Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

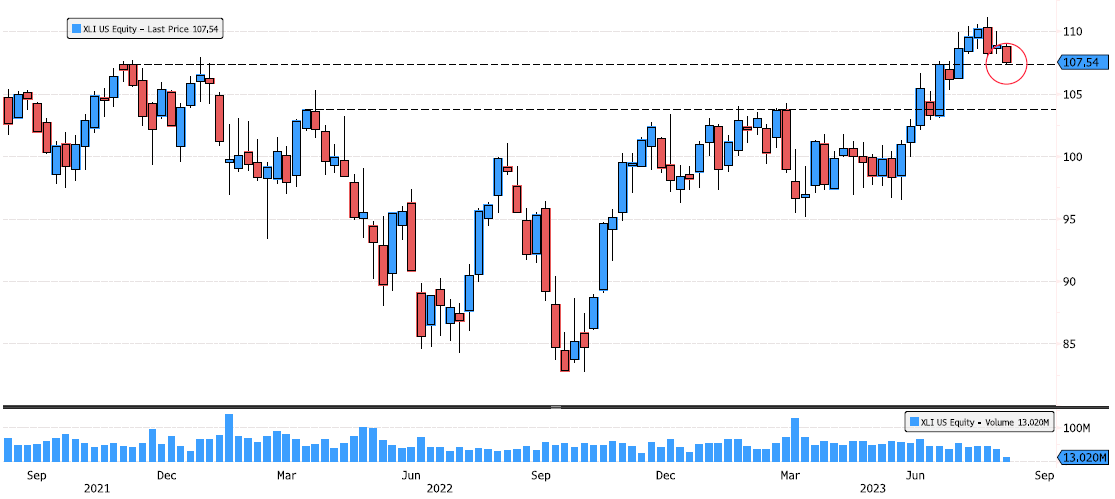

Industrial Sector retesting recent breakout

Industrial Sector (XLI US) is retesting July's breakout level. Keep an if it can hold. Next major support level is 103-104 zone. Source : Bloomberg

Coinbase Lands Regulatory Approval to Offer Crypto Futures Trading in US

Coinbase Financial Markets, Inc. announced this Wednesday that it has secured approvals from both the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). That means that the firm can now operate as a Futures Commission Merchant (FCM), and will therefore be able to offer investments in crypto futures to eligible customers in the United States.

Coinbase is now poised to be the pioneer in offering U.S. clients both traditional spot crypto trading and regulated crypto futures.

Source: Decrypt

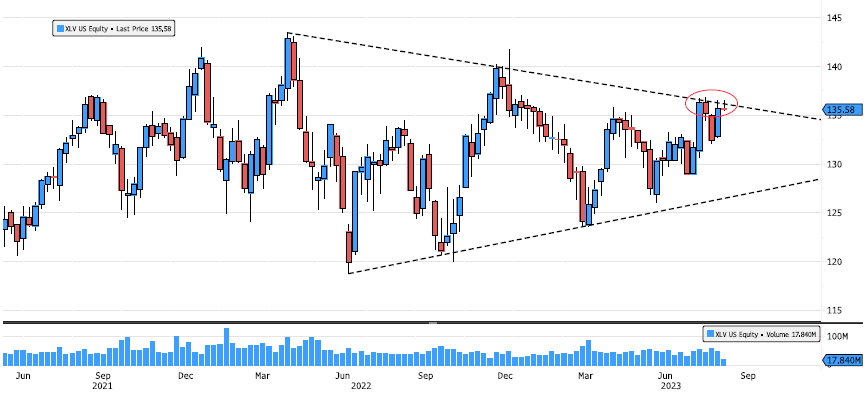

Health Care Sector pennant weekly pattern

Health Care Sector (XLV US) is in a consolidation pennant pattern since April 2022 ! Since 5 weeks, it's trying to breakout on the upside. Keep an eye on this level. Source : Bloomberg

Materials sector retesting important level

Materials sector (XLB US) is retesting April 2022 resistance downtrend level. Keep an eye at this level for breakout confirmation. Source : Bloomberg

European gas spikes on market jitters over LNG strike risk

European natural gas futures spiked for the second time in less than a week, with market tensions running high over the possibility of strikes in Australia that could severely tighten the global market.

Source: Bloomberg

China Shadow Banking Giant Alarms Investors With Missed Payments

One of China’s largest private wealth managers is triggering fresh anxiety about the health of the country’s #shadowbanking industry after missing payments on multiple high-yield products. Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole, indicating troubles at the embattled Chinese shadow bank are deeper than previously known. Wang Qiang, board secretary of the firm partly owned by financial giant Zhongzhi Enterprise Group Co., told investors in a meeting earlier this week that the firm missed payments on a batch of products on Aug. 8, adding to delays on at least 10 others since late July, according to people familiar with the matter. At least 30 products are now overdue and Zhongrong also halted redemptions on some short-term instruments, one of the people said. Source: bloomberg

SMI Index on lower end of trend channel

SMI Index (SMI) is testing the lower end of September 2022 bullish trend channel. Will market have enough strenght to rebound from here ? Next support levels are 10'850 and 10'600. Source : Bloomberg

Watchcharts Rolex and Patek second-hand indices are dropping rapidly, down -11.5% and -16.8% respctively over the last 12 months

This is an interesting smooth time series for global economy as it is independent from manipulation and less prone to day-to-day shift in sentiment. Source: www.watchcharts.com

Investing with intelligence

Our latest research, commentary and market outlooks