Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

At least a positive (contrarian) news

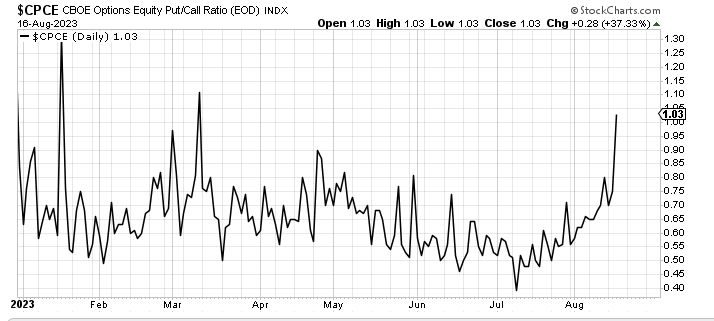

The SPX Put to call ratio is at its highest since the SVB banking crisis. In a short term view, the 'PUT BUS' is getting crowded and a crowded trade is usually not a good trade. Source: JC Investment

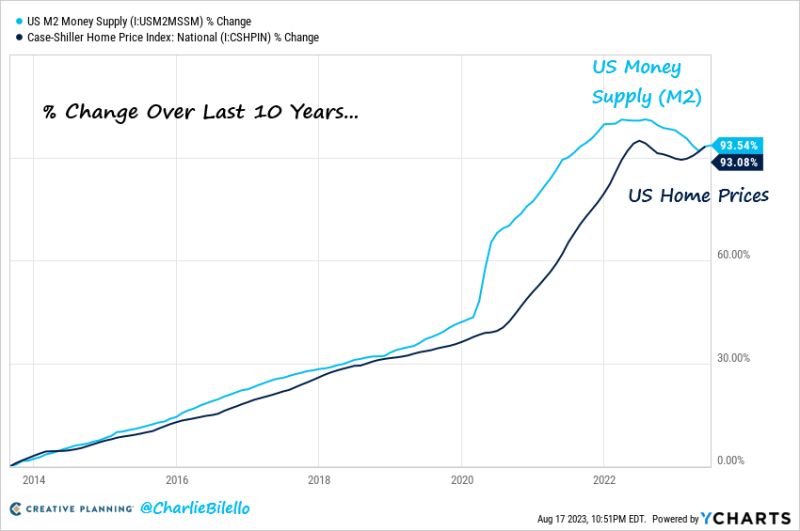

"inflation is always and everywhere a monetary phenomenon." - Milton Friedman

Source: Charlie Bilello

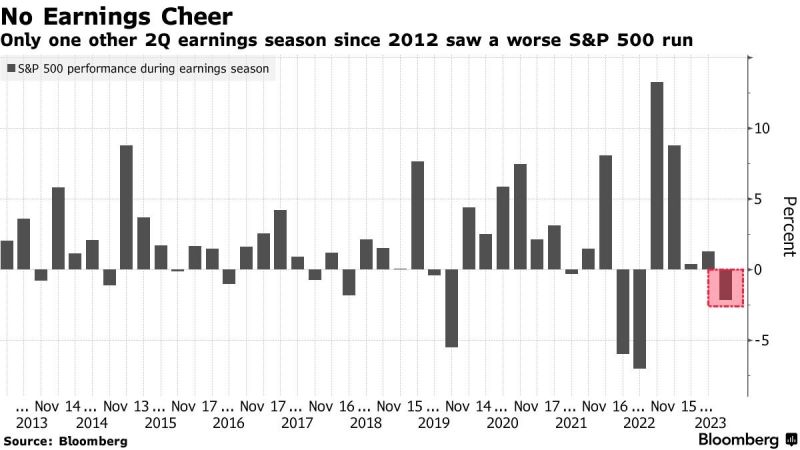

More than 80% of SP500 companies that have reported so far have beaten profit expectations but the returns are setting this up to be one of the worst earnings seasons over the last 11 years

Source: Bloomberg

The fact that Chinese State property developers are also in big troubles complicates the issue for the China real estate

Mainly, as it reduces their ability to support the sector by taking over incomplete projects by private sector. Source: Bloomberg

PepsiCo testing major trend support

PepsiCo (PEP US) is testing a major support zone. February 2021 uptrend has been tested 5 times successfully. Will it be able to hold once again ? Keep an eye at zone 176-178. Source : Bloomberg

Idexx Laboratories back on breakout levels

Idexx Laboratories (IDXX US) is testing July breakout level after a 14% consolidation since the highs. Source : Bloomberg

Zurich Insurance triangle pattern

Zurich Insurance (ZURN SW) is reaching the lower end of the triangle pattern. This continuation pattern is forming since more than 70 weeks ! Will it rebound once again ? Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks