Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Technology

- Commodities

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

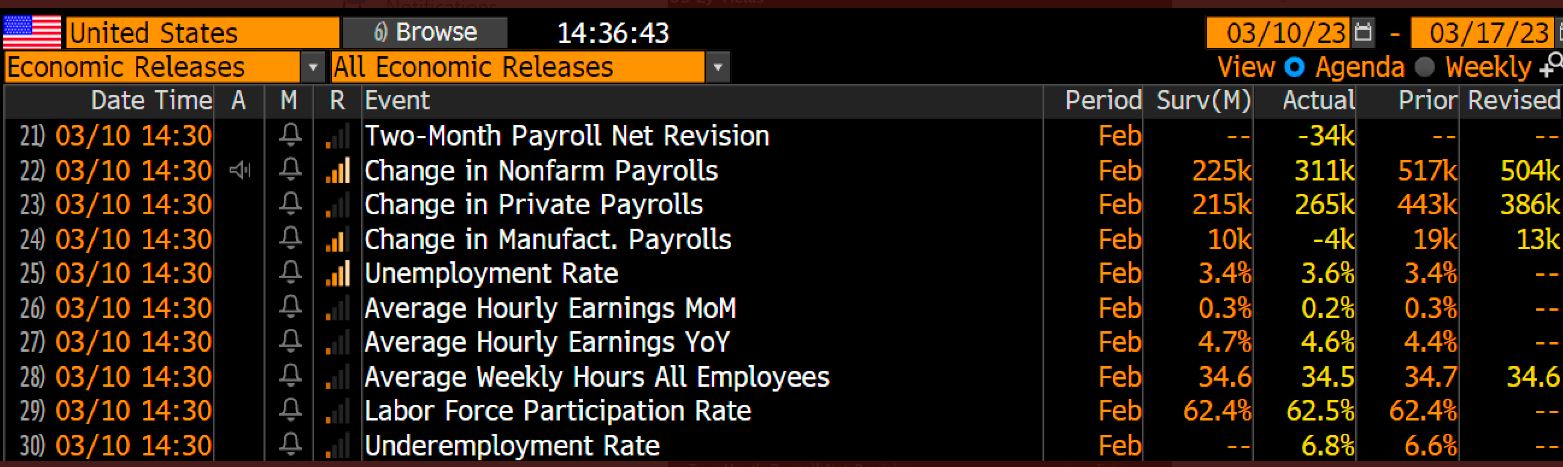

Unemployment rate increased to 3.6%, above expectations

February US jobs data was mixed. US economy created 311k new jobs in February, above forecast of 225k but household numbers below forecasts with unemployment rate rises to 3.6% above 3.4% expected AND wages cool. Monthly wages rose 0.2% vs 0.3% expected.

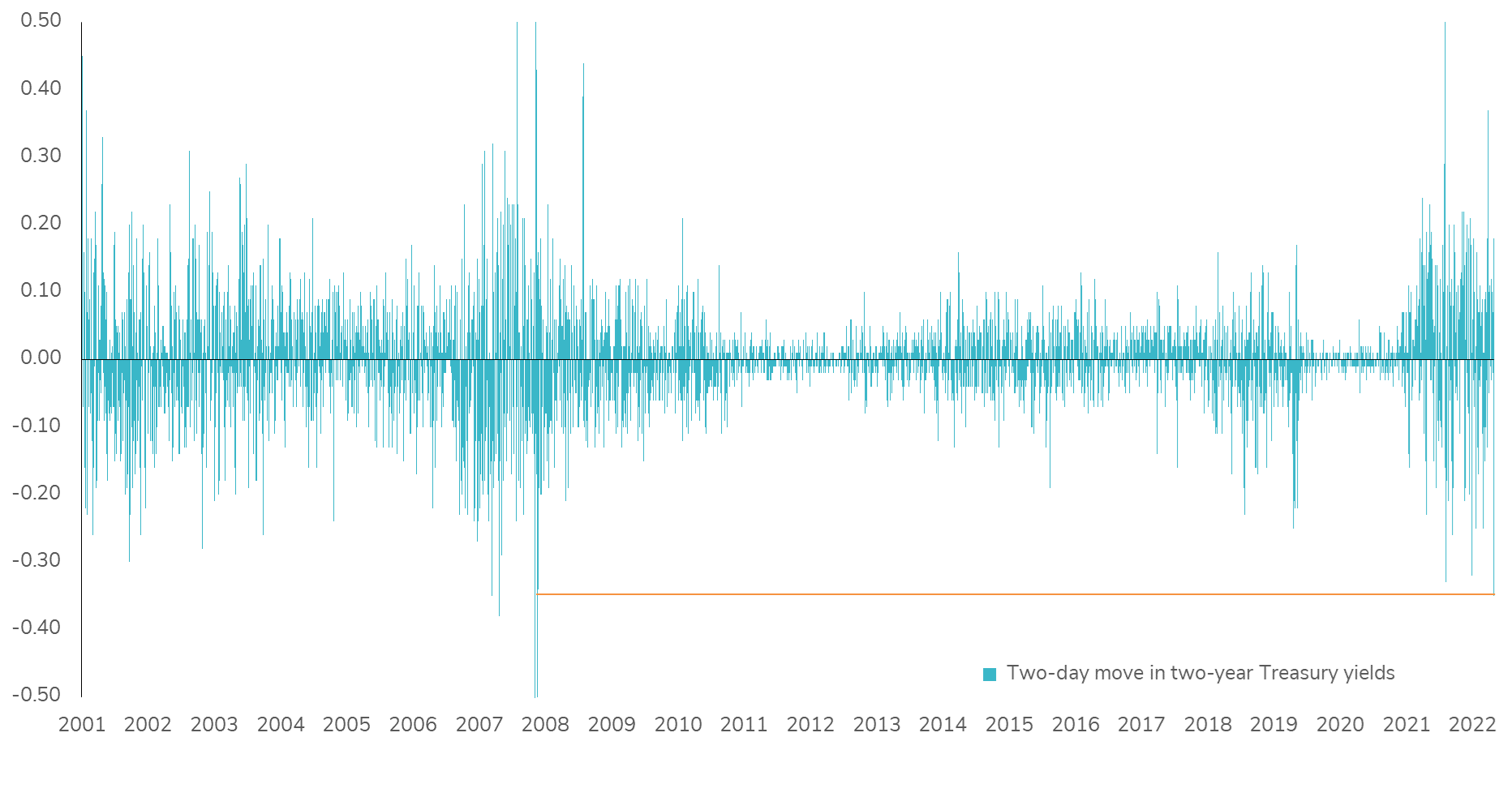

Biggest two-day drop since 2008 for the 2-year US Treasury yield!

What a week for the Treasury market! Following the SVB story and the U.S. jobs report, the U.S. yield curve rallied sharply, with the front end leading the way. Indeed, the 2-year US Treasury yield has dropped nearly 50 bps (!) in two days. The reversal is significant => the market has now priced in an interest rate cut by year-end and is unlikely to get a 50 bps increase at the next FOMC meeting. The fear of a recession back on the agenda? Source: Bloomberg

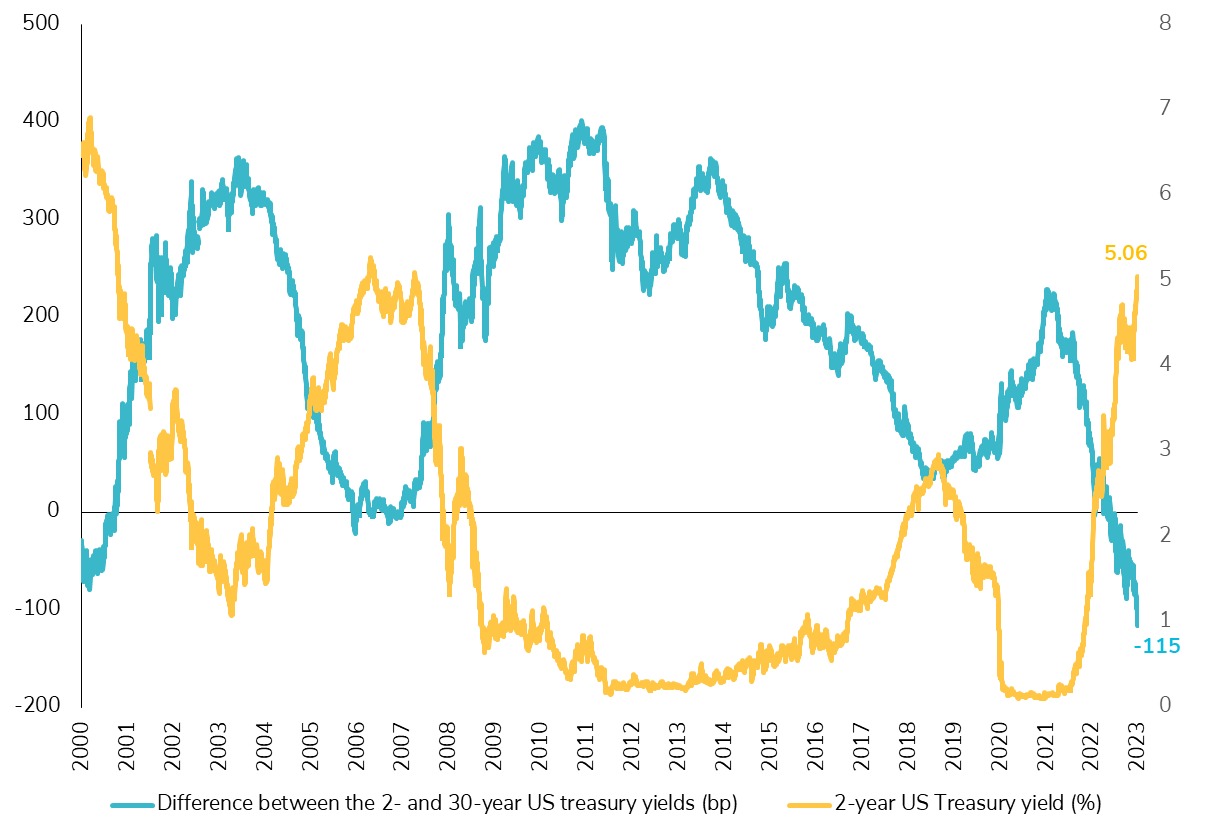

Fed Chairman Powell has tipped the US yield curve into an unknown zone!

Fed Chairman Powell shifted the U.S. Treasury yield curve into its steepest inversion ever after his hawkish remarks to Congress. He deliberately opened the door to a higher terminal rate and a 50 basis point increase at the March FOMC meeting! The market reaction was quite brutal, with the 2-year U.S. Treasury yield rising above 5% for the first time since 2007, while the spread between the 2-year and 30-year yields reached -115 basis points for the first time ever. It will be interesting to see if Powell confirms today his comments from yesterday before the House Financial Services Committee. Source: Bloomberg

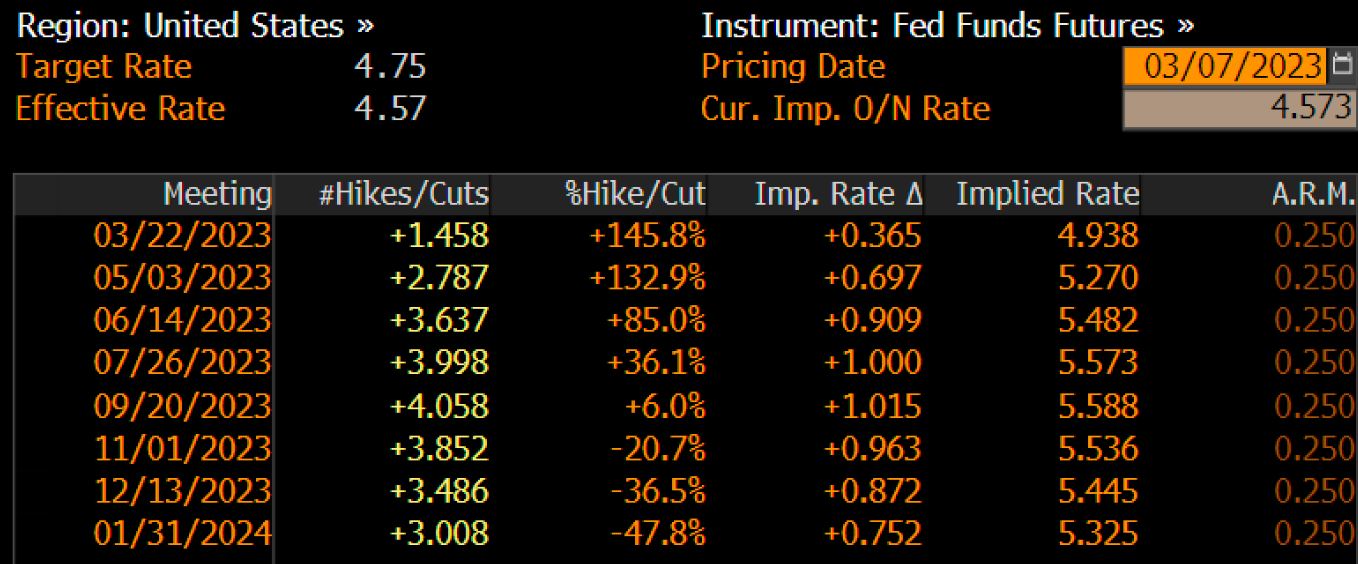

Traders see half-point Fed hike in March as more likely scenario after hawkish Powell

Fed Terminal rate now at 5.6% - via Bloomberg and HolgerZ

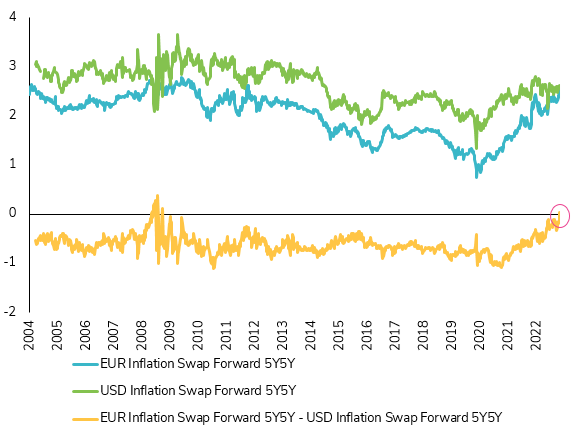

Another indicator shows that inflation is expected to be higher in EUR than in US in the medium term!

The 5y 5y forward inflation swap, an indicator of what the market expects inflation to be over the next decade, is rising faster in Europe than in the United States. In fact, markets seem to expect more inflationary pressure in Europe than in the U.S. over the medium term. This is quite significant because the last time this gap between inflation expectations in Europe and the US was in positive territory was in 2009! So more pressure on the ECB to continue tightening monetary policy! Source: Bloomberg

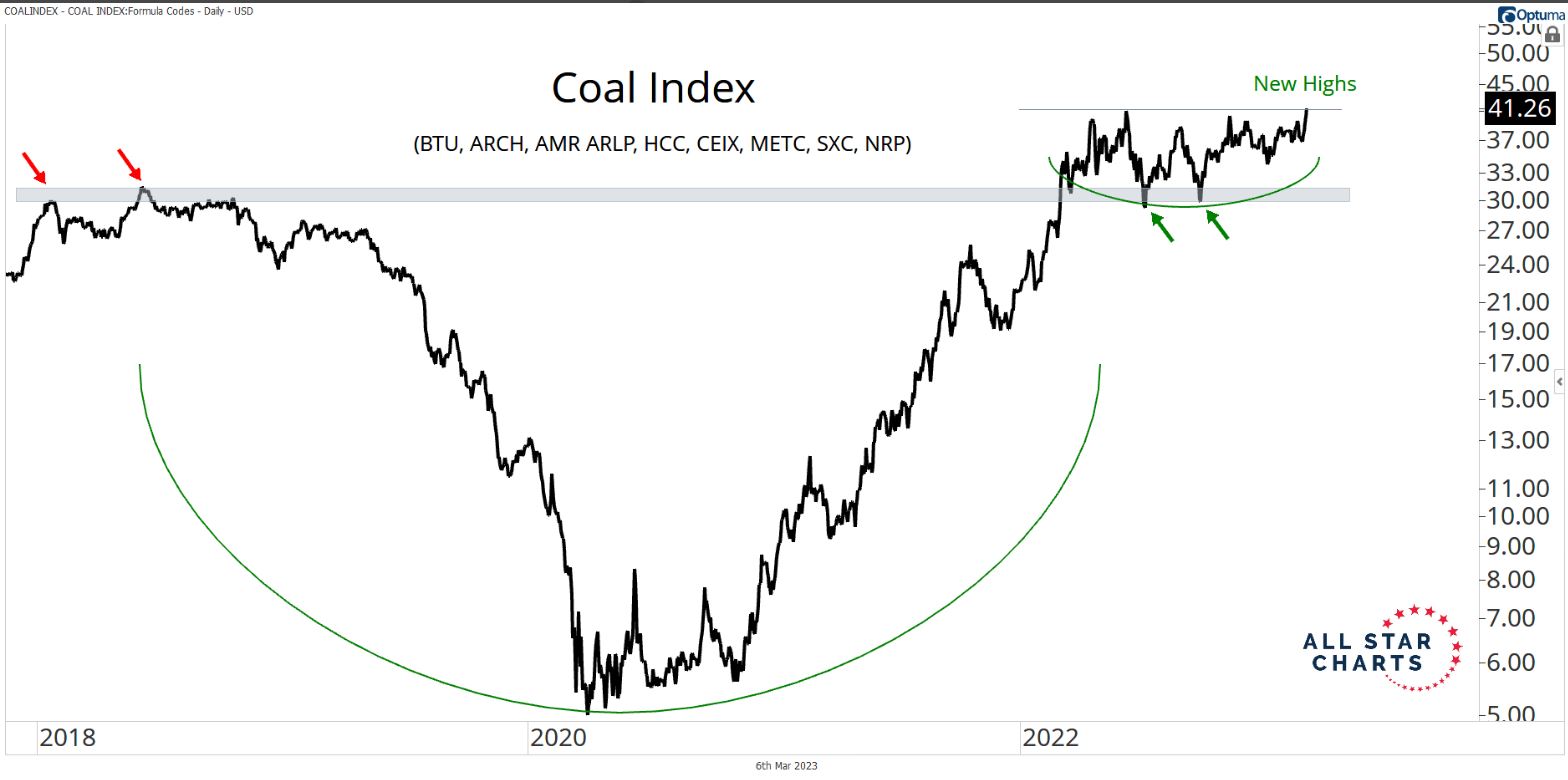

Coal stocks pressing to new multi-year highs

Not really the market action which was expected... In the face of limited energy supply, coal stocks are booming to a surge in coal demand. Source: Steven Strazza, All Start Charts

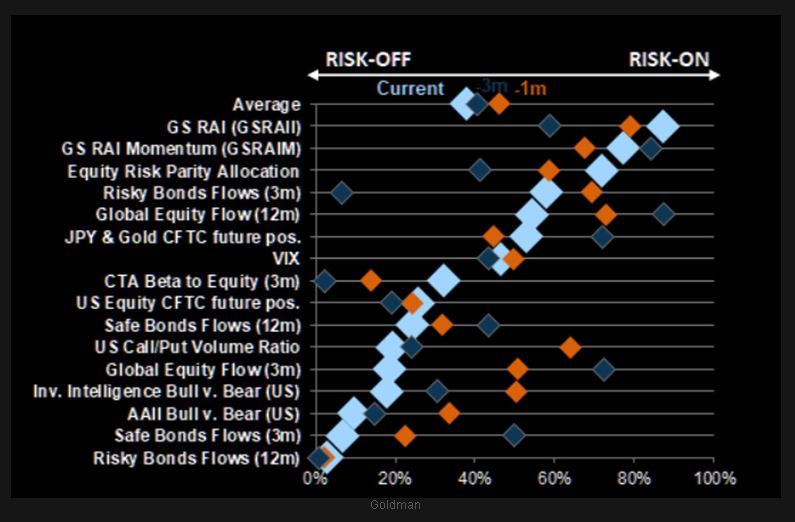

Climbing the wall of worry: US equities sentiment remains bearish

According to Goldman's average percentile of 16 sentiment & positioning indicators, sentiment today is more bearish than it was 1 month ago and 3 months ago. Peculiar. Climb the wall of worry.

Investing with intelligence

Our latest research, commentary and market outlooks