Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

Yen declines as BOJ sticks with super easy policy unlike peers

The Bank of Japan continued to defy global central bank trends by sticking with stimulus as it waits for signs of more sustainable inflation while its peers signal the need to raise interest rates further to rein in prices.

Governor Kazuo Ueda and his fellow board members left their negative interest rate and yield curve control program unchanged at the end of a two-day gathering and maintained their view that inflation will slow over the coming months, according to a statement Friday.

The yen declined after the decision, falling to around 141.40 per dollar. It had hit a seven-month low of 141.50 on Thursday.

Source: Bloomberg

USDT selling sets off alarm bells as Curve, Uniswap pools flooded with tethers

Speculation is mounting that Tether’s USDT, the largest stablecoin by market capitalization at around $83.4 billion, may be under pressure. Specific liquidity pools on the Uniswap and Curve protocols — the deepest pools in the DeFi ecosystem — currently seem to be flooded with USDT sellers. When sellers flood the market it can cause a rapid depeg, a situation noted during the Silicon Valley Bank collapse, when the well-regarded USDC stablecoin (issued by Circle and Coinbase) lost its peg and fell as low as $0.93 before regaining its dollar parity within a couple of days. Source Blockworks

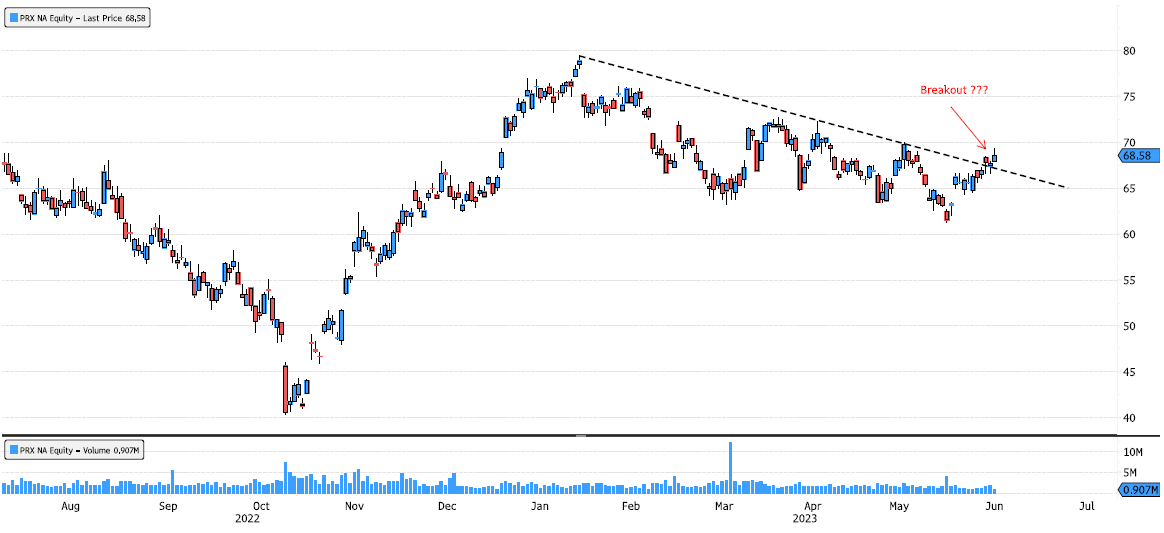

Prosus NV breakout ?

Prosus (PRX NA) is now trading over the downtrend consolidation that started end June. Is this the breakout ? Source : Bloomberg

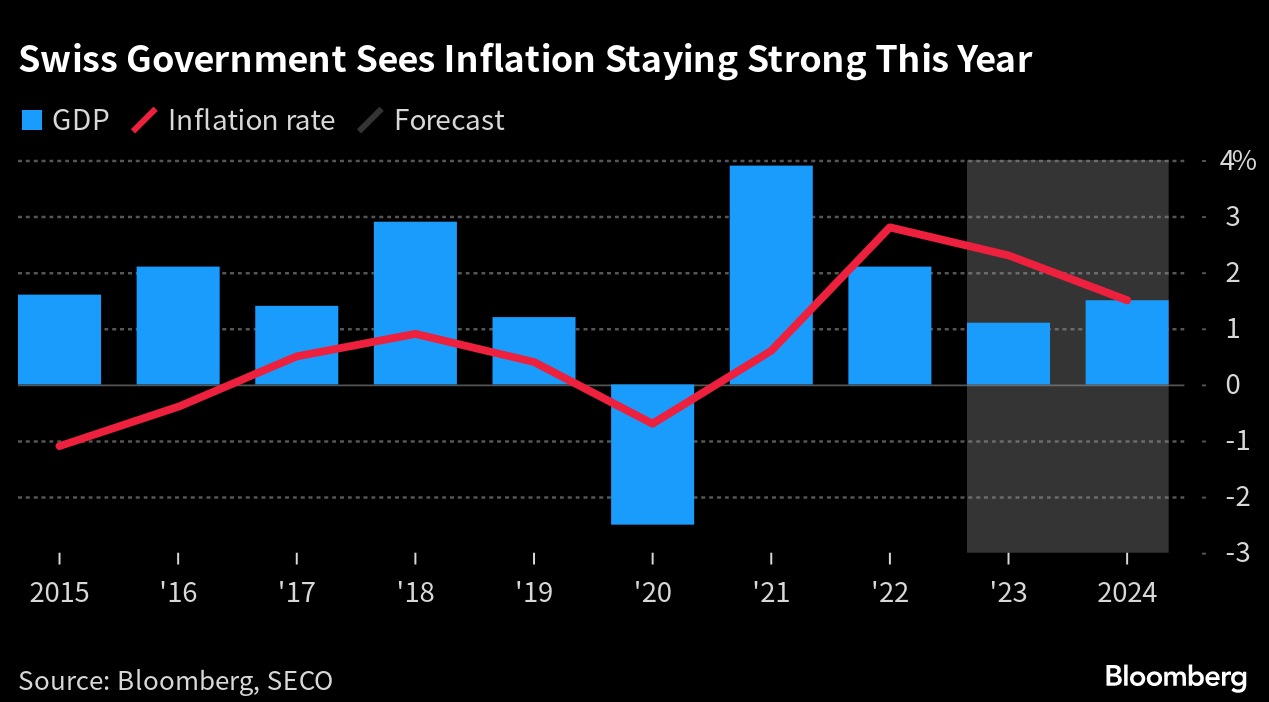

Switzerland’s new inflation forecast supports another SNB hike

The government expects inflation to be above the central bank’s target this year which reinforces a likely interest-rate hike next week. The SECO said consumer prices will rise 2.3% this year. That down from 2022’s 2.8%, and also slightly lower than a March prediction of 2.4%.

Source: Bloomberg, SECO

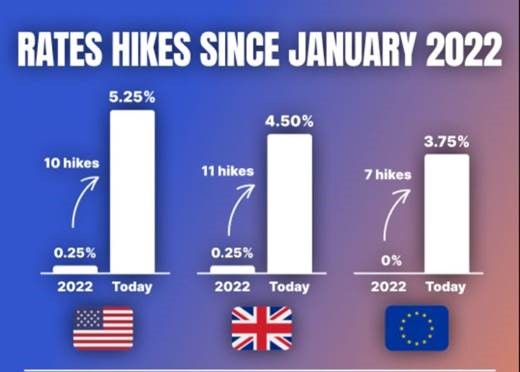

The rate hikes marathon

Since the start of 2022: The Federal Reserve has raised its benchmark rate 10 times to 5.25% from 0.25%. The Bank of England has hiked its key rate 11 times to 4.5% from 0.25%. The European Central Bank increased its seven times to 3.75% from 0%. Source: Ignacio Ramirez Moreno

Treasury longs extend

The latest JP Morgan client survey shows the most outright long positions since 2019. Source: Bloomberg

NYSE Airlines Index rallied to hit another new 52-week high yesterday

Source : J-C Parets

Fed left interest rates unchanged but suggest further hikes

Federal Reserve officials paused their series of interest-rate hikes but projected borrowing costs will go higher than previously expected.

Powell, speaking to reporters in a press conference Wednesday, faced the challenging task of explaining two possibly contradictory policies: deciding to leave rates unchanged following 10 straight hikes while also indicating that at least two more increases might be necessary this year, possibly as soon as July.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks