Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Investors predict that the coming years will be marked with defaults and spending cuts as a larger portion of corporate, household and state income goes into financing debt

A stark indicator of the approaching sea change is the gap between what governments and companies globally are currently paying in interest and the amount they would pay if they refinanced at today’s levels. Apart from a few months around the global financial crisis, the gauge has always been below zero. Now it’s hovering around a record high of 1.5 percentage points. Source: Bloomberg

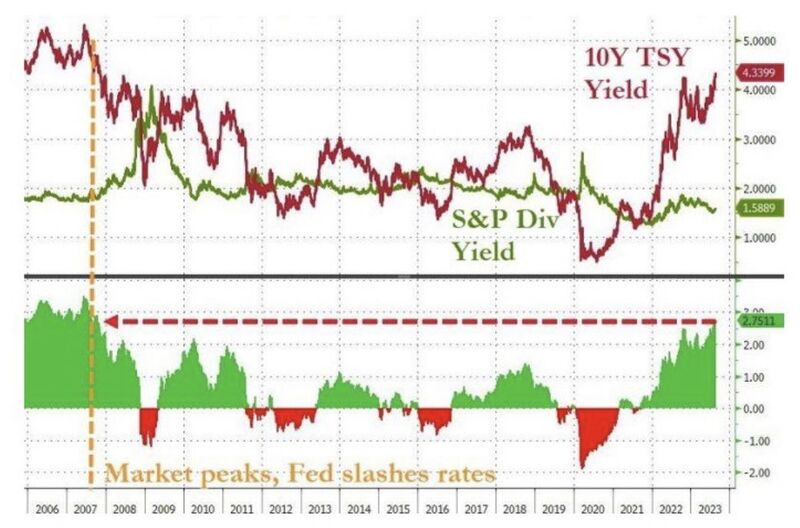

The last time 10Y yields were this far above $SPX dividend yields was September 2007, the month stocks peaked

Source: zerohedge

The 2,850% gain in $AMC shares during the 2021 meme stock mania has been completely erased after a 98% decline

Barbie and Oppenheimer movies could not do anything about it Source chart: Charlie Bilello

Global liquidity slump could become a drag on risk assets

Source: Bloomberg, HolgerZ

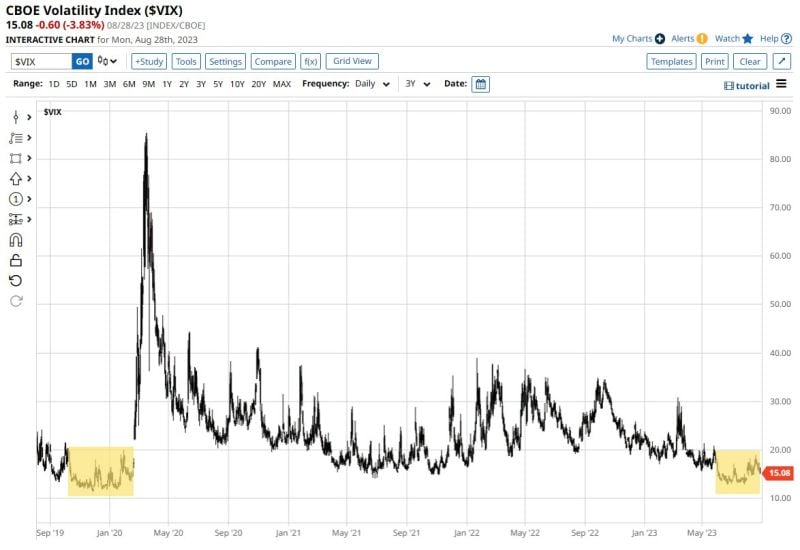

CBOE Volatility Index $VIX has closed under 19 for 64 consecutive trading days, the longest streak since early 2020

Source: Barchart

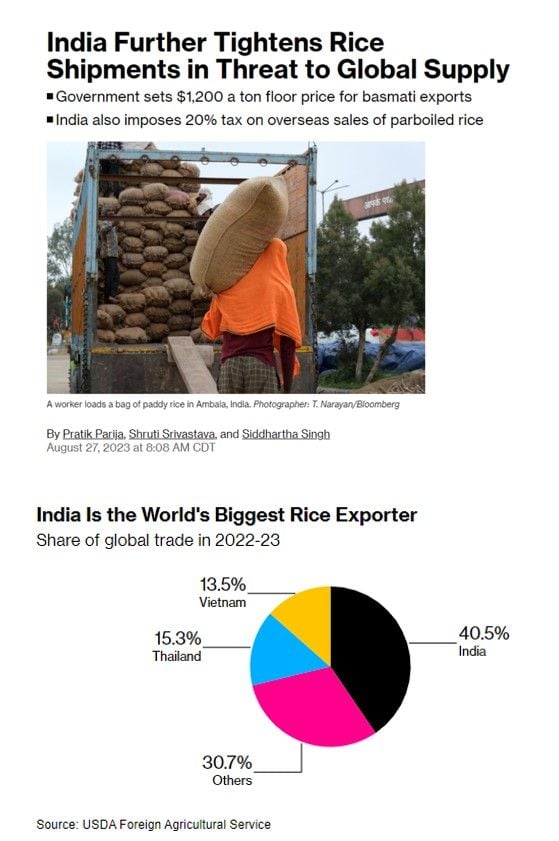

Rice likely to get even more expensive as India imposes additional restrictions

India further tightens rice exports as the government sets a floor price of $1,200 per tonne for basmati rice exports. India also imposes a 20% tax on rice sales abroad. Rice is a staple food for half the world. Source: Barchart, Bloomberg

Zillow expects U.S. home prices to jump by 6.5% over the next 12 months

Source: Barchart, Fortune

Investing with intelligence

Our latest research, commentary and market outlooks