Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️US freight shipments are sliding fast

The Cass Freight Index, a key measure of freight volumes in the US, has fallen to its lowest since the Great Financial Crisis, when excluding 2020. This signals weakening demand for shipping and goods movement, and a slower economy. Source: Global Markets Investor

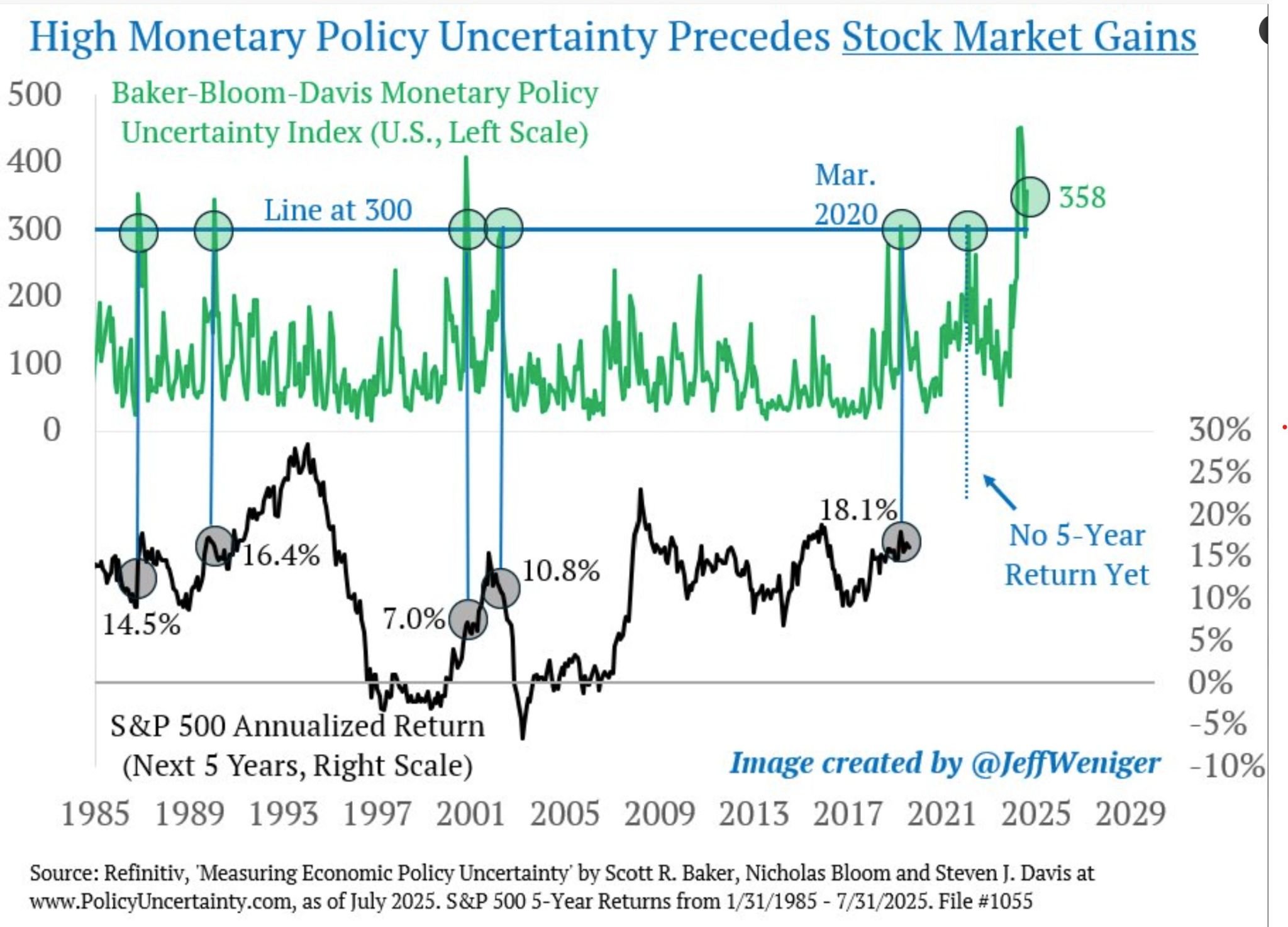

Periods of acute monetary policy uncertainty are Buy Signals.

October 1987, the Iraq-Kuwait recession, September 11th, the 2003 "jobless recovery," Covid lockdowns. These are times to buy the US stock market, not sell it. At 358, the MPU index is about as high as ever. Bullish. Source: Jeff Weniger @JeffWeniger

People who bought Palantir last week

(Palantir has officially entered bear market territory). Source: Not Jerome Powell

Another day of rotation out of tech

Source: Daily sp500 heat map by Finwiz

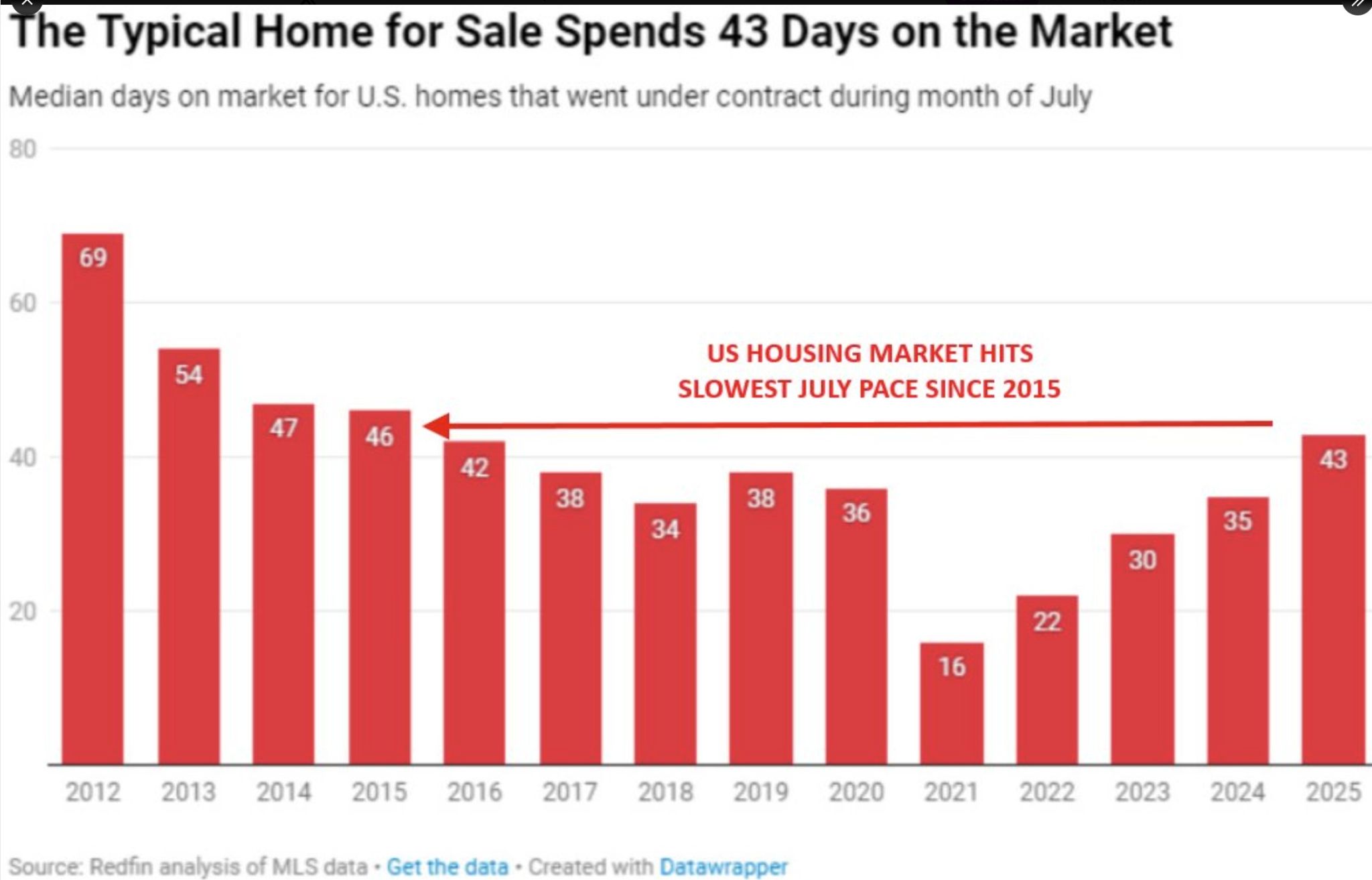

US housing market activity is rapidly slowing down

In July, the typical home sat on the market for 43 days, the slowest July pace in 10 years. By comparison, it was just 16 days in July 2021. Additionally, pending home sales fell -1.1% MoM, to their lowest since November 2023. Despite this, prices are still rising, with the median home sales price up +1.4% YoY, to a record July high of $443,867. Many homeowners are choosing to rent or delay selling rather than accept lower offers, further limiting supply. The housing market is stalling. Source: The Kobeissi Letter

Since the April 8 low, the SP500 has rallied by 30%.

This is powered by a 50% surge in Mag7 stocks, while the rest of the S&P 500 members gained 21%. Source: Augur Infinity on X

Investing with intelligence

Our latest research, commentary and market outlooks