Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

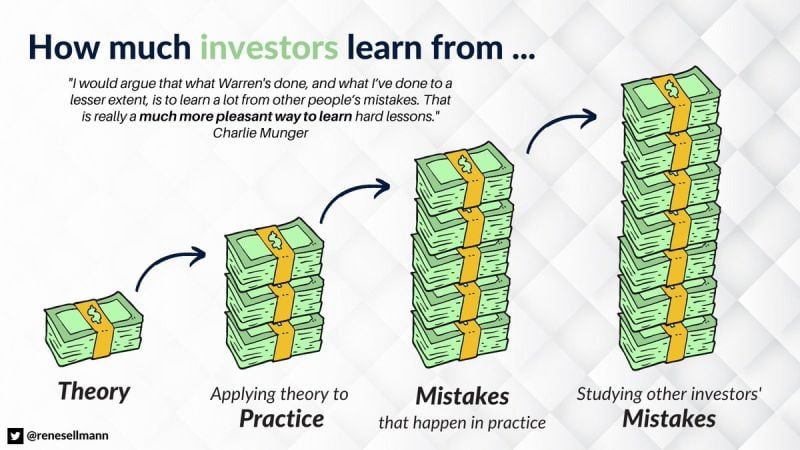

Investors learn the most by studying other investors' mistakes

Source: Brian Feroldi

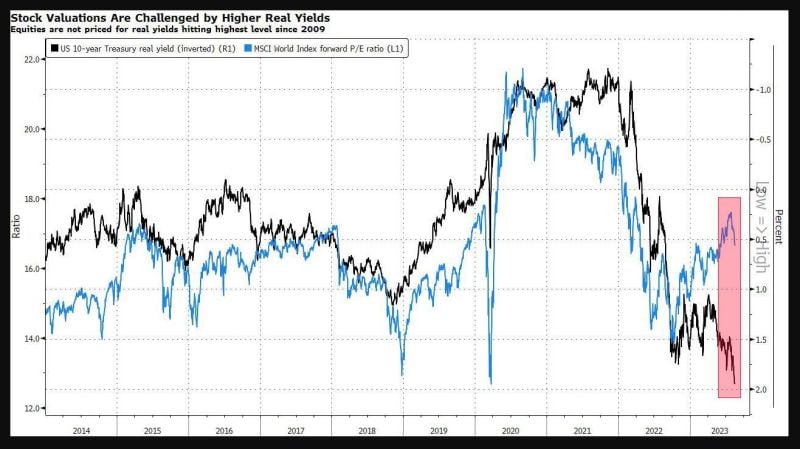

Higher real bond yields create a challenge for global equities valuations

Source: Bloomberg

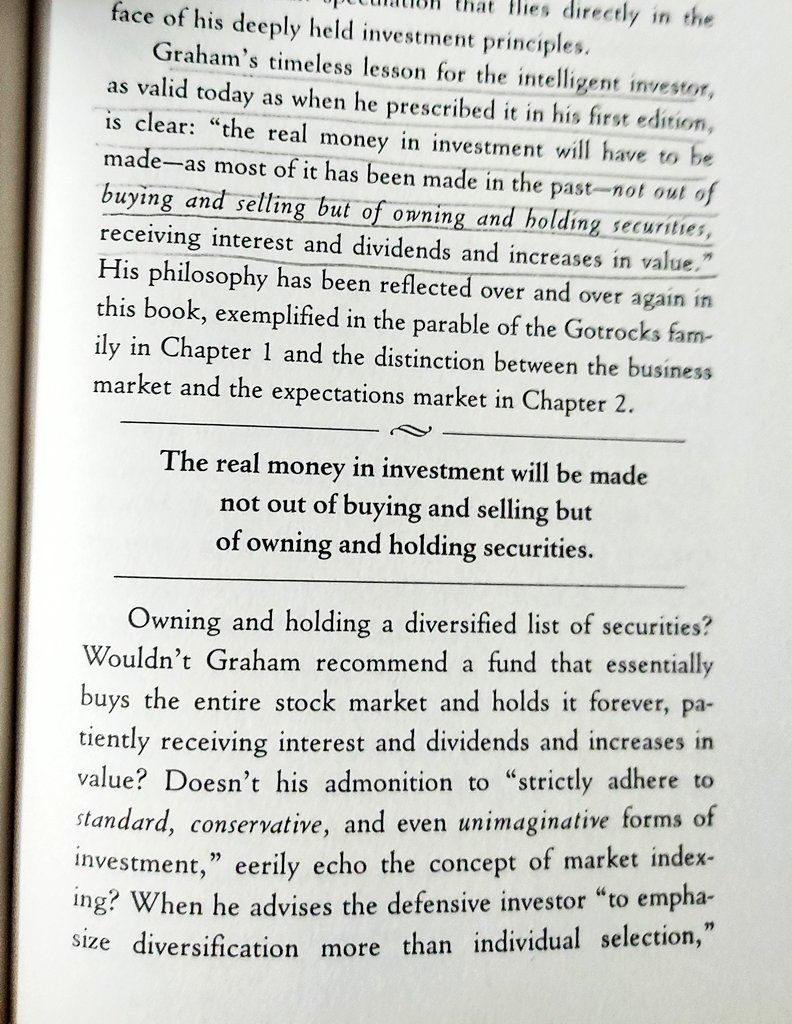

"The real money in investment will be made not out of buying and selling but of owning and holding securities" - Charlie Munger

Source: Investment Books (Dhaval)

Eli Lilly stock hit a new record high yesterday as the company continues to record a surge in sales for its buzzy diabetes drug Mounjaro

