Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

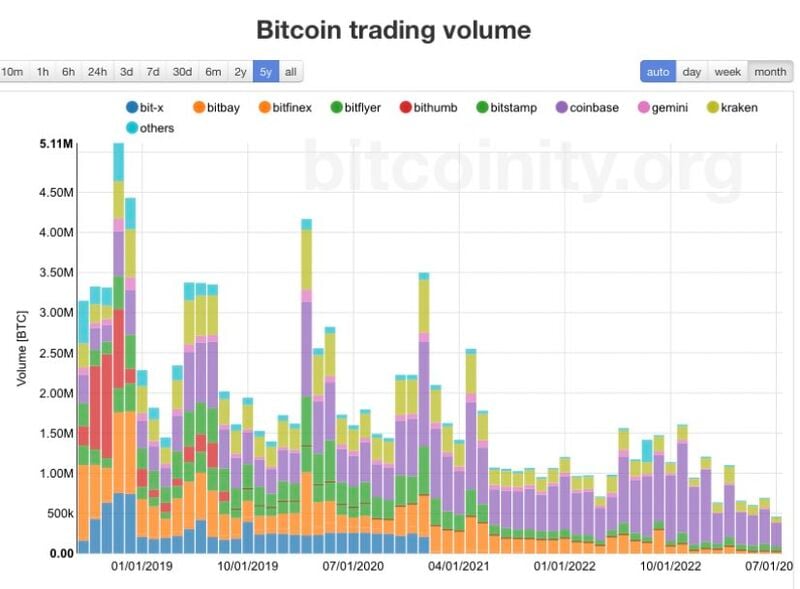

Bitcoin approaching support 28’000

Bitcoin (XBTUSD) is approaching December 2022 uptrend support at 28’000. Keep an eye. Source : Bloomberg

Dassault Systemes at a very interesting level

Dassault Systemes (DSY FP) is back on a very interesting level. After May breakout and a 3 months consolidation (13% down since June high), stock is testing October uptrend support. Keep an eye at this zone 35.75-36.25. Source : Bloomberg

Gold breaking double support

Gold (XAU) is breaking June support 1907 and 200 days Moving Average at 1905. Next support levels are 1856 (minor) and 1807 (major). Source : Bloomberg

As highlighted by Caleb Franzen, the relative chart of SP500 / M2 money supply is trading at the exact same level as July 2007

This range also coincided with market peaks in: • Feb.'20 • Q4'21 While the S&P 500 itself has gained +181% in the past 16 years, $SPX/M2 has made no progress. Should this be seen as a logical resistance zone?

10-Year Treasury Yield is now 4.28%, the highest level since October 2007

From a total return perspective, the 10-Year Treasury Bond is now down 1% in 2023, on pace for its third consecutive negative year. With data going back to 1928, that's never happened before. Source: Charlie Bilello

Saudi Arabia reduced its US treasury holdings by $3.2 Billion in June to the lowest level in nearly 7 years.

Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks