Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it -> The Yuan exceeds dollar in China's bilateral trade for first time

The yuan was used in 49% of China's cross-border transactions last quarter, topping the dollar for the first time, a Nikkei analysis shows, mainly due to a more open capital market and more yuan-based trade with #Russia. Nikkei looked at international trade by companies, individuals and investors based on currency, using statistical data from the State Administration of Foreign Exchange of China. Nikkei's compilation does not include yuan-based settlements for trades and capital transactions that do not involve China as a counterparty. Source: Asia Nikkei

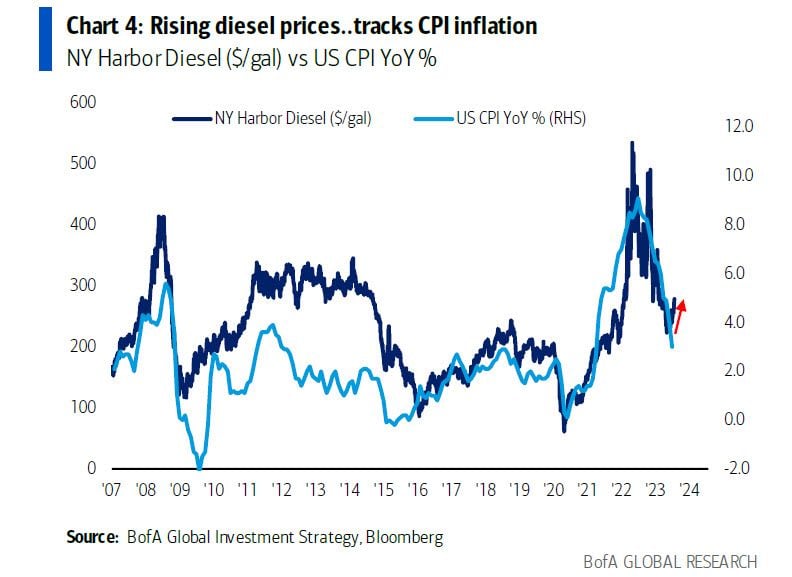

US diesel vs inflation: if history is any guide, recent pop of US diesel prices could imply CPI going back over 4%

Source: BofA

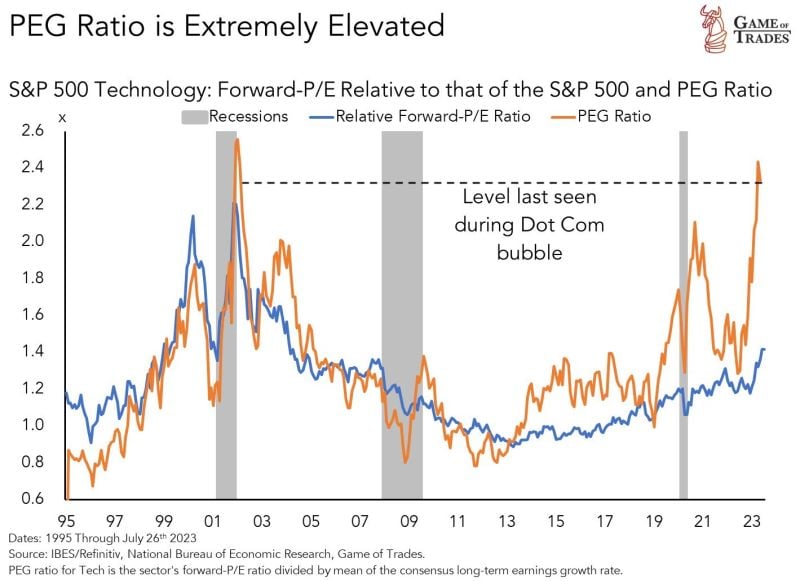

The S&P 500 Technology sector forward P/E to that of the SP500 is not as expensive as it was during the Internet bubble

However, the PEG ratio (forward PE divided by consensus long-term EPS growth rate) is roughly at the same level. Source: Game of Trades

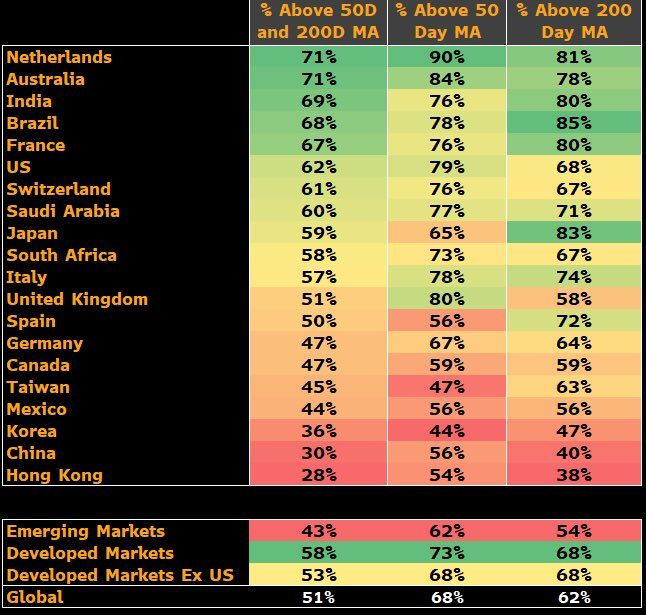

More than half of the major markets in the Bloomberg World Index are now recording positive breadth signals.

Source: Bloomberg, Gina Martin Adams

Another massive us earnings week ahead

Tuesday: $UBER, $AMD, $PINS Wednesday: $PYPL, $SHOP, $U Thursday: $AMZN, $AAPL, $COIN, $SQ, $ABNB, $NET Friday: $FUBO, $NKLA Source: Earnings Whisperers

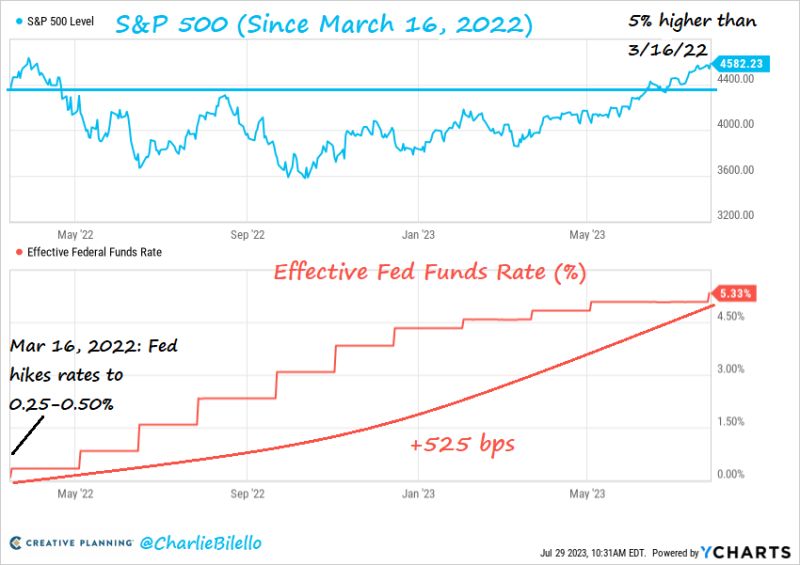

The SP500 is now 5% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

“We keep this picture in the office to remind our people that one should always look for opportunity away from where the crowd is going.” -Bruce Flatt, CEO Brookfield Asset Management

Source: Compounding Quality Chris Quinn

Investing with intelligence

Our latest research, commentary and market outlooks