Sales of Mounjaro, which has also gained popularity for weight loss, came in at $979.7 million for the second quarter, up from $16 million a year earlier when it was introduced (2Q results were publichsed 2 weeks ago). That helped the drug company post higher-than-expected sales for the second quarter. Novo Nordisk is also surfing on the strong demand for a similar weight loss blockbuster

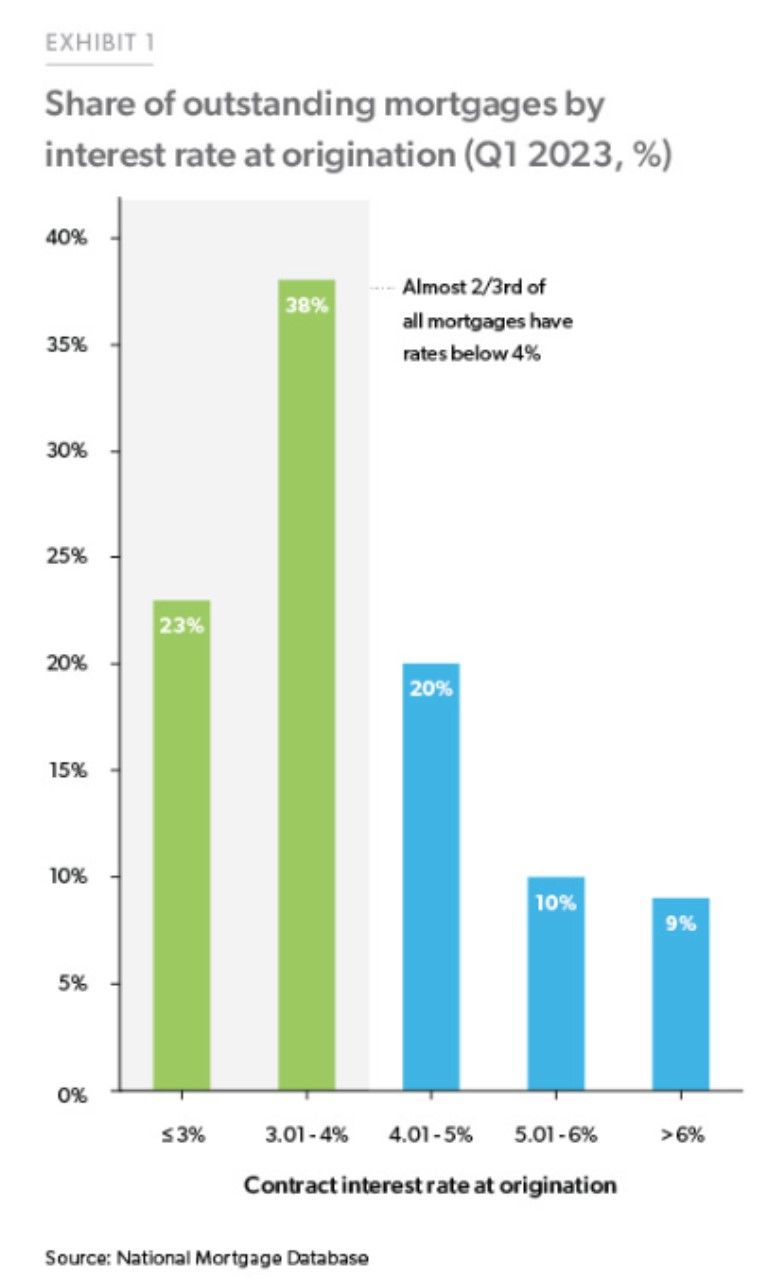

Over 60% of outstanding US mortgages have an interest rate below 4%. Current average 30y mortgage rate is north of 7.5%...

This is the 1 factor driving the limited housing supply as many of these homeowners can't afford to move... Source: Charlie Bilello, National Mortgage Database

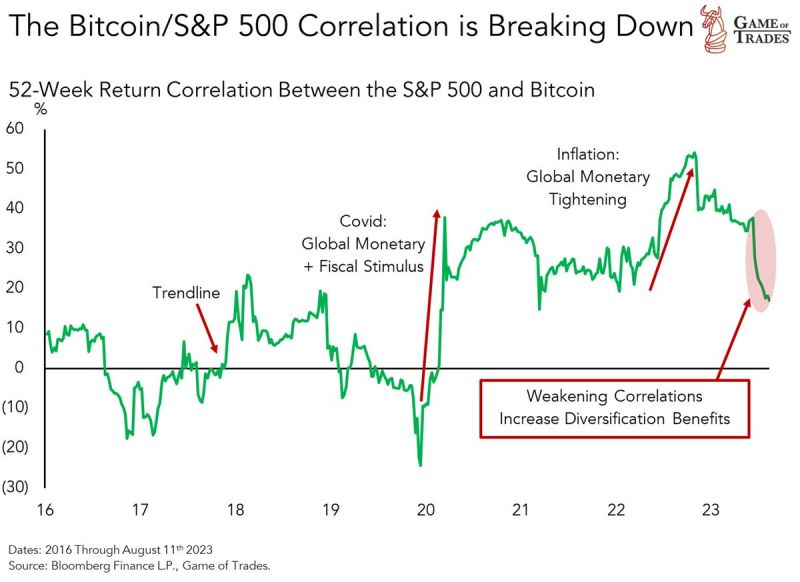

Bitcoin's correlation to the sp500 has shown signs of breaking down Lower correlation boosts BTC's diversification potential

Source: Game of trades

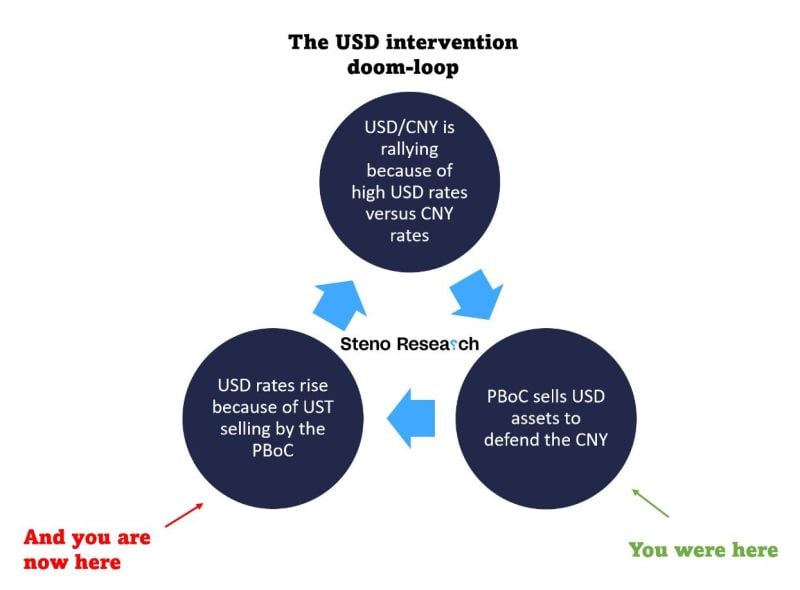

Nice one by Steno research

While there are some fundamental reasons for US Treasury yields to keep rising (check out the Atlanta Fed Nowcast model poiting towards nearly 6% annualized real GDP growth in 3Q), what is currently going in China probably has some impact as well Source: Stenio research

Investing with intelligence

Our latest research, commentary and market outlooks