Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

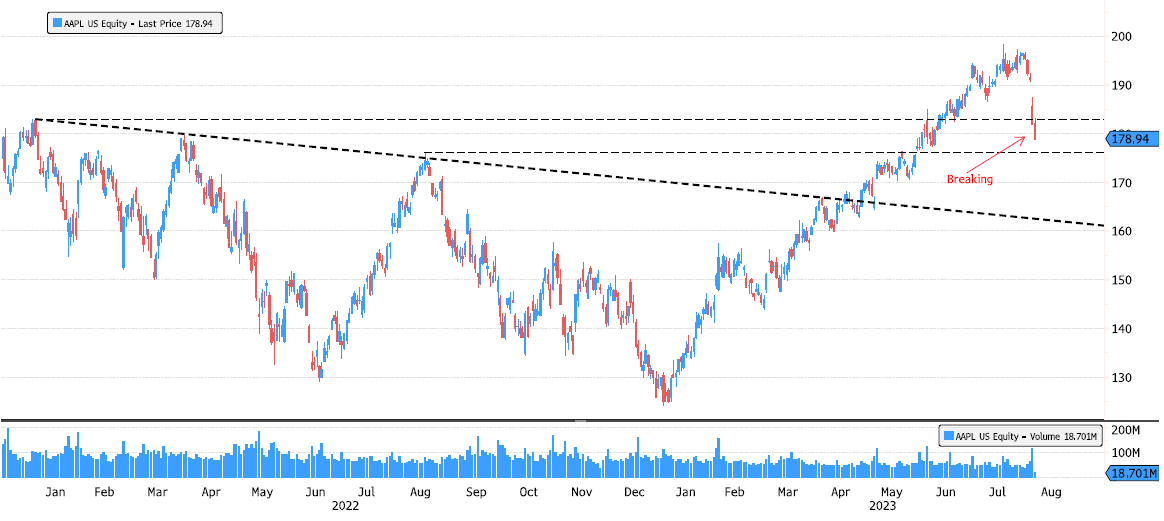

Apple breaking

Apple broke first important support at 183. Next support to keep an eye is 176.15 which was August 2022 high. If that one breaks also, will be looking at 170-160 zone which is a major level. Source Bloomberg

The lagging effects of higher interest rates ?

Yellow Corp. filed for bankruptcy and will remain shuttered after the trucking firm’s long-running financial woes (rising bond & loan payments) were compounded by a dispute with its labor force (wage inflation). The firm closes after nearly 100 years and leaves 30k employees jobless (this will likely be reflected in a lower payroll print for August). Source: Bloomberg

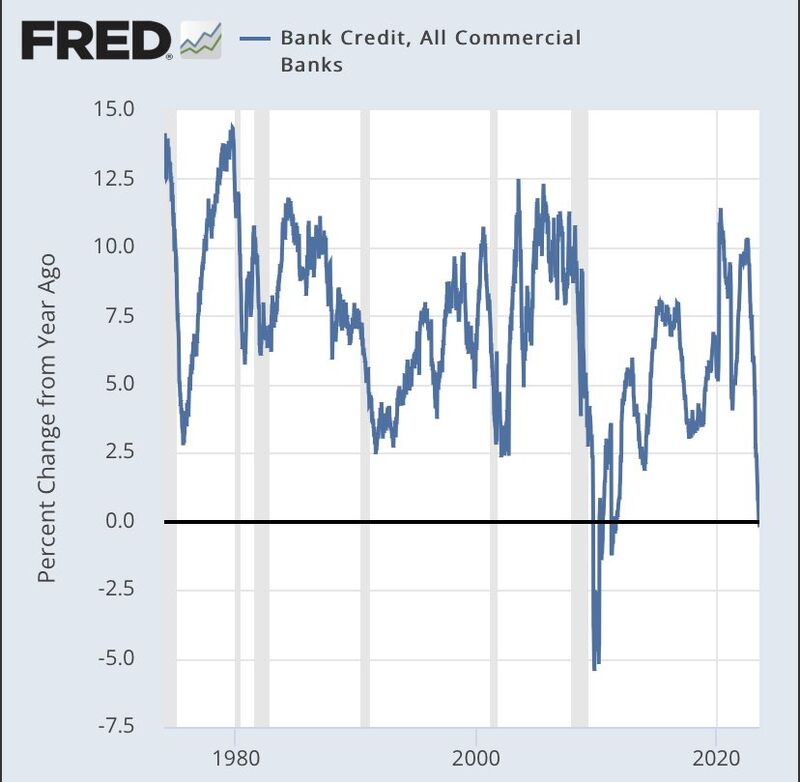

US Bank credit YoY is now -0.2% YoY. First time negative since 08 (Keep in mind that in the US about 25% of credit is securities and the other 75% loans)

Source: FRED, Adem Tumerkan

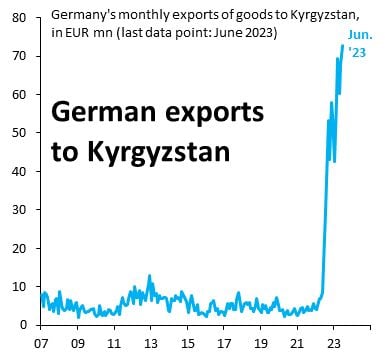

German exports to Kyrgyzstan are up 2000% in the past 3 years

Value of these exports is small, but this is just one of many examples showing how hard it is to police export controls on western goods to Russia. Source: Robin Brooks

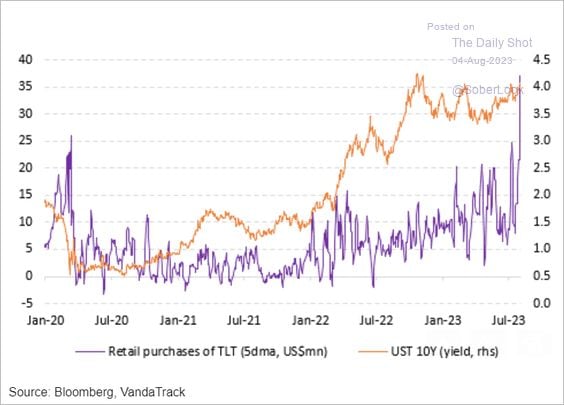

The fact that Retail investors are rapidly buying the iShares 20+Year Treasury Bond ETF (TLT) - despite the bond bloodbath - could mean that the sentiment is far from being oversold

From a contrarian perspective, this is NOT a positive for long-dated bonds. Source: The Daily Shot, Bloomberg, VandaTrack

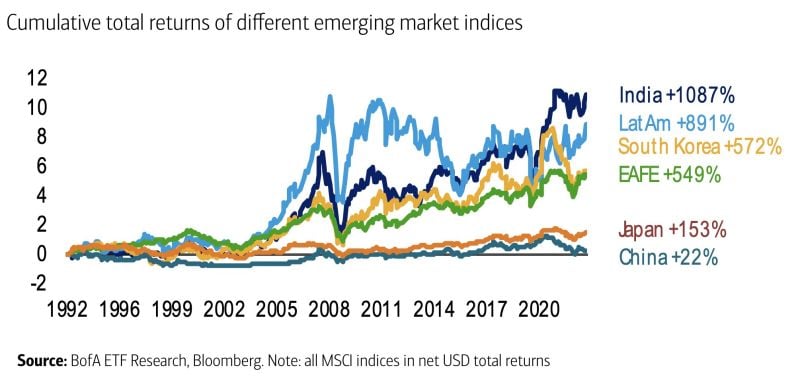

EM returns over past 5-10yrs have been lackluster, w/most EM equities returning low-to-mid single digits

Over longer-term, returns range from extraordinary (India: 1000%) to respectable (Indonesia: 469%) despite volatility & some prolonged periods of choppy trading, BofA has calculated. All EMs have outperformed China's 22% total return. Source: HolgerZ, BofA, Bloomberg

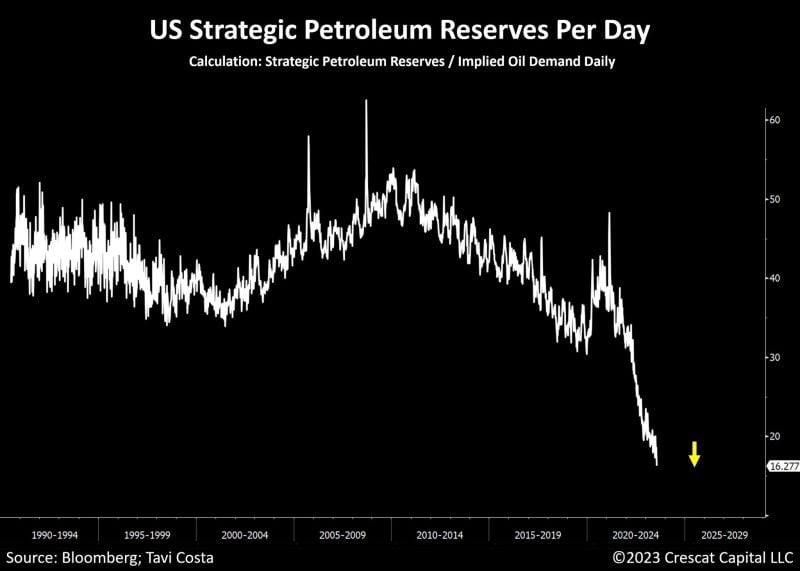

With the recent surge in oil demand, the US government is now left with a petroleum reserve sufficient for only 16 days

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks