Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

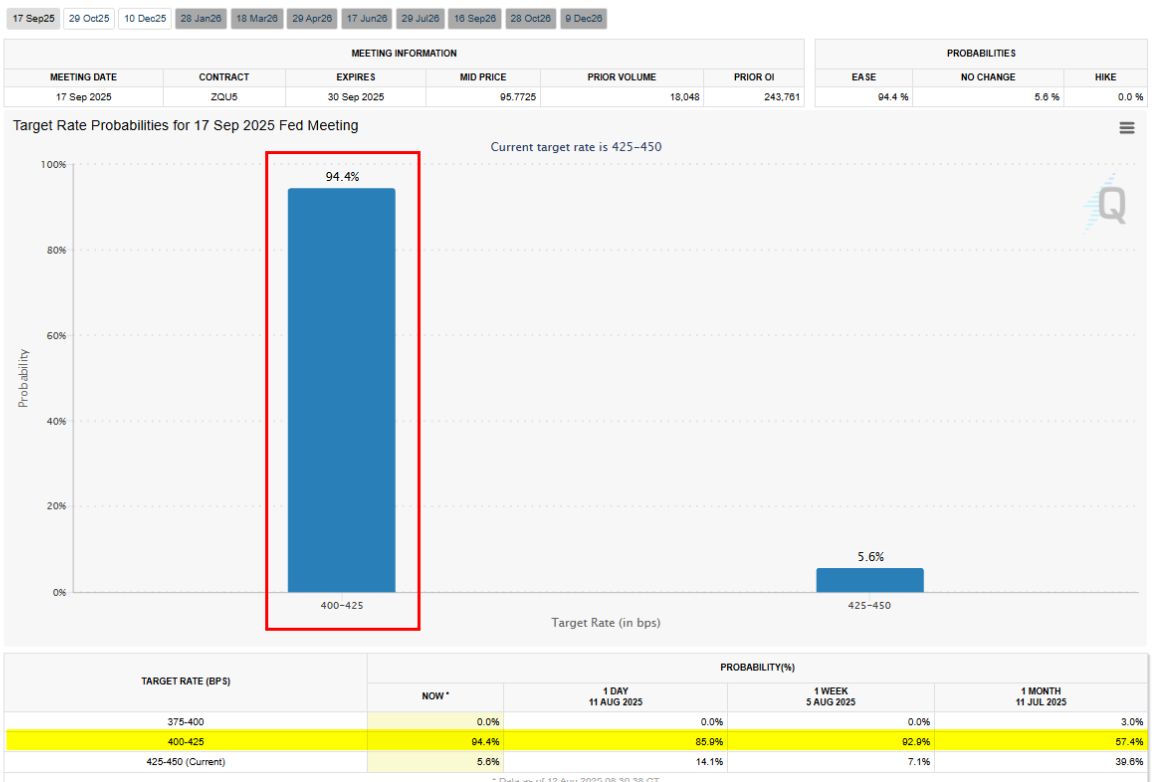

Markets see the US CPI report as a dovish one.

September rate cut odds (based on Fed funds futures) have jumped to 95% probability (from 82% pre-July CPI print). Source: Bespoke

Trump is now attacking Goldman Sachs and his CEO David Salomon

Source: X

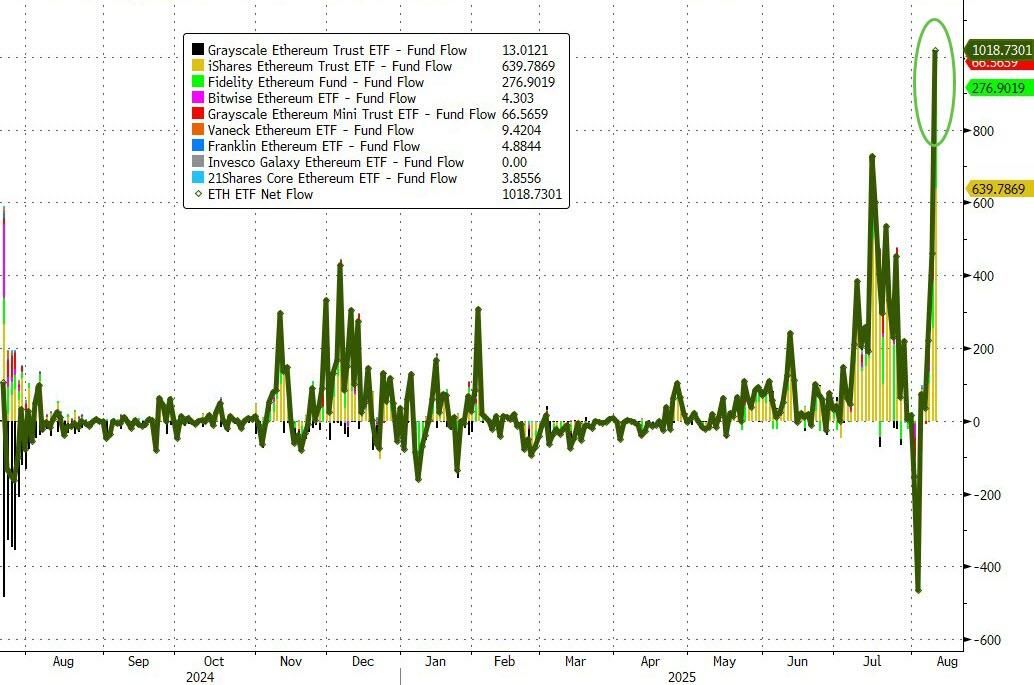

Ether ETFs See Record $1 Billion Inflows

👉 Inflows into Ether ETFs far exceeded those of their Bitcoin counterparts, which saw a net inflow of $178 million on Monday, according to Farside Investors. 👉 CoinTelegraph's Tarang Khaitan reports that for the Ether funds, BlackRock's iShares Ethereum Trust ETF (ETHA) attracted the lion’s share of flows, with a record $640 million going into the fund. 👉 The Fidelity Ethereum Fund (FETH) was the runner-up and also recorded its largest single-day inflow, taking in $277 million. Source: zerohedge, Bloomberg

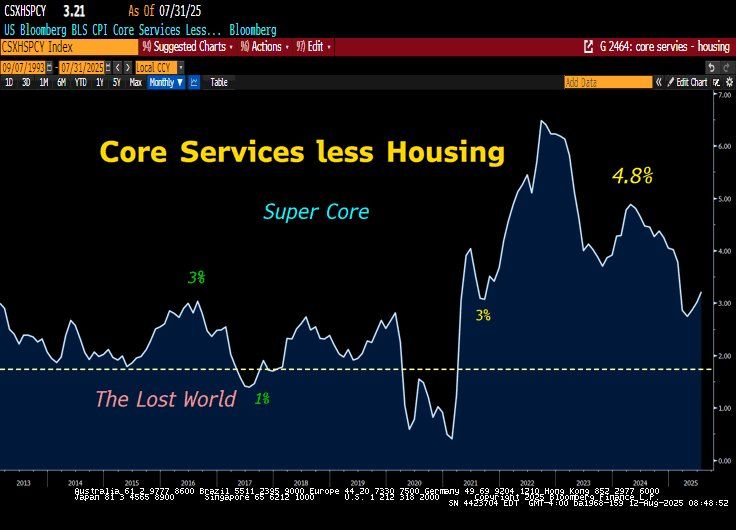

‼️ An important item of today's CPI

The super-core measure, which is probably the Fed's most closely watch component, did increase further in July: +0.48% MoM (prior +0.21%) and +3.21% YoY (prior +3.02%). This is the largest annual increase since February. ▶️ As highlighted by Lawrence McDonald on X, the Supercore has been higher than 3% for four years vs. below 3% for the previous 8 years pre-2020. Source: Lawrence McDonald, Bloomberg

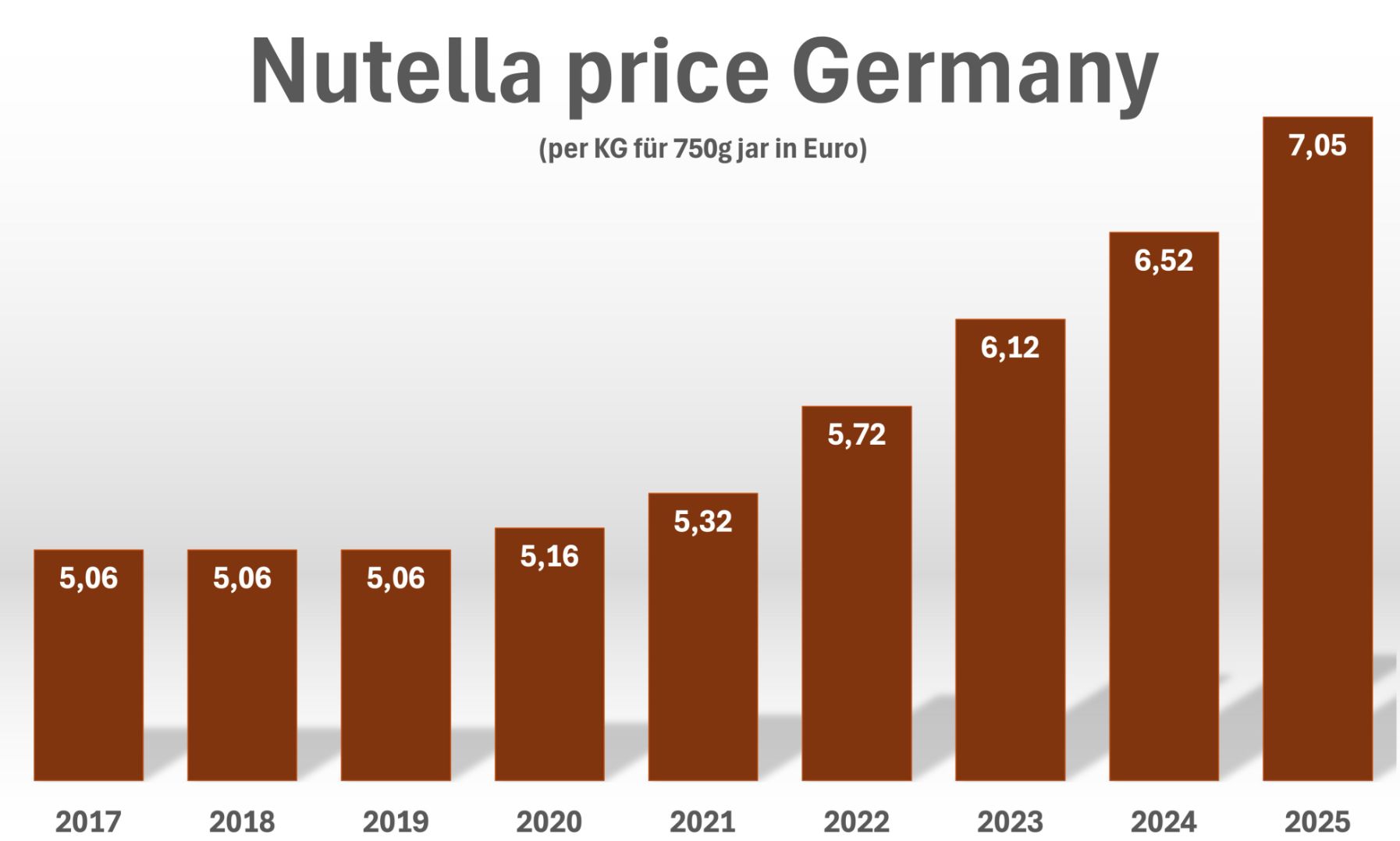

The cost of Nutella in Germany is rising faster than overall inflation.

A 750g jar has gone up by nearly 40% since 2019, far outpacing Germany’s general inflation rate of 21.8% over the same period. But this isn’t just about hazelnut spread: food prices in Germany as a whole have climbed by 38.4% since the end of 2019, according to Eurostat’s Food CPI. That’s much higher than in Italy (+29.5%) or France (+25.9%), highlighting how sharply grocery bills have risen in Germany. Source: Bloomberg, HolgerZ

Isn't this the time of year when volatility typically picks up?

Source: Lance Roberts

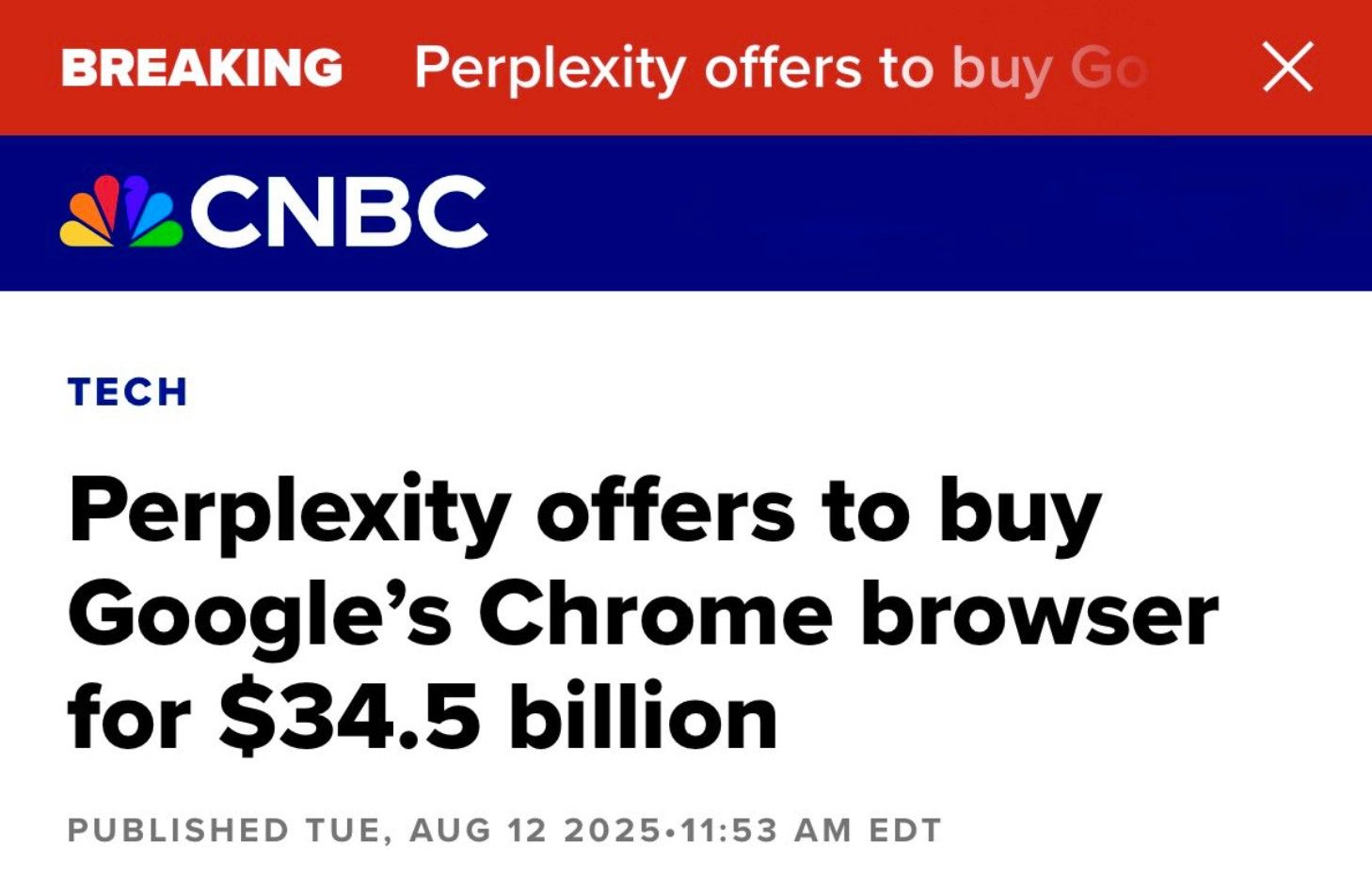

Perplexity, valued at $18 billion, is offering $34.5 billion to buy Google Chrome.

Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks