Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

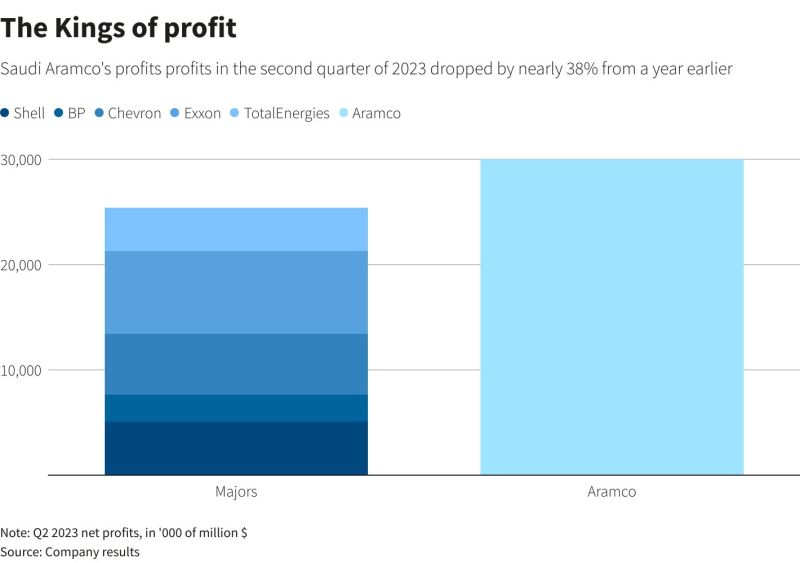

Saudi Aramco 2Q 2023 profit vs. profits of the Majors

Source: company results

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year

Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. Source: Bloomberg, Lisa Abramowiz

Unicredit under pressure

Unicredit (UCG IM) is under pressure. Keep an eye on next support level 20.69 ! If it can't hold that level, the next majort support zone to look at will be 19.60-20.00. Source : Bloomberg

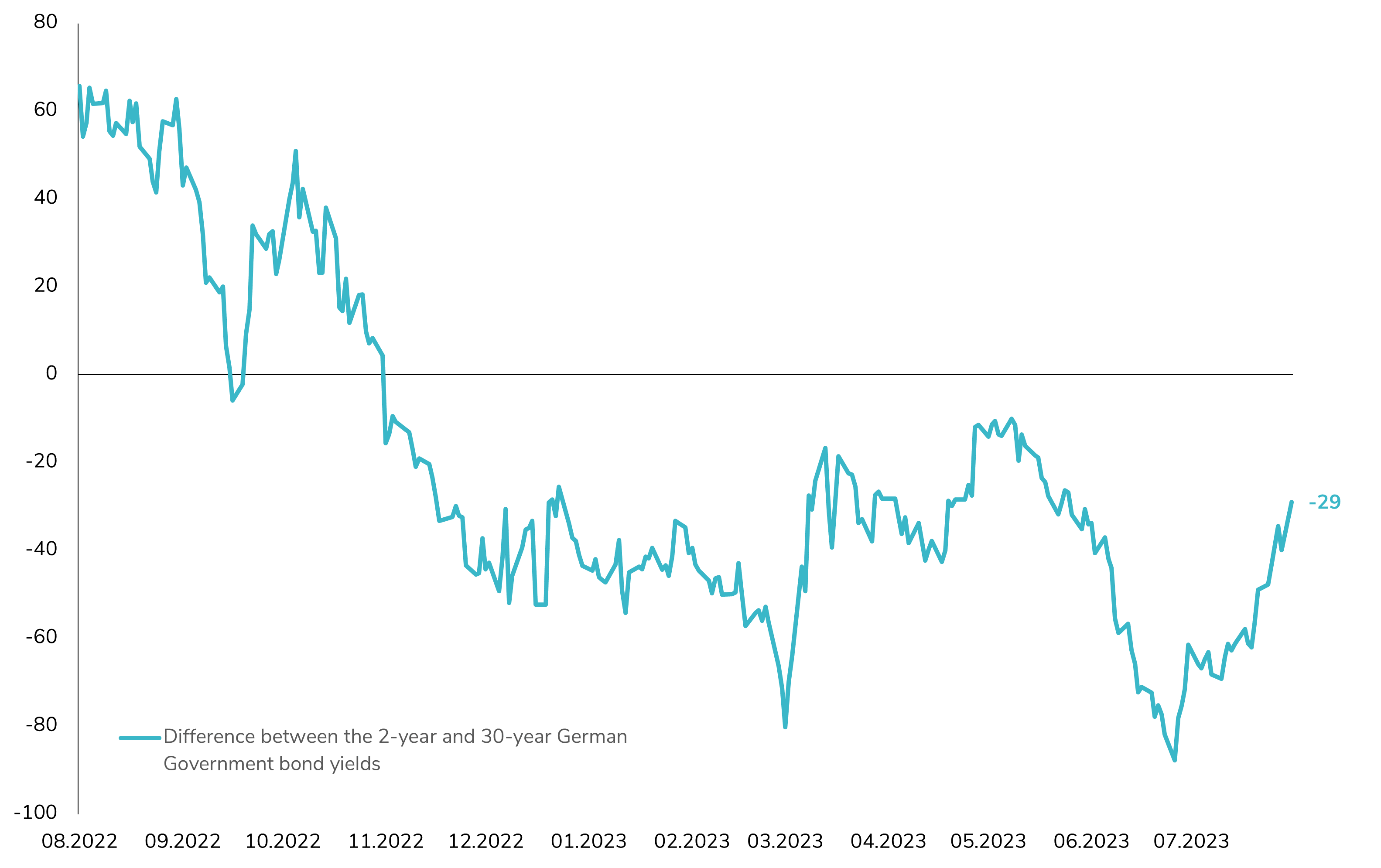

Why is the German Yield Curve Sharply Steepening?

The German yield curve has experienced an impressive steepening of almost 60bps in just one month! This significant movement can be attributed to several key factors that are driving the shift: Fundamentals and Economic Outlook: One of the primary drivers behind this steepening is the market's reassessment of the potential avoidance of a recession. There's a positive repricing of economic fundamentals, suggesting improved prospects for growth and stability. Additionally, there's growing concern about structural inflation running higher than initially expected. Notably, the German 5-year breakeven rate has surged to 2.63%, reaching its highest level since 2009, which has translated into higher long-term yields. Front-End Yield Curve Repricing: The recent decisions made by the European Central Bank (ECB) have also played a role in the steepening. Firstly, the ECB chose to no longer remunerate the bank's minimum reserve held at the central bank. Additionally, today's surprise decision by the Bundesbank's Executive Board further impacted the market. The decision was to remunerate domestic government deposits held with the Bundesbank at 0%, starting from 1 October 2023. Both of these developments could potentially increase demand for German short-term papers. Source: Bloomberg.

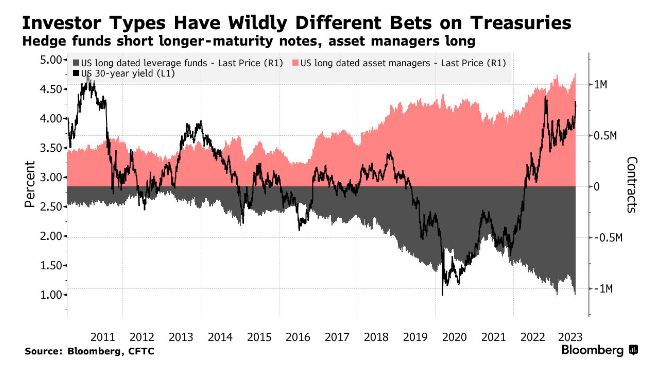

One asset class - two different bets => hedge funds are shorting US treasuries at historic levels while asset managers are doing the exact opposite 👀

Source: Barchart, Bloomberg

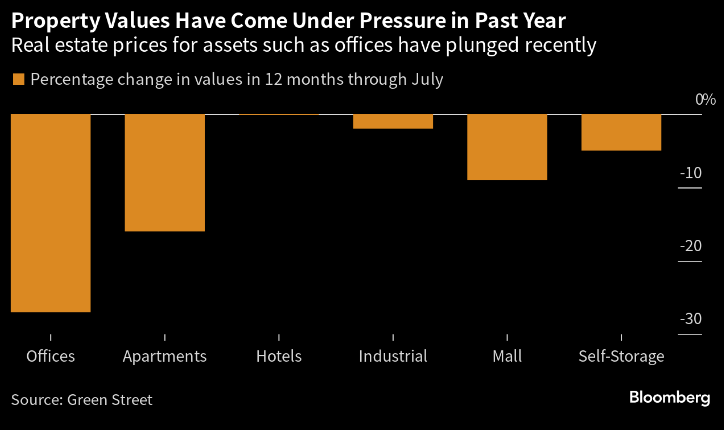

US Property loans are so unappealing that banks want to dump them

Lenders including GS and JPM. have been trying to sell debt backed by offices, hotels and even apartments in recent months, but many are finding that tidying up loan books is no easy feat when concerns about commercial real estate have surged.

Maturing loans that will need to be refinanced is a major concern in a high-interest-rates environment. Source: Bloomberg, Green Street

PayPal launches stablecoin tied to the US dollar, issued on Ethereum

PayPal is rolling out a new dollar-backed stablecoin.

The stablecoin, issued by Paxos Trust Co, was detailed in a statement published Monday morning by the American payments giant.

PayPal announced that customers who purchase PayPal USD will be able to transfer the stablecoin between “compatible external wallets” and PayPal. They will also be able to fund purchases with PayPal USD.

The stablecoin will be available starting Monday, and PayPal customers will be able to purchase, send, convert and fund purchases in the “coming weeks.”

The announcement marks the first time that a major US financial company has created a stablecoin. PayPal’s leadership confirmed the existence of the project in early 2022. PayPal began integrating crypto services in early 2021, allowing users to buy, sell and hold major digital assets like bitcoin and ether.

Source: Blockworks

Investing with intelligence

Our latest research, commentary and market outlooks