Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

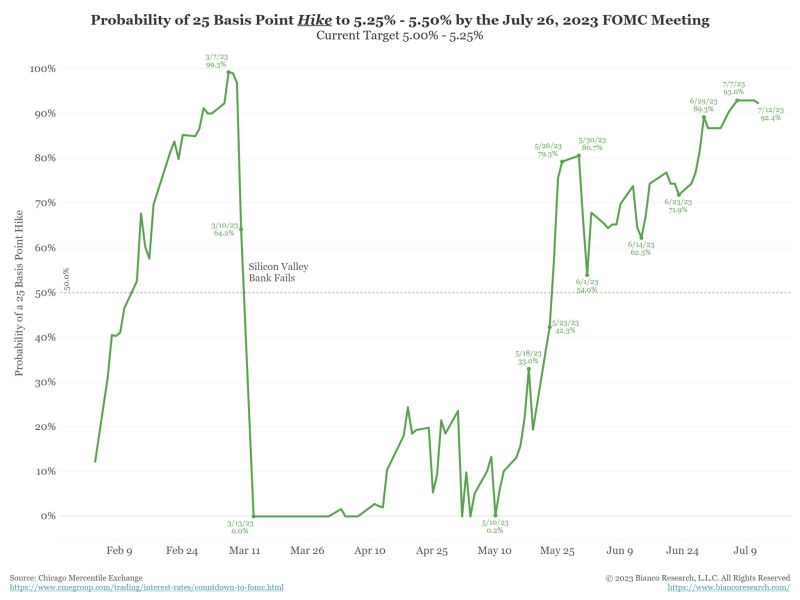

The probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved. The market is strongly expecting a hike in two weeks. Source: Jim Bianco

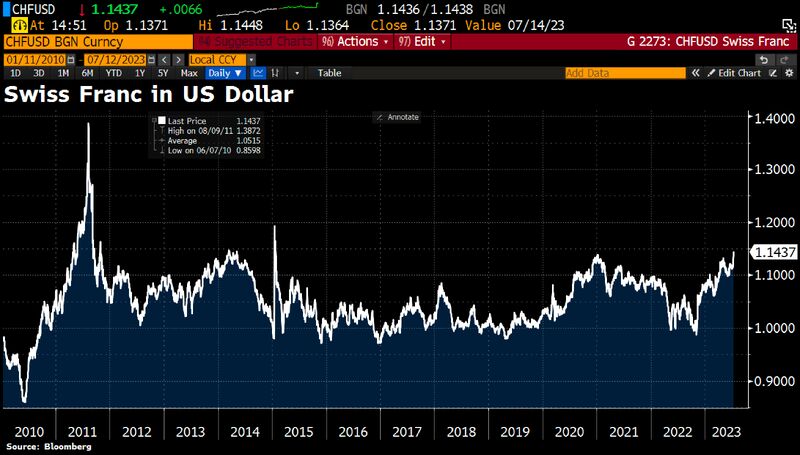

The swissfranc rises to strongest against the dollar since 2015

The swissfranc rises to strongest against the dollar since 2015 after weaker than expected US inflation data. Source: HolgerZ, Bloomberg

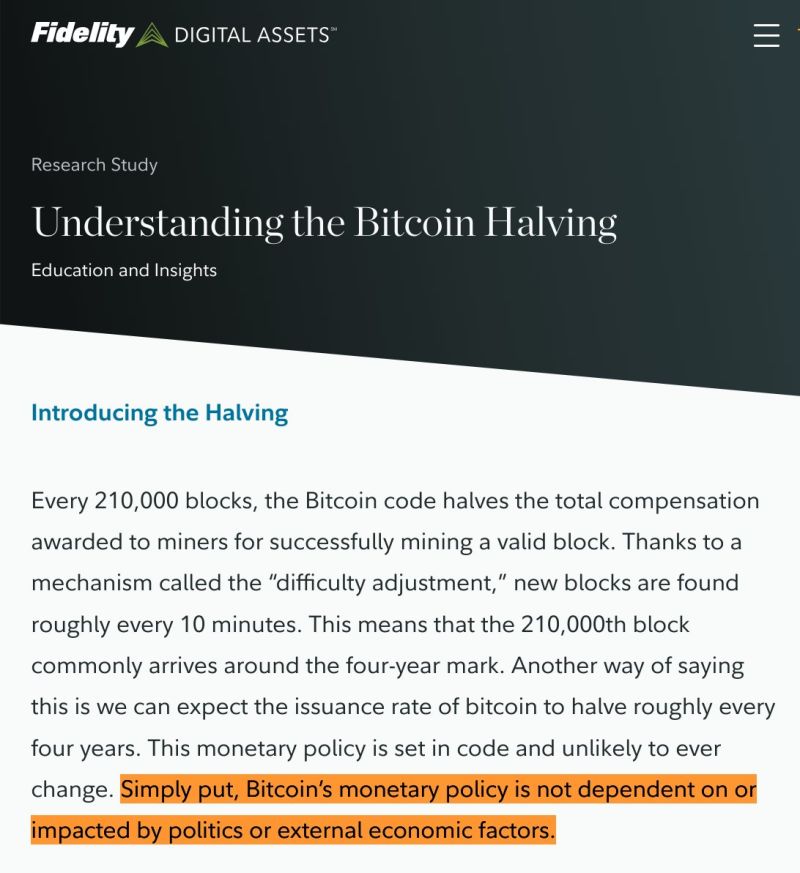

Fidelity's new research about bitcoin

"The monetary policy is set in code and unlikely to ever change. Simply put, Bitcoin's monetary policy is not dependent on or impacted by politics or external economic factors." Source: Documenting bitcoin

More bullish signs on bitcoin.

Bitcoin HODLers remain in a regime of accumulation, continuing to absorb coins at a rate of +27.1K BTC / Month. Only 11.5% of Bitcoin supply left on exchanges, lowest in over 5 years. Source: Glassnode

US inflation eased further in June w/core & headline coming in each at 0.2% MoM (v.s 0.3% expected).

Headline CPI slowed to 3% YoY vs 3.1% expected (and lowest since March 2021), core dropped to 4.8% YoY vs 5% expected. This is the 12th straight month of YoY declines in headline CPI - equaling the longest streak of declines in history (since 1921)... Source chart: Bloomberg

Chinese money trends are improving

M1 and M2 growth 3% and almost 2% on the month. Japan & China are the only places with positive money growth... Source: Andreas Steno Larsen

7 key lessons from the Millionaire's next door

1️⃣ Live below your means 2️⃣ Invest a significant portion of your income 3️⃣ Have a long-term plan 4️⃣ Create passive income 5️⃣ Be frugal 6️⃣ Avoid debt 7️⃣ Invest in yourself (source: Compounding Quality)

Investing with intelligence

Our latest research, commentary and market outlooks