Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

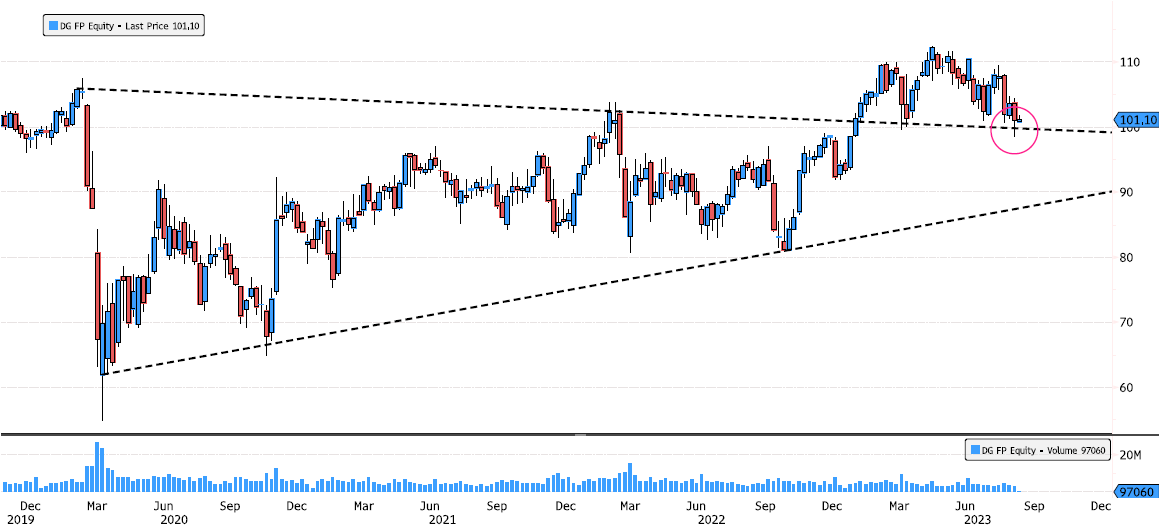

Vinci retesting breakout triangle level

Vinci (DG FP) retested and bounced on support level 100 last week. This level represents the top of the triangle (January breakout and March retest). Source : Bloomberg

Europe Consumer Staples Sector Index on support level

Europe Consumer Staples Sector Index (SEUCONS Index) rebounded Friday over support 3'090 with a Hammer reversal candel. It's also back over 3'120 support level. Keep an eye at this zone. Source : Bloomberg

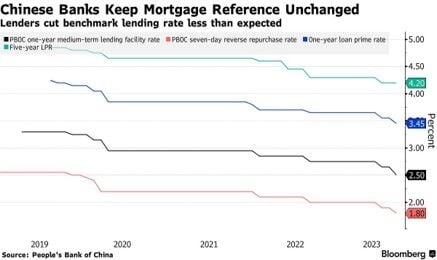

Overnight, Chinese banks made a smaller-than-expected cut to their benchmark lending rate

(cut 1-year rate by 10bps; no change in 5-year while the market was expecting a 15-basis-point cut on both rates) and avoided trimming the reference rate for mortgages, despite the PBOC urging lenders to boost loans. Banks’ failure to follow the central bank suggests they were unprepared, but that cuts to their lending rates may still arrive in the coming months.. Meanwhile, The Hang Seng Index declined as much as 1.8% and was set for its lowest close since November. Shares in mainland China also dropped into a second day, with finance stocks among the worst performers. Source: Bloomberg

Higher real rates and an upward-trending dollar spell trouble for Gold, with ETF outflows and shrinking longs in the futures market underlining weaker investor appetite

The metal has fallen below the 200-day average, with both the 100-day and 50-day moving averages trending lower. And given gold’s propensity to trend, this is NOT a positive for Gold. However, a quiet season in the jewelry market should see some pick up as the Hindu festival of Diwali approaches in November. This event is associated with gold gifting, and kicks of a wedding season in India that also features strong demand. Source: Bloomberg

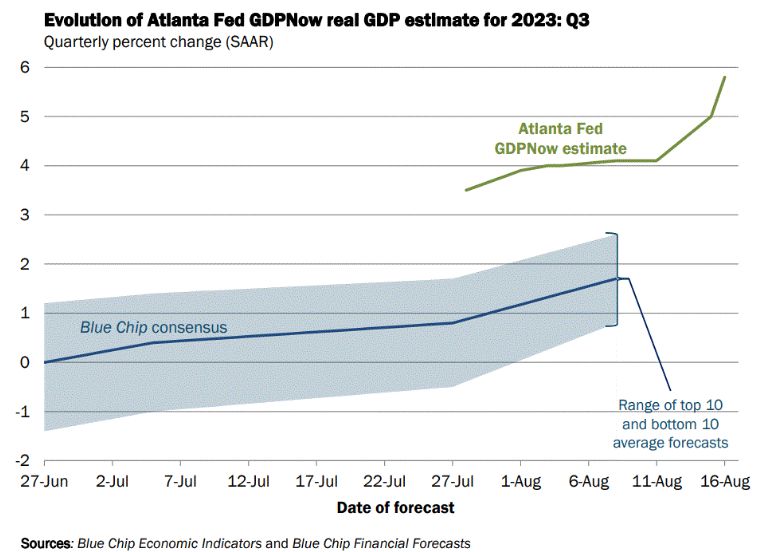

Ahead of Jackson Hole this week, Atlanta Fed GDP Now for US real GDP in 3Q is at 5.8%...

Way ahead of Street consensus and with a clear acceleration since early August...

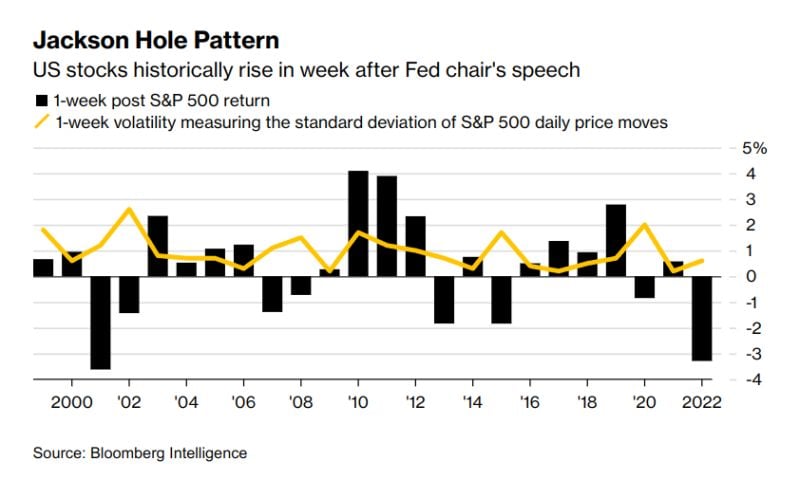

More often than not, stocks rise the week after Jackson Hole Will this year follow the pattern, or will it be one of the outlier years with a sell-off?

Source: Markets & Mayhem, Bloomberg

China’s central bank issues Sunday statement

They said that on Friday, China’s central bank and financial regulators met with bank executives and told lenders again to boost loans to support a recovery, adding to signs of heightened concern from policymakers about the deteriorating economic outlook. Authorities also urged for adjustments and an optimization of policies for home mortgages at the meeting on Friday, according to a statement from the People’s Bank of China on Sunday, without elaborating on the housing initiatives. China is expected to make the biggest cuts this year to two of its core lending rates as pressure mounts on policymakers and banks to reverse slowing momentum and revive flagging demand in the world’s second-biggest economy.

Investing with intelligence

Our latest research, commentary and market outlooks