Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

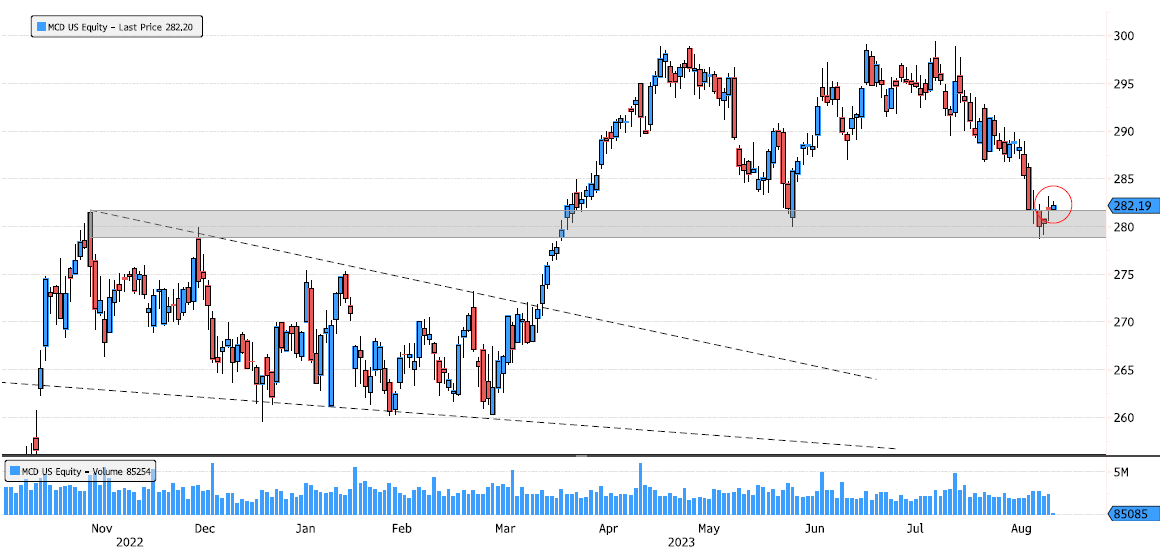

McDonald on major support

McDonald (MCD US) is testing for the second time the April breakout level. Keep an eye on this zone 279-282. Source : Bloomberg

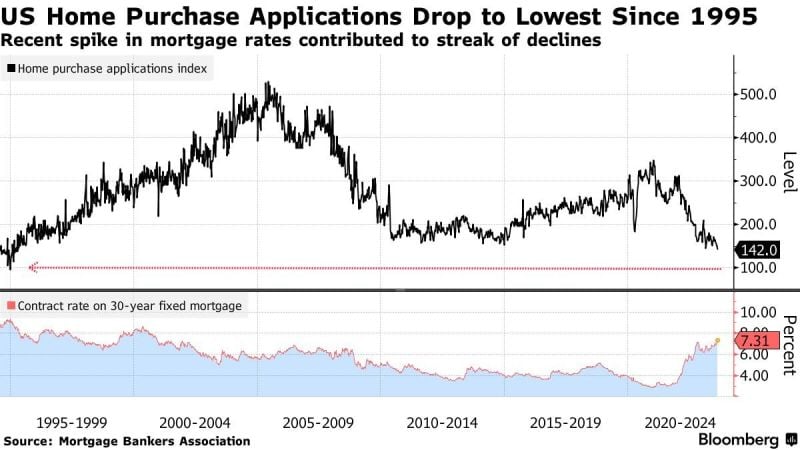

U.S. Home Purchase applications drop to lowest level in nearly 30 years

Source: Bloomberg, Barchart

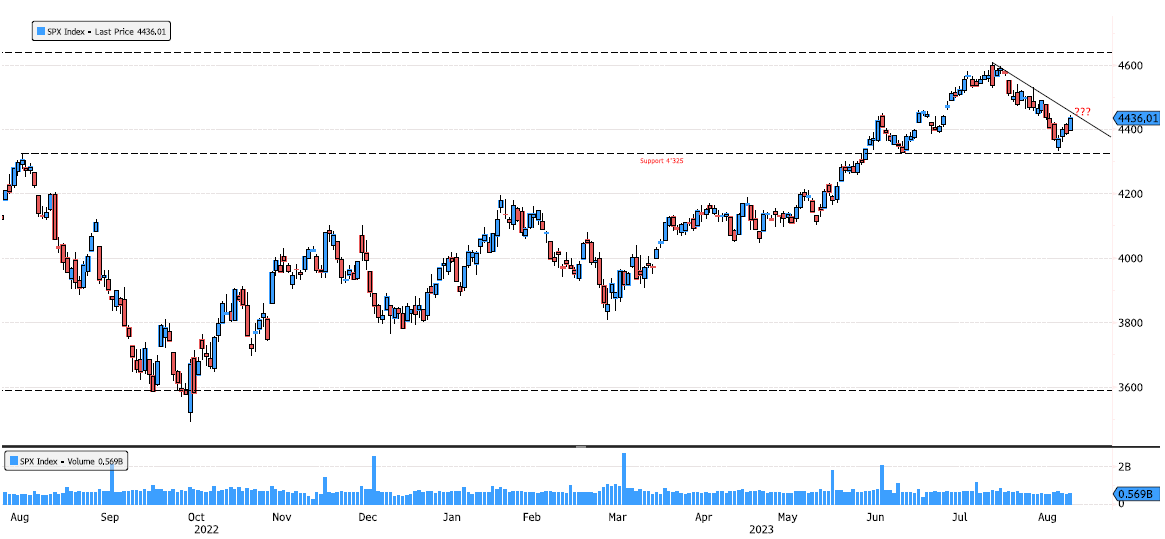

S&P 500 now what ?

S&P 500 index (SPX) rebounded just over support 4'325 a few days ago. Now it's retesting July downtrend resistance and June highs. Keep an eye at that resistance zone 4'448-4'458. Source : Bloomberg

TotalEnergies tested again high end of triangle

TotalEnergies (TTE FP) reversed yesterday on the high end of the triangle. Will it have enough strength to breakout or is it on it's way to retest the lower band ? Source : Bloomberg

Nvidia CEO: "Software Is Eating the World, but AI Is Going to Eat Software" (and Nvidia eats AI?)

After Nivdia $NVDA earnings 🚀🚀🚀 yesterday: 1. Nvidia is now worth 8.8x more than Intel 2. Nvidia is now worth 6.9x more than AMD 3. Nvidia is now worth nearly 3x as much as JP Morgan by market cap 4. Nvidia is now the 5th most valuable public company 5. Nvidia expects $183 million in revenue per DAY in Q3 6. EPS increased by nearly 900% since last year 7. Short sellers have now lost nearly $10 BILLION this year Source: Baris Aksoy, The Kobeissi Letter

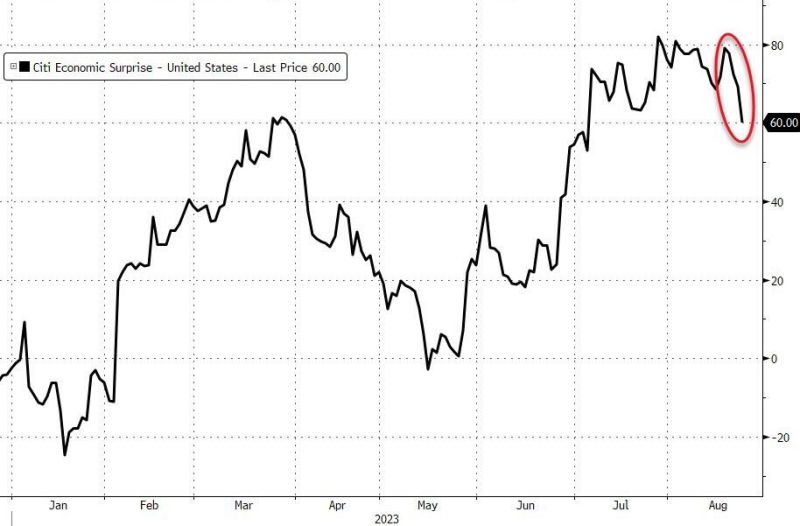

This week has seen the biggest set of 'bad news' since April...

And that bad news prompted a very aggressive bid for global bonds with USTs tumbling 8-12bps on the day, leaving the long-end down 9bps on the week (but 2Y +2bps still) Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks