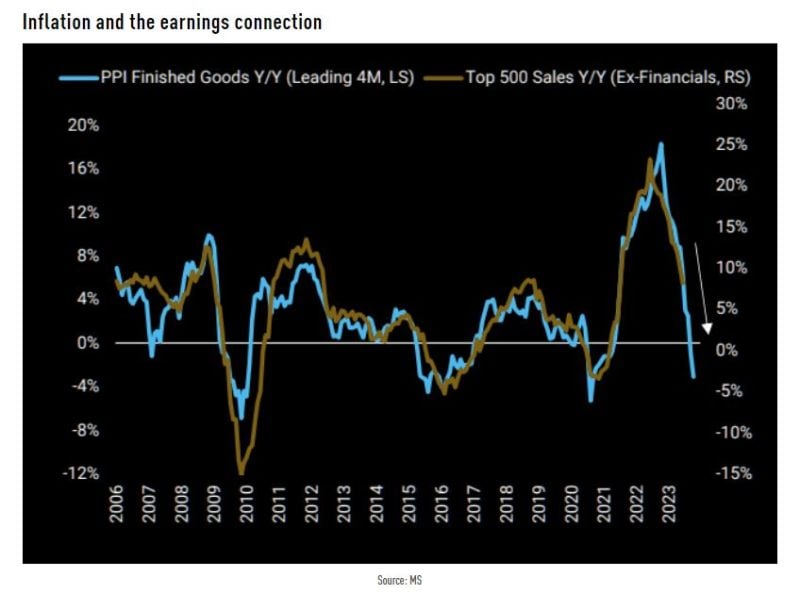

Inflation has been a boost to sp500 companies top-line growth

Now that inflation starts to cool down, could it work the otehr way around? here's the view from Morgan Stanley: "Our boom/bust framework would suggest inflation as it relates to corporate earnings (i.e., pricing) falls toward zero or even below. This is likely to have a significant impact on sales growth and, consequently, on earnings growth as negative operating leverage takes hold." Source: TME

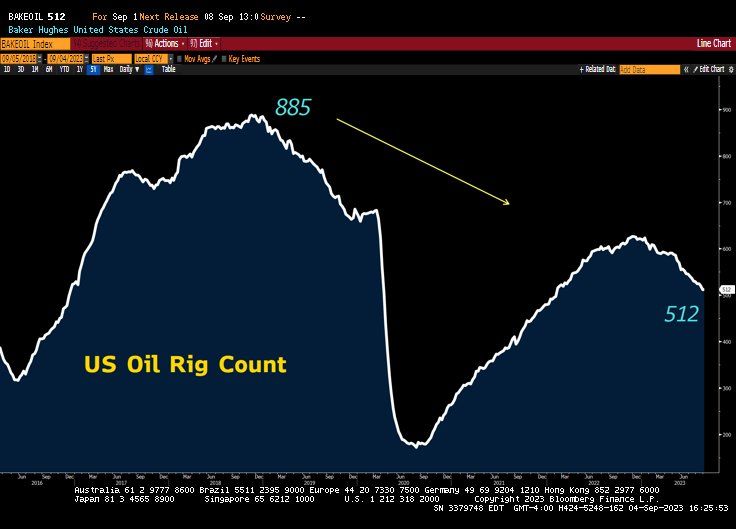

While WTI oil hit $86, the rig count is still in plunge mode...

*A cumulative $4.9T of investments in global upstream oil and gas are needed by 2030 to meet market needs and prevent a supply shortfall" ---International Energy Forum (IEF) and S&P Global Commodity Insights. Source: Lawrence McDonald, Bloomberg

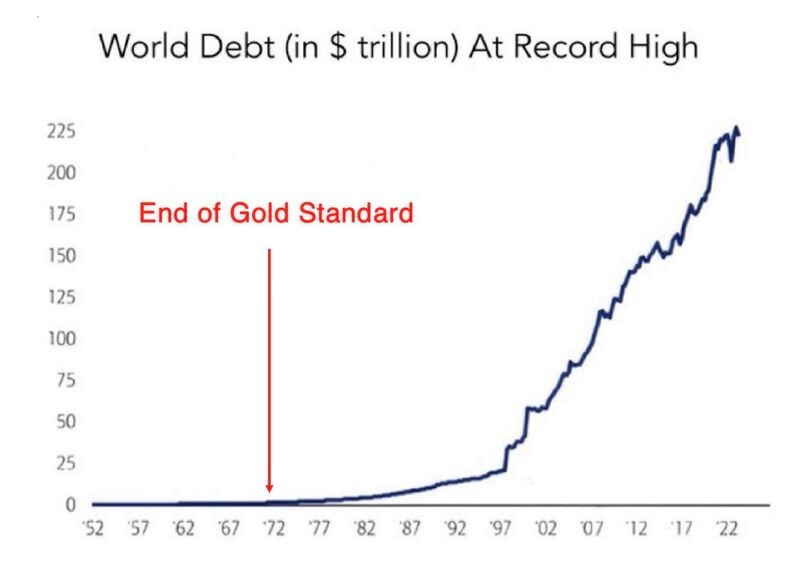

Total Global Debt is now estimated to be over $300 Trillion and has been rising exponentially since 1971

Source: TheBTCTherapist

Investing with intelligence

Our latest research, commentary and market outlooks