Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Stocks and rate-cut expectations have decoupled significantly since the start of the Summer... will they start to move in sync after Jackson Hole ?

Source: zerohedge

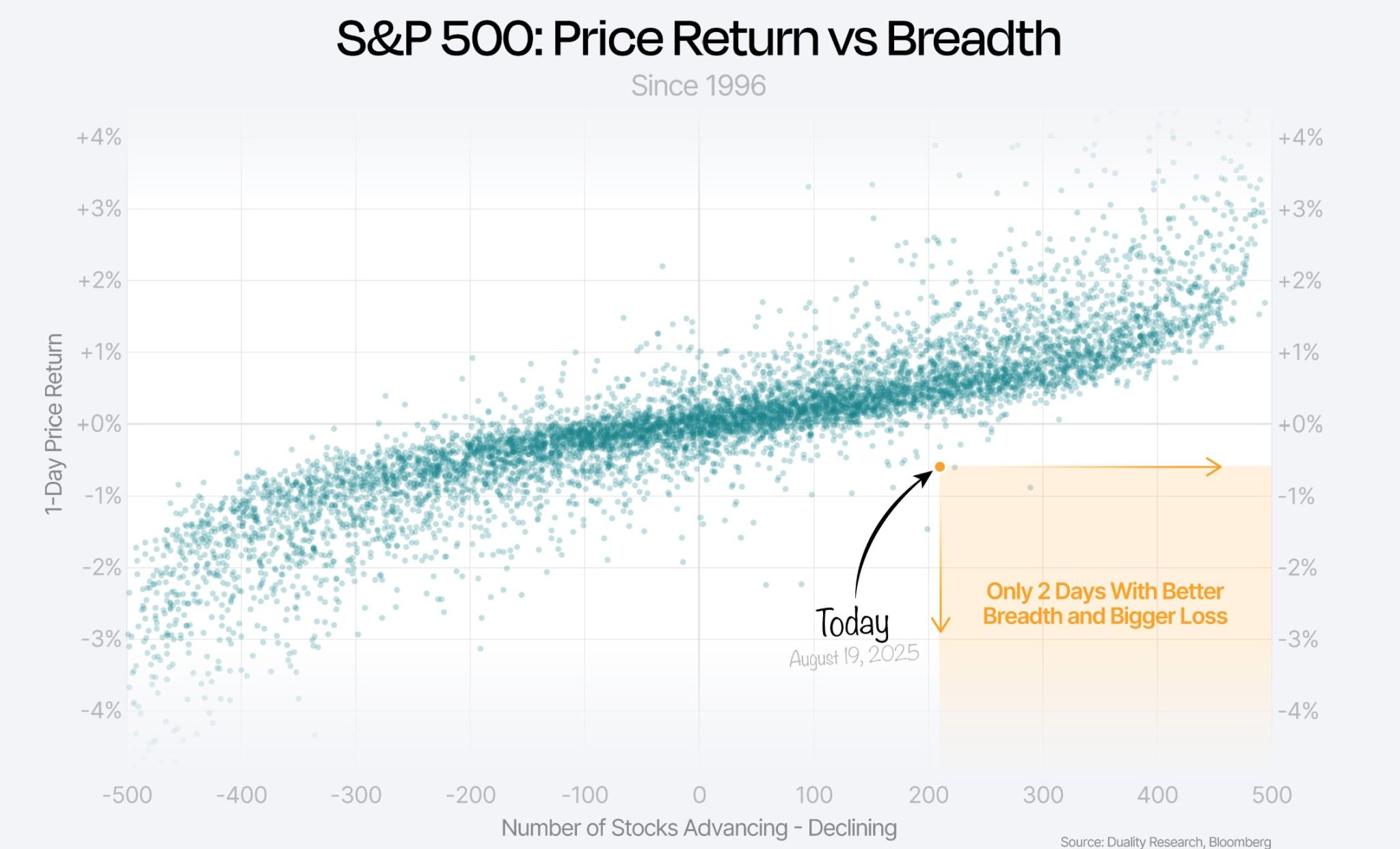

Very interesting session in Wall Street yesterday Since 1996, only two other days have seen stronger S&P 500 breadth paired with a bigger loss.

Source: Duality Researchv@DualityResearch

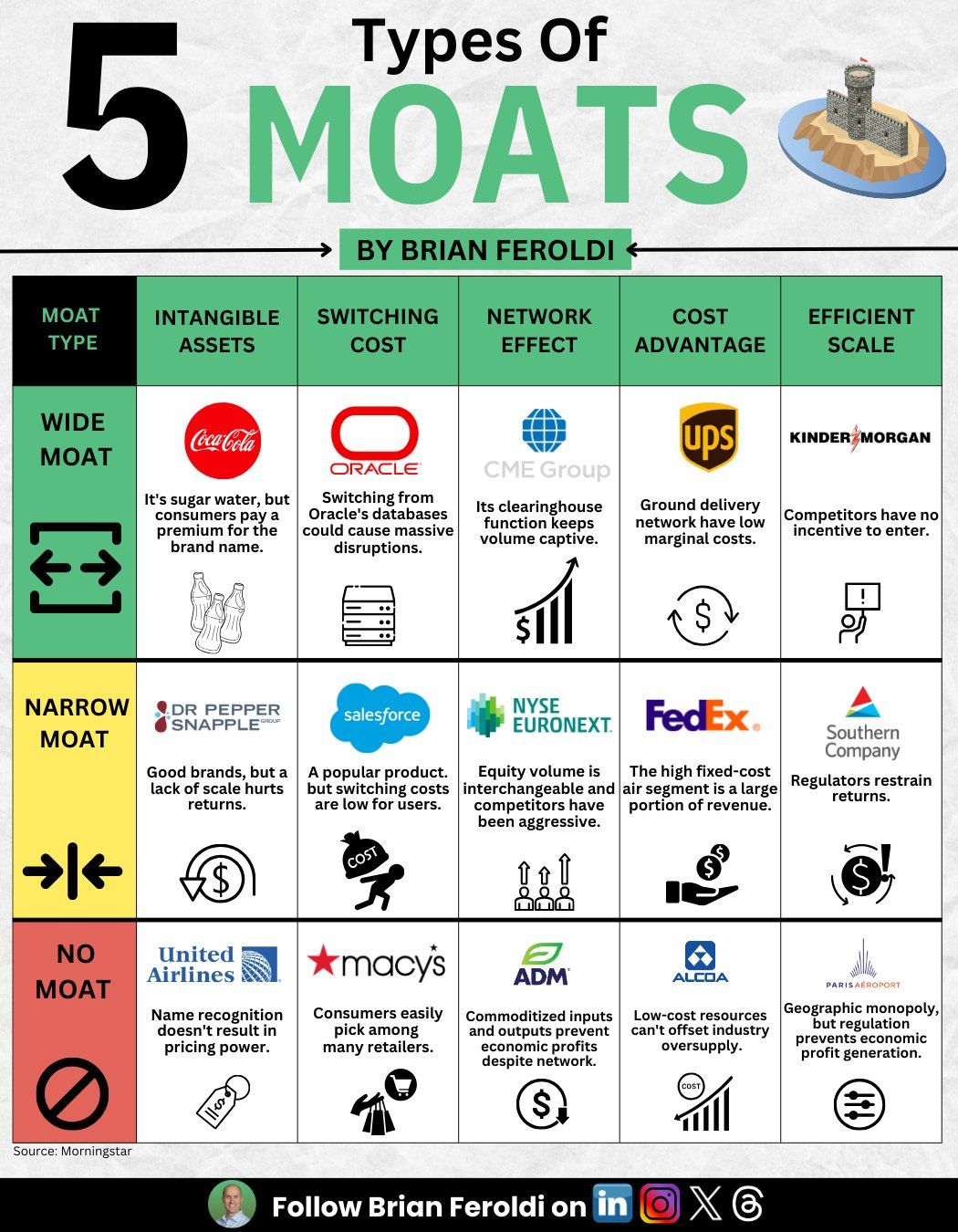

If you buy individual stocks, you must know how to identify a moat

Source: Brian Feroldi

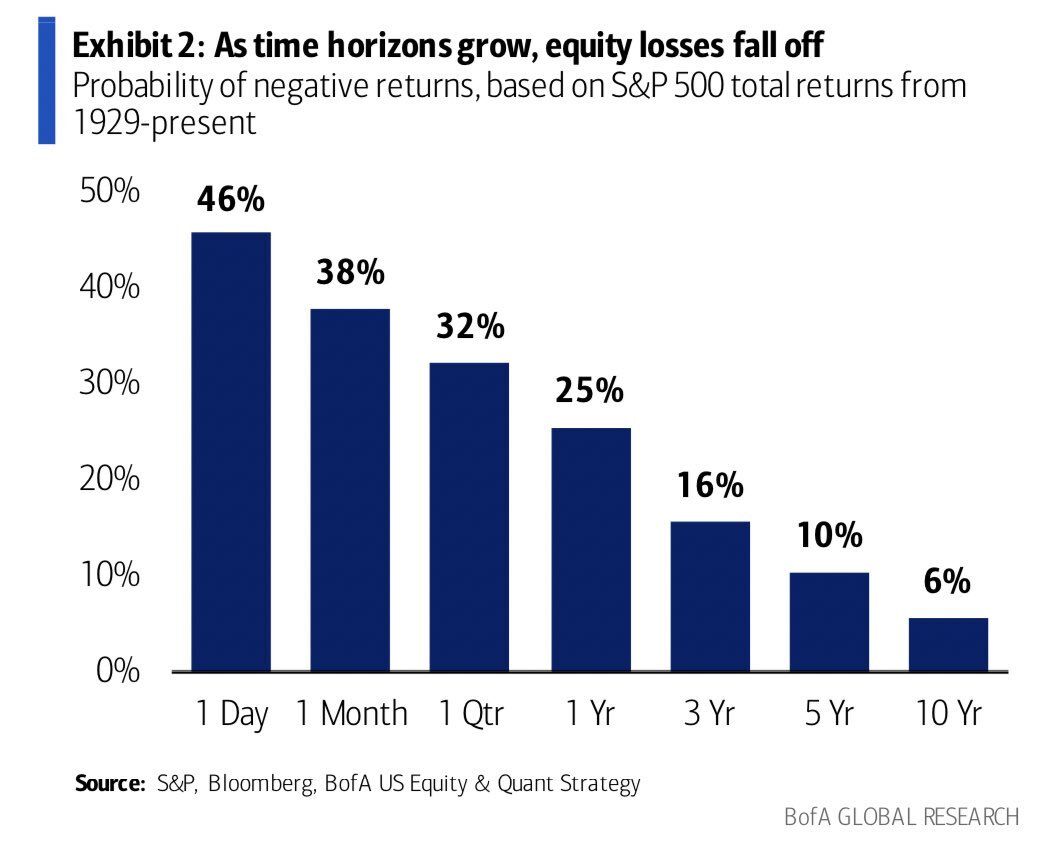

How to not lose money in the stock market

1: Wait longer Source: Brian Feroldi, BofA

The 12-month rolling sum of foreign flows into longer-term US assets reached an all-time high in June.

That's well after all the chaos in April around "Liberation Day" and all the weirdness on Russia and China. Markets just don't care. They continue to see US "exceptionalism..." Source: Robin Brooks @robin_j_brooks on X

Gold ETFs Breach 92 Million-Ounce Threshold

Bloomberg's measure of total gold ETF holdings jumped to a two-year high. At 92.7 million ounces on Aug. 15, my graphic shows this metric surpassing the 92 million threshold first reached in 2020, but with a big difference - stock market volatility was rising then. Source: Mike McGlone, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks