Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

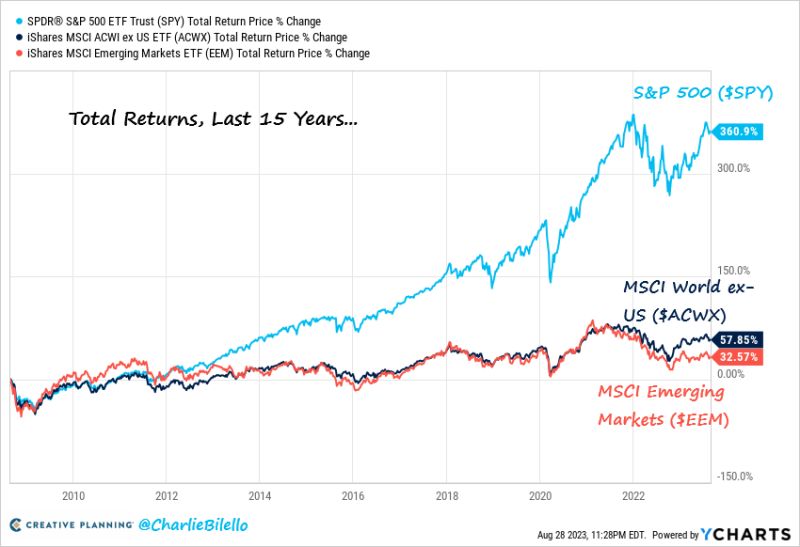

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A BAZOOKA CUT BY THE NATIONAL BANK OF POLAND...

Is it the most dovish central bank around? Despite roughly 10% inflation, The National Bank of Poland cut rates by 75bp to 6%, versus expectations of a 25bp cut. - Poland’s central bank delivered a surprisingly steep interest rate cut in a bid to boost a slowing economy less than six weeks before a tightly-contested election, weakening the zloty and hammering banking stocks. - The decision to lower the benchmark rate by three quarters of a percentage point — the most since the fallout from the great financial crisis in 2009 — to 6% caught economists off guard. Most had predicted a quarter point reduction. - The decision takes on a political dimension coming so close to the Oct. 15 election and has left investors guessing at the next move, with some predicting that the easing cycle has ended as soon as it began. Source: Bloomberg

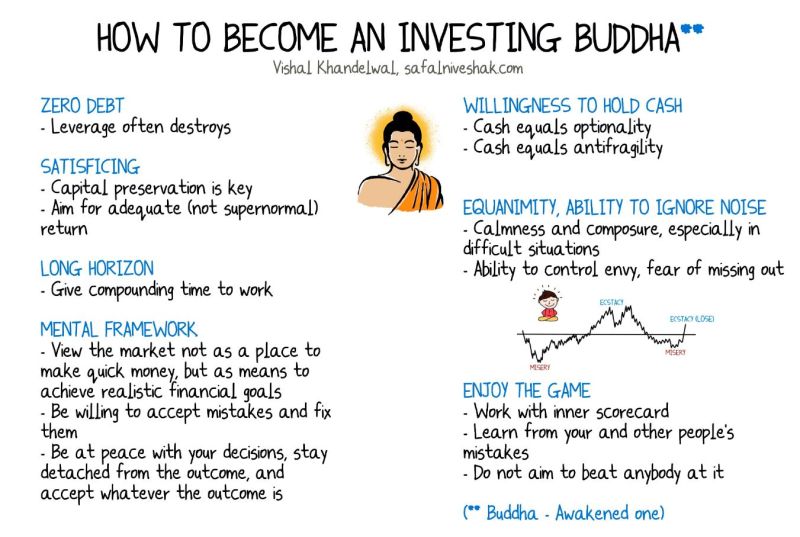

How to become an investing buddha

Source: Vishal Khandelwal

China Reportedly Bans Apple iPhones And Other Foreign Devices Among Government Officials according to the WSJ

-> Citing unnamed people familiar with the matter, the Journal said officials at central government agencies had been told of the ban by superiors in recent weeks through workplace chat groups or in meetings. -> The order also prohibits officials from bringing iPhones and other foreign devices into the workplace. -> It’s not clear how widely the orders have been disseminated across China’s government but similar instructions have also been handed down to employees at some central government regulators, according to the Journal. Source: Forbes

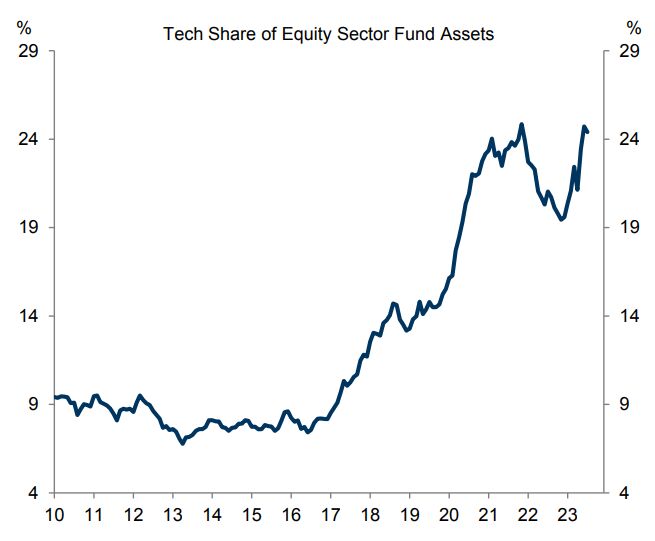

Technology stocks now reflect a record ~25% of all equity fund assets

Just 8 years ago, technology stocks only reflected just ~9% of all equity fund assets. Meanwhile, 5 stocks currently account for ~70% of the Nasdaq's gain this year. Technology stocks have become the backbone of the stock market. Source: The Kobeissi Letter

European stocks are becoming very disconnected from macroeconomic data

Source: Cheddar Flow, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks