Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

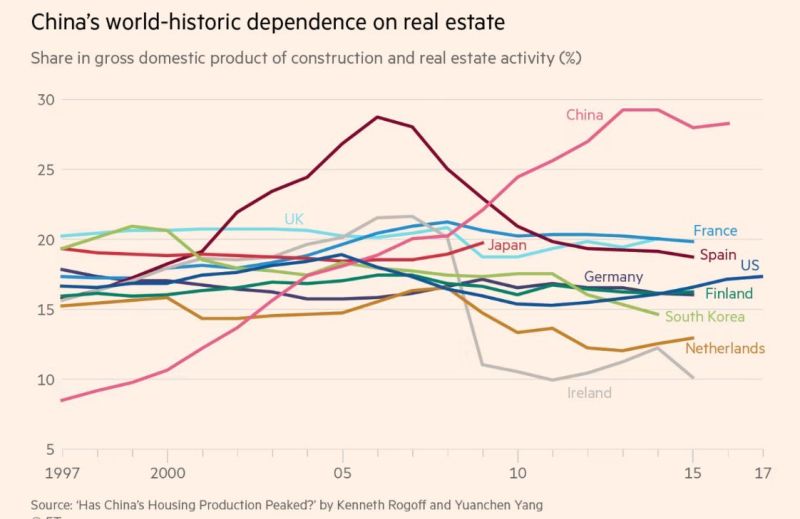

China is more dependent on real estate than any other country

Almost 30% of Chinese GDP dependent on #realestate combined with 50 million vacant apartments is a dangerous mix. Source: FT

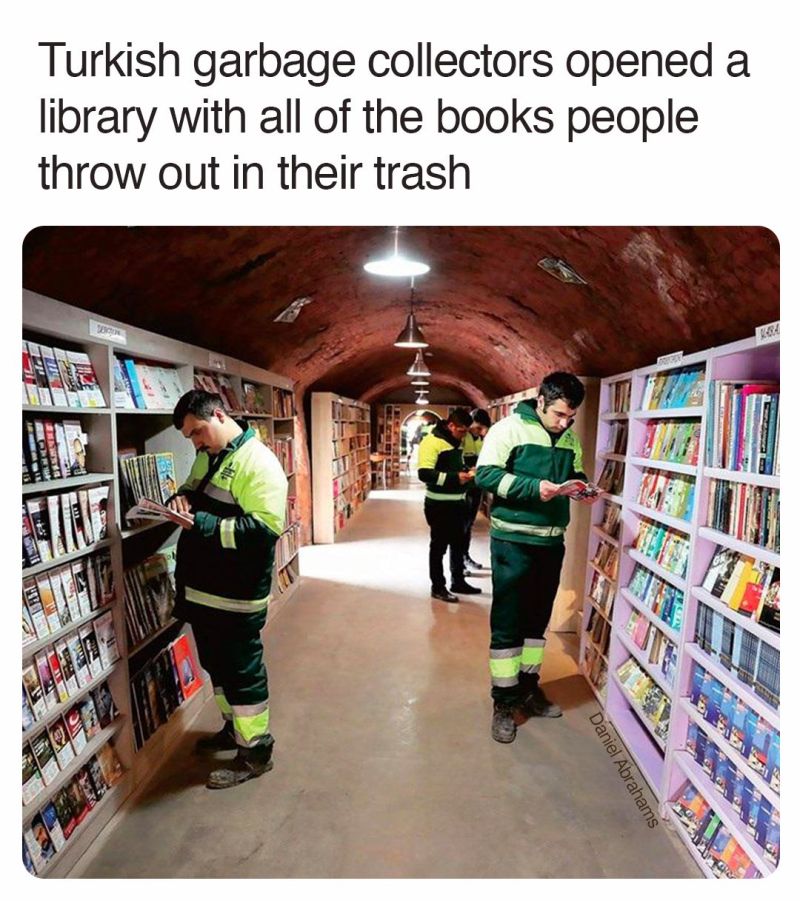

A public library made up entirely of books once destined for landfill. 🙌🏼

Source: Daniel Abrahams

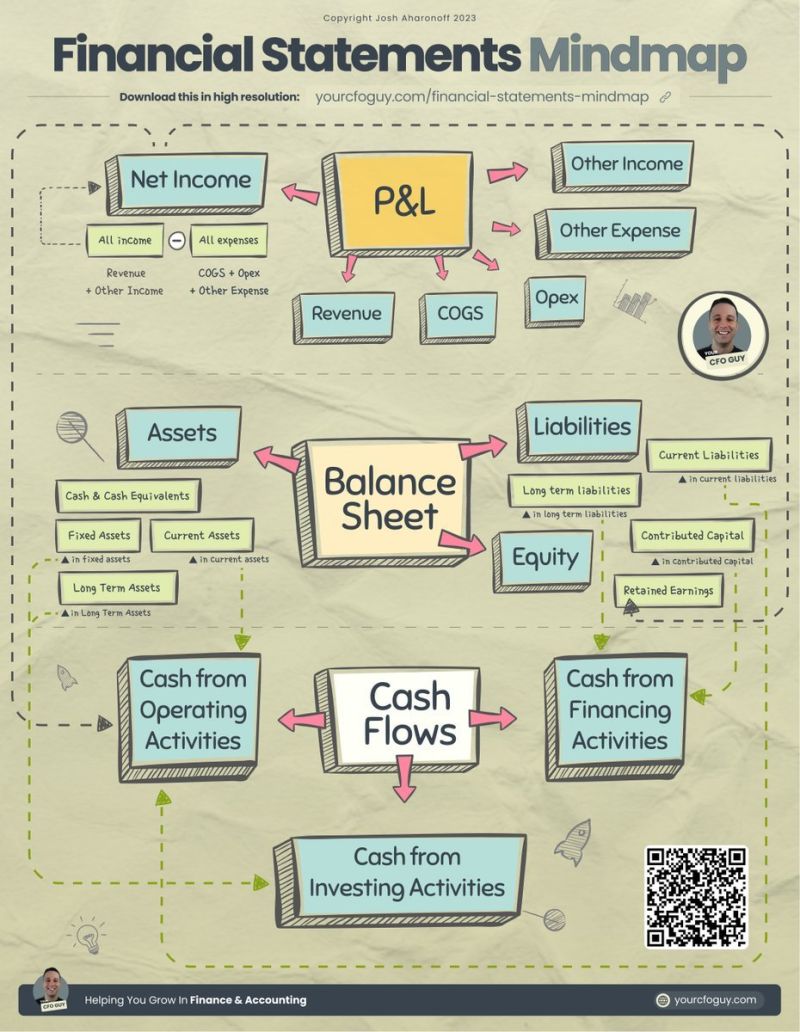

How all 3 Financial Statements Connect

by Josh YourCFOGuy

What were hedge funds buying in Q2?

(source: App Economy Insights) Here are some findings when diving into 13F: 🤖 AI models ⚙️ Semiconductors 🎤 A bit of Taylor Swift 💊 And... weight-loss drugs?!

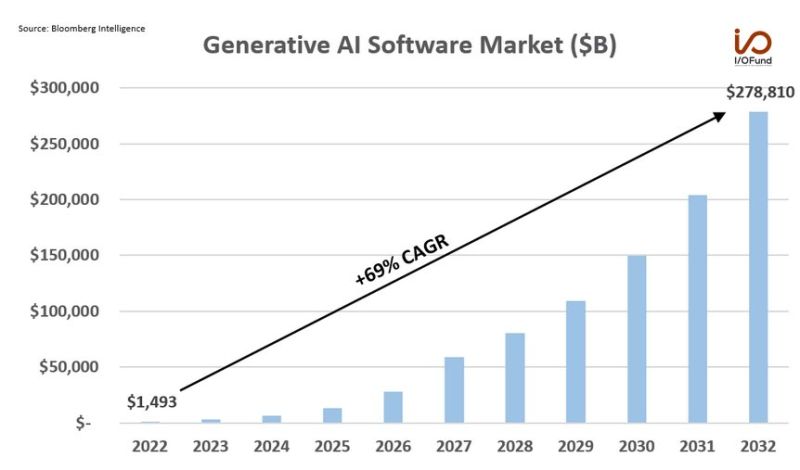

The generative AI software market is forecast to rapidly grow from $1.5B in 2022 to nearly $280B in 2032

Representing a 69% CAGR – driven by AI assistants and workload infrastructure software, which could contribute $160B combined. Source: Bloomberg, Beth Kindig Potential winners? $META $ADBE $NVDA $MSFT (not an investment recommendation)

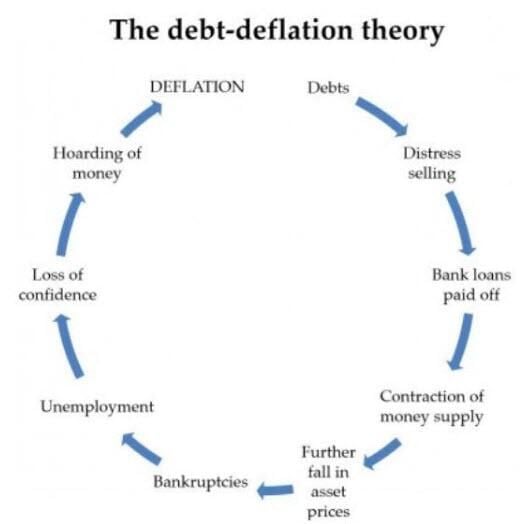

In 2009 China sparked global reflation. In 2023, could China to spark global deflation?

Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks