Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

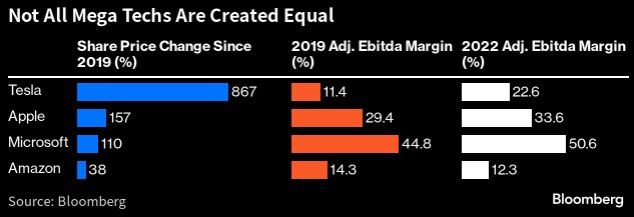

Mega caps often looked at as a monolith but that can be misleading …

Mega caps often looked at as a monolith but that can be misleading … for those below via Bloomberg, share price changes and margins are quite different, while Tech is not sole sector represented (Cons Discretionary and Comm Services are included in “Super 7”). Source: Liz Ann Sonder

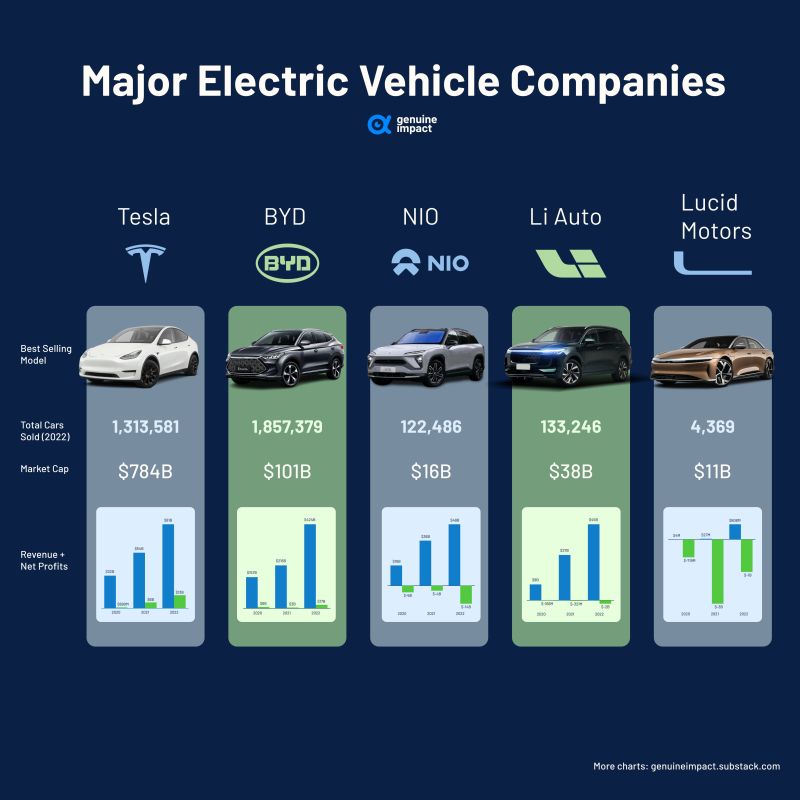

Tesla holds the undisputed leadership position among #electriccar companies based on market capitalization

Tesla holds the undisputed leadership position among electric car companies based on market capitalization. However, this year, BYD has surpassed Tesla to become the world's top-selling EV brand. Source: Genuine Impact

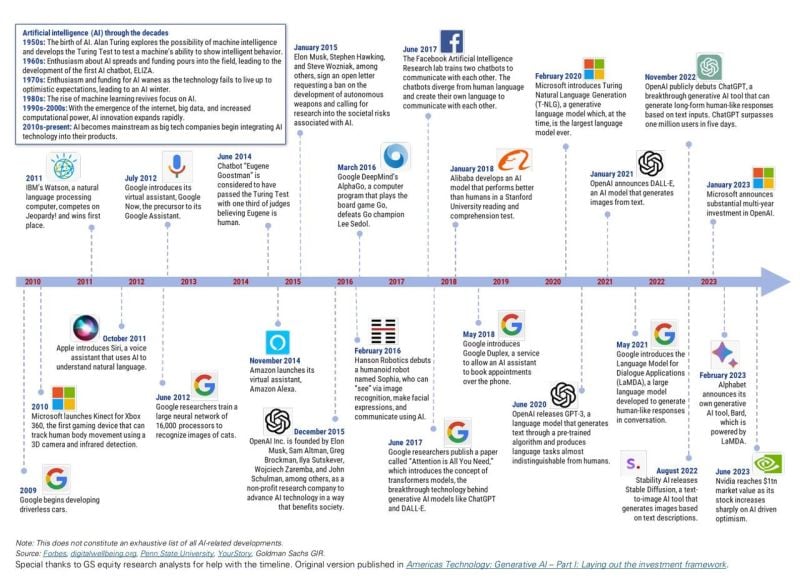

Artificial Intelligence through the decades - how did we get there?

Source: Forbes, Goldman Sachs

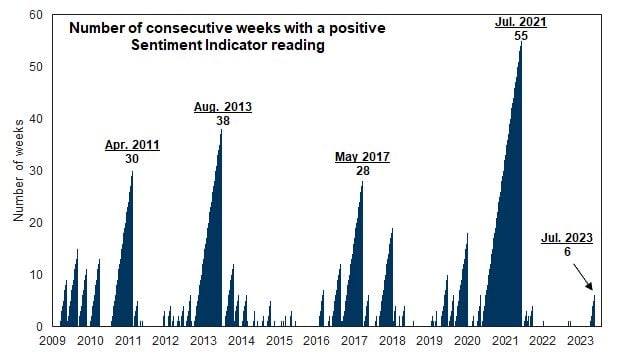

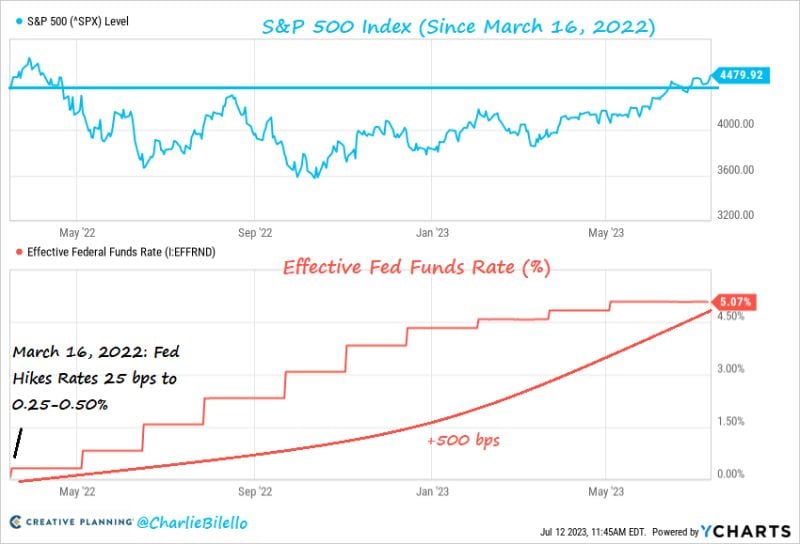

The S&P 500 is now 3% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

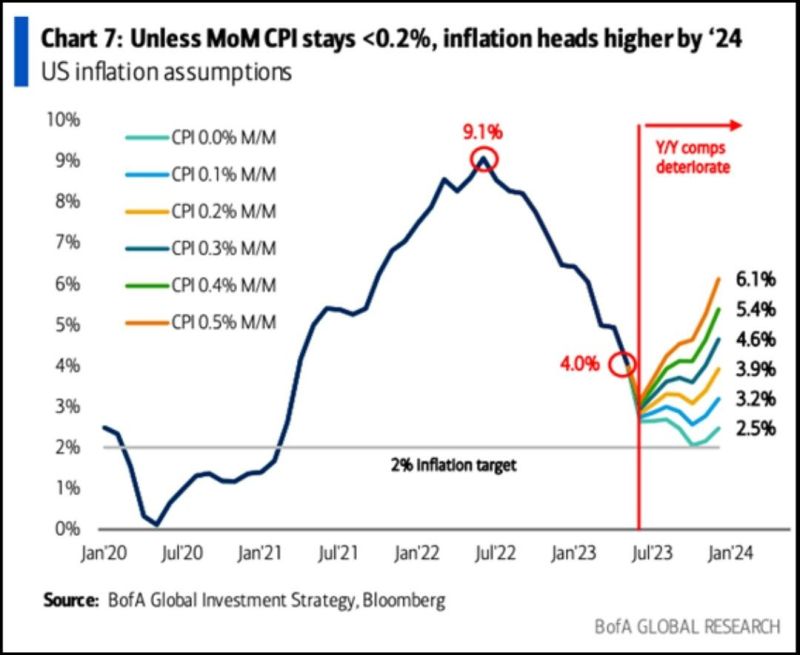

The easy part is over for disinflation as disinflationary base effects are behind us

The easy part is over for disinflation as disinflationary base effects are behind us. The MoM CPI now needs to be lower than 0.2% for #inflation to continue moving lower. Source: BofA

Ethereum activity on the rise as on-chain metrics print fresh highs

The total value of staked ether (ETH) continues apace, reflecting positive signs of growth and stability for the world’s second-largest digital asset. Following Ethereum’s critical PoS upgrade in April, the amount of ETH that has been deposited to the ETH 2.0 contract now stands above 25.6 million. Yield on staked ether is currently around 4.5%, paid in ETH. Participants continue to bank on the value of the Ethereum network, with those holding the underlying becoming more hesitant to relinquish their assets as they anticipate future demand.

Source: Blockworks

Phillips 66 Closed Above its Bollinger Band, Still in Downtrend

Phillips 66 closed above its upper Bollinger band, indicating shares may be overbought. In the past 12 months, the stock has crossed above this level 10 times and fell an average of 5.6% in the next 20 days. Can it break?

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks

%20%20Dai%202023-07-13%2013-03-46.jpg)