Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

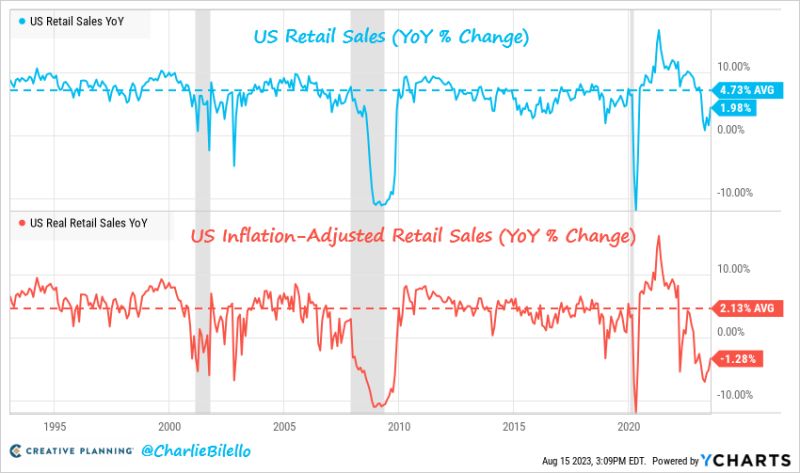

After adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

Hedge funds top 5 holdings Q2 2023

Recurring #themes: Hyperscalers $AMZN $GOOG $MSFT Semiconductor $AMD $NVDA $TSM Consumer tech $AAPL $TSLA Specialty Retail $BBWI $RH Global apps $META $NFLX Payments $MELI $V Source: App Economy Insights

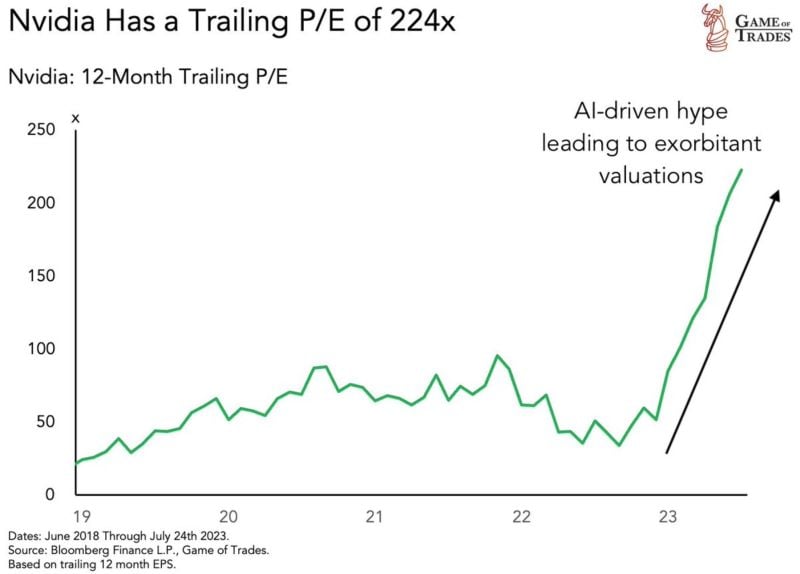

The AI-hype has driven some stocks valuations to extreme levels

The most emblematic one among large-caps is Nvidia with a P/E ratio which went from under 50x to 224x in just 8 months. Source: Game of Trades

US stock market current mood in one picture

Source: Heisenberg - Mr_Derivatives

Michael Burry is an outstanding contrarian investor and did exceptionally well during the 2006-2008 US housing crash

However, performance is not always repeatable and his next bets haven't paid off that well (at least the market views shared publicly - hedge fund long-term performance looks quite strong on a sharper ratio basis). Adam Khoo had a look at all of Michael Burry's recent predictions and he shared it with a chart on X. Here's a summary: In 2005, Predicted the collapse of the subprime mortgage market -> Housing market crashes in 2008, Global Financial Crisis. On Dec 2015, he predicted that the stock market would crash within the next few months. -> SPX +11% Next 12 months. On May 2017, he predicted a global financial meltdown-> SPX +19% Next 12 months. On Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs -> SPX +15% Next 12 months. Source: Adam Khoo Trader

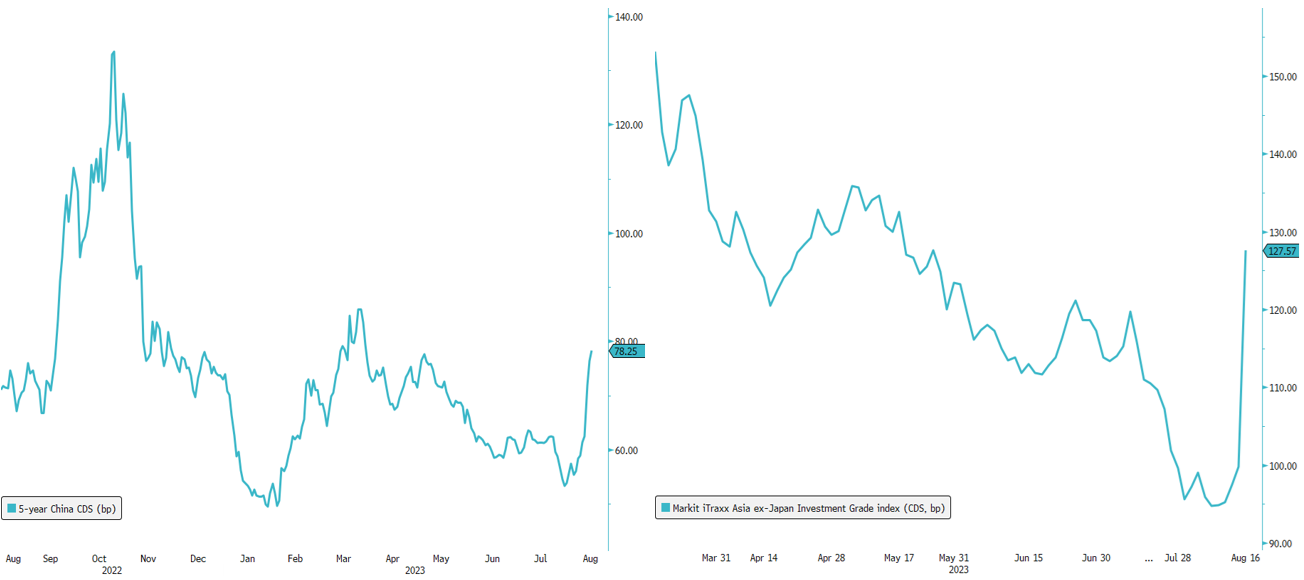

China's credit landscape under stress!

Ever since the shockwaves of the #CountryGarden upheaval, the Chinese credit landscape has been undergoing a seismic shift. The credit default swap (#CDS) market tells a compelling story - #China's 5-year CDS is on a relentless rise (+25bps), and the Markit iTraxx Asian ex Japan #InvestmentGrade index is soaring (+30bps). Foreign investors are strategically repositioning, swiftly #divesting their holdings in Chinese #assets, particularly on the domestic front. Can the #PBOC orchestrate the necessary #stimulus maneuvers to put an end to this spiral of uncertainty?

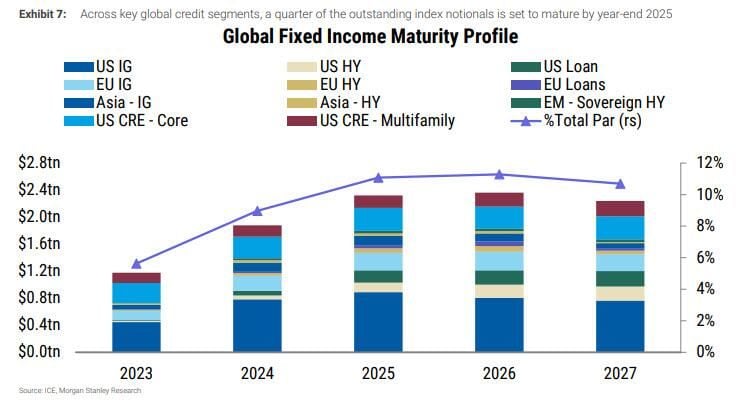

We are approaching quite a formidable global #debt maturity wall...

Source: Markets & Mayhem, Morgan Stanley

Investing with intelligence

Our latest research, commentary and market outlooks