Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

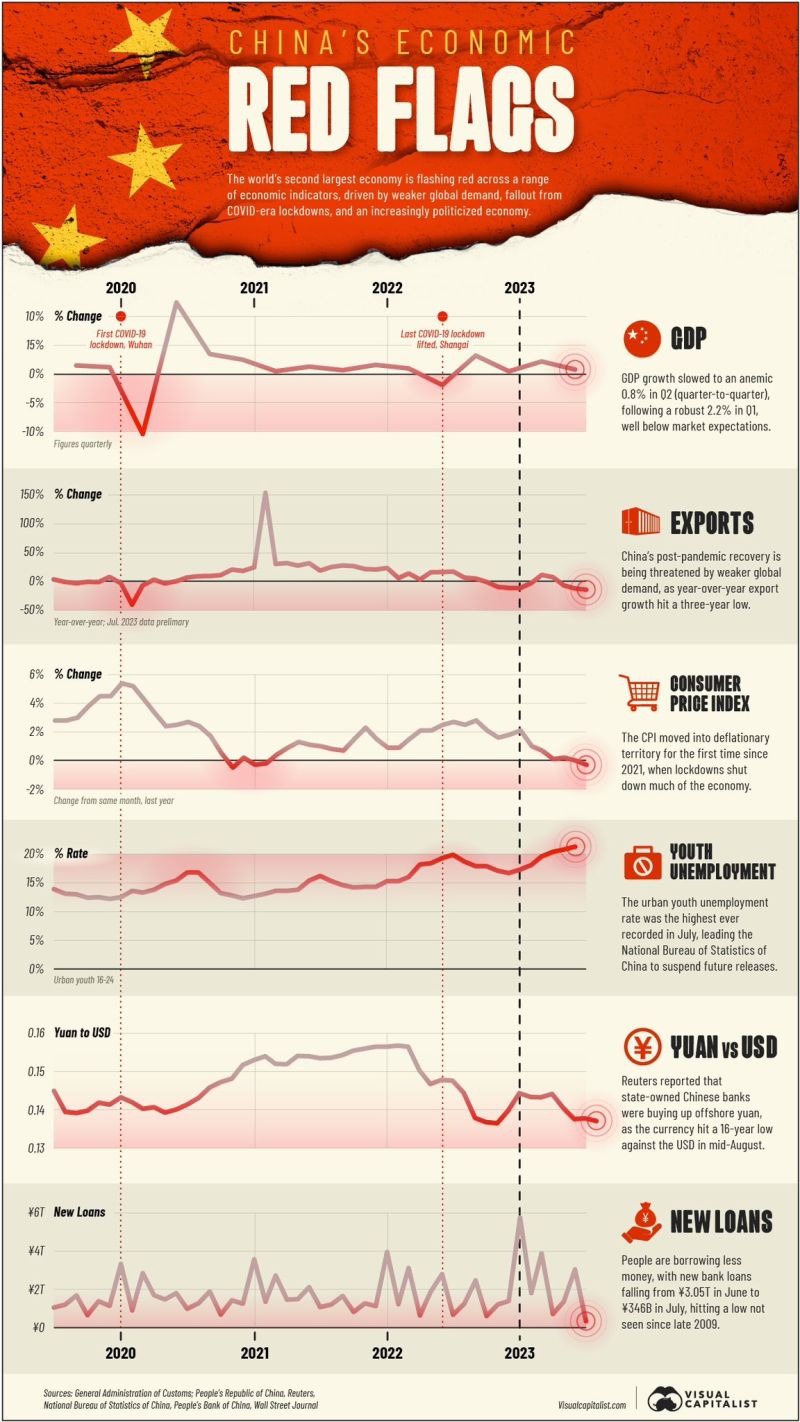

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

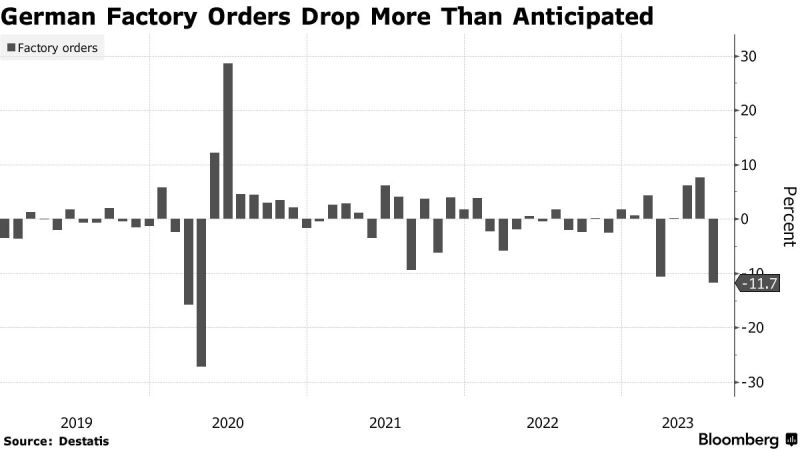

Germany Factory Orders Slumped 11.7% at Start of Third Quarter

*GERMANY JULY FACTORY ORDERS FALL 11.7% M/M; EST. -4.3% *GERMANY JULY FACTORY ORDERS FALL 10.5% Y/Y; EST. -4.5% German factory orders plummeted in July, a sign that the woes of Europe’s biggest economy continued into the third quarter. Demand decreased by 11.7% from June, far worse than the 4.3% drop expected by economists in a Bloomberg survey. That decline was due to major orders, without which the gauge would have increased by 0.3%. The drop in what is a volatile series did follow three months of gains. Source: Blooomberg

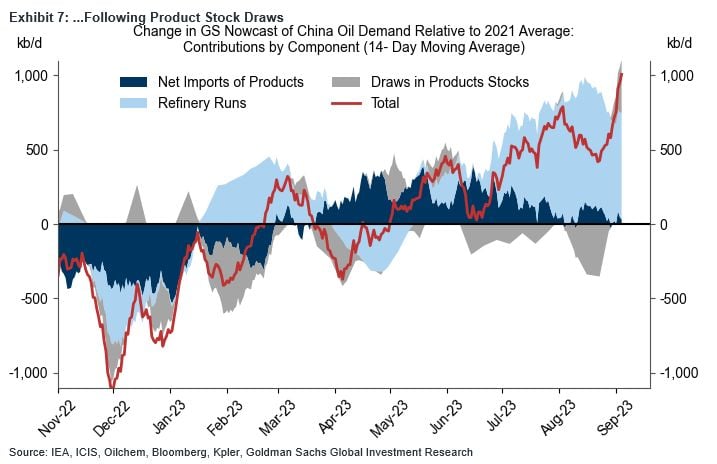

Can oil move back to triple-digits?

According to the GS commodities team, production cuts by Saudi Arabia and its OPEC+ partners - at the time demand continues to rise - will result into an average 3 MILLION BARREL DAILY SHORTFALL into year end (vs. 2 million barrel previously). This is coming at the time when: 1) Not much help is expected from US Strategic Petroleum Reserve (Biden adminstration has already drained half of the SPR, as such there are virtually no levers left to pull at this point); 2) Net spectulative positions on WTI Oil futures contract is at the LOWEST since years Source: Goldman Sachs, www.zerohedge.com

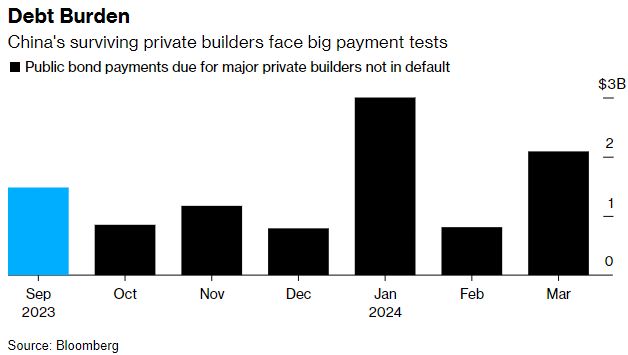

Shares of Chinese property developers Evergrande soared as much as 82% on Wednesday

Other stocks like Country Garden Holdings and Logan Group also surged, gaining as much as 26% and 28% respectively. The gains come after Country Garden reportedly managed to pay $22.5 million in bond coupon payments on Tuesday, narrowing avoiding default. Let's keep in mind though that the sector is far out of the wood. According to Bloomberg, 34 out of the top 50 private real estate developers in China are suffering delinquencies. The remaining 16 developers face a combined $1.5 billion of bond payments this month. In January 2024, these remaining 16 Chinese developers will face a massive $3.0 billion in bond payments. Source: The Kobeisi Letter, CNBC

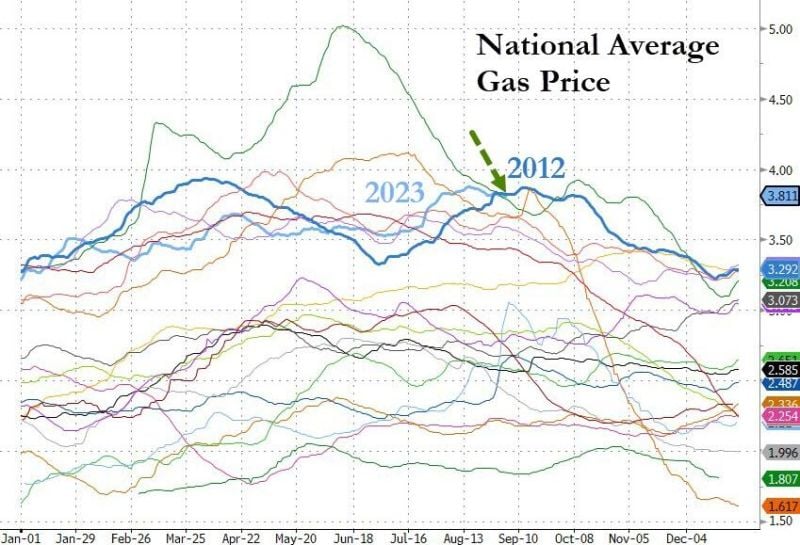

An immediate consequence of soaring oil prices mean -> Soaring gas prices in the US

Now at their highest for this time of year since 2012 (and 2nd highest ever)... not great for headline inflation and consumer purchasing power Source: Bloomberg, www.zerohedge.com

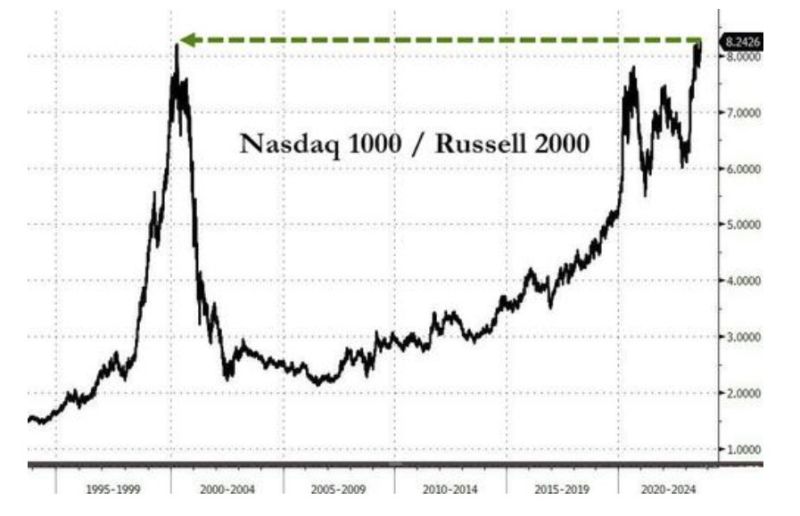

Despite the rise in bond yields, the Nasdaq 100 held up better than the Dow and other US indices on Tuesday

Tuesday was the way the Nasdaq's second best performance relative to the Russell 2000 since November 2021, breaking out to a new cycle high. The last time Nasdaq/Russell 2000 traded here was March 2000 - the very peak of the dotcom bubble... Source: Bloomberg, www.zerohedge.com

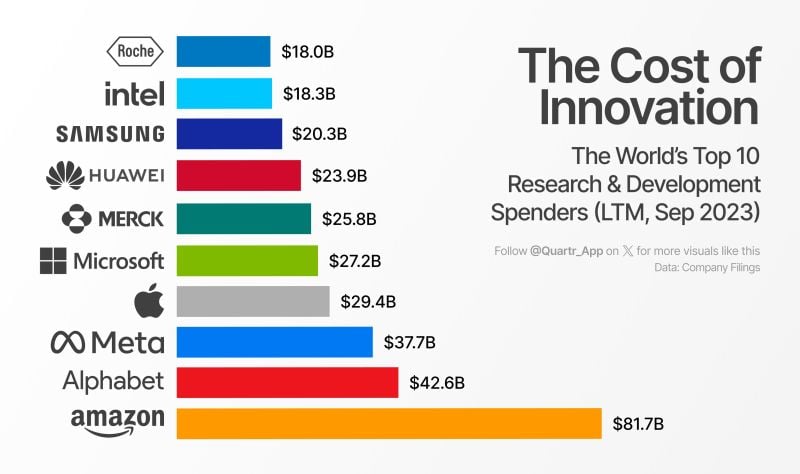

The cost of innovation

Did you know that $AMZN has spent more on R&D over the last twelve months than $AAPL, $MSFT, and $INTC *combined*? See below the World’s Top 10 R&D Spenders Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